CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

Gold Outlook: Policy Fog, Fiscal Surge, and Tariff Risks Fuel Support

.jpg)

Over the past week, gold initially rallied and then pulled back, reclaiming the $3,300 level but still facing pressure from the bears. Resilient U.S. economic data, the Fed's cautious stance on rate cuts, and persistent equity market inflows have all dampened gold's short-term appeal. However, from a medium-term perspective, mounting debt risks, inflation concerns, and trade uncertainty continue to support gold's role as a hedge.

This week, market focus shifts to developments in U.S. trade policy and related comments from Donald Trump, which could serve as key short-term catalysts for gold.

$3,300 in Focus as Bulls and Bears Battle

On the daily XAU/USD chart, gold bulls managed to reclaim both the $3,300 mark and the 50-day moving average last week. Although they briefly took control, momentum failed to hold. Since Thursday, the market has entered a tug-of-war, with $3,300 now being tested as support.

Should this level fail, the late-May and late-June lows near $3,250 may become the next area to watch for buying interest. Conversely, if bulls regain control, price action around $3,400 could be key.

In my view, gold's recent weakness reflects a confluence of three factors: strong U.S. economic data, a lack of urgency from the Fed to cut rates, and a robust stock market diverting some safe-haven flows away from gold.

Stronger NFP, Lower Rate-Cut Odds

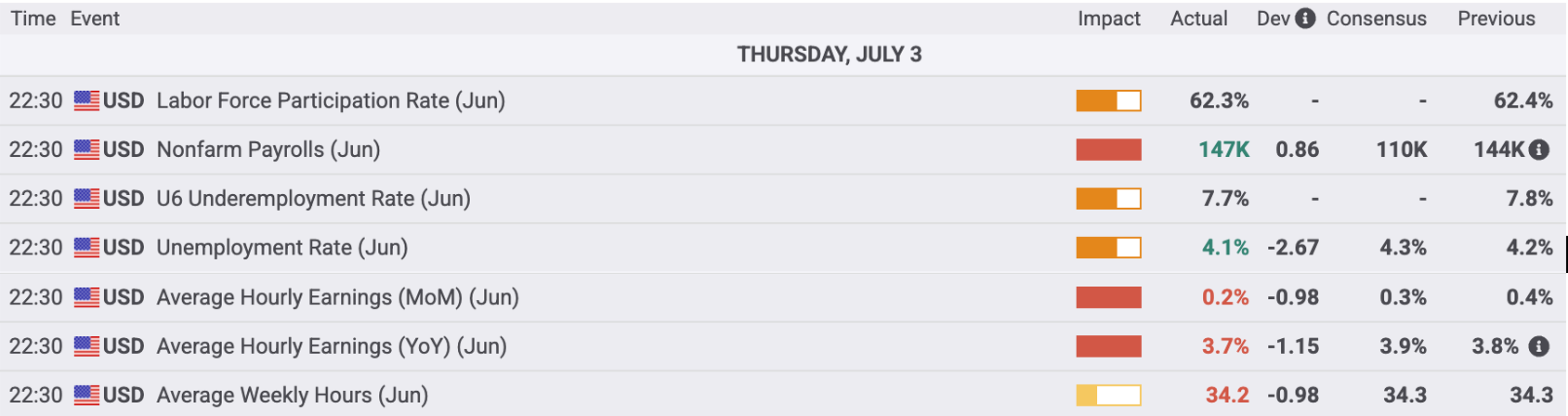

Last week's U.S. nonfarm payrolls surprised to the upside: 147,000 new jobs were added, beating the 105,000 consensus, while the unemployment rate unexpectedly dipped to 4.1% from a forecasted 4.3%. Average hourly earnings growth came in slightly below expectations but remained steady overall. Taken together, this was a textbook "soft landing" report — not weak enough to stoke recession fears, yet not hot enough to reignite inflation worries.

Following the report, market pricing for a July Fed rate cut dropped sharply from around 25% to just 5%. Still, markets have not entirely ruled out two cuts by year-end.

This policy shift carries mixed implications for gold. On one hand, delayed rate cuts reduce gold's relative appeal as a non-yielding asset. On the other hand, the growing uncertainty surrounding future monetary policy may enhance gold's defensive allure.

"One Big Beautiful Bill" Spurs Fiscal Concerns, Supports Gold

As Trump continues to pressure the Fed for 300 basis points of cuts while Powell holds firm, fiscal policy has taken the lead. The "One Big Beautiful Bill" narrowly passed Congress, extending 2017 tax cuts and lifting the debt ceiling to $5 trillion. As a result, the U.S. fiscal deficit is projected to rise above 7% of GDP, marking an aggressive fiscal expansion.

In the short term, this measure helps stave off a Treasury cash crunch and boosts market confidence. Some investors believe this fiscal stimulus could support economic growth and fuel equity gains, drawing capital away from defensive assets like gold.

However, the risks are clear: surging Treasury issuance may increase supply-side pressure, reduce liquidity across asset classes, and raise questions about fiscal sustainability. Against this backdrop, gold remains a viable hedge against fiscal imbalance.

Dollar Bearish Narrative Intact, Gold Gets Structural Tailwind

Despite a broad rise in Treasury yields, the dollar struggled to gain traction following the strong jobs report — a sign of waning upside momentum.

Meanwhile, central banks continue to accumulate gold reserves, with many emerging markets treating it as a core de-dollarization asset. This structural demand offers solid support for gold. In essence, even if real yields rise in the short term, any erosion of trust in dollar-denominated assets may boost gold's appeal.

Trade Policy Uncertainty: A Catalyst as always

These developments are just the beginning. July 9 marks the expiration of key tariff exemptions, known as "Freedom Day." Trump has announced plans to send tariff notices to multiple countries starting July 7, with new tariffs set to take effect August 1 unless agreements are reached.

Markets largely view this as another round of hardball negotiation tactics — threats followed by concessions — which has eased immediate tensions and weighed on gold.

Still, this optimism may be premature. With corporate margins only just stabilizing and global manufacturing recovering, new tariffs could raise input costs and stoke core inflation via higher import prices. In this environment, the demand for gold as a hedge remains very real.

When Policy Is Cloudy and Fiscal Firepower Is Unleashed, Gold Has a Story

All things considered, gold reversed course last week and is now testing support at $3,300. In the short term, resilient economic data, the Fed's patience, and strong equities continue to limit upside. But from a broader perspective, a widening fiscal deficit, active central bank gold purchases, and policy uncertainty are laying the foundation for a more stable gold floor. If gold holds above $3,300, I continue to view dips as buying opportunities.

Looking ahead, key market events will include progress on trade negotiations and the July 15 release of U.S. CPI data. If tariff negotiations stall or take a more hawkish turn, safe-haven demand could rise quickly, weighing on risk assets and supporting gold and the yen.

Meanwhile, June CPI will likely be the Fed's main reference point for whether a September cut is warranted. While the jobs report looked strong on the surface, underlying labor trends were less robust, putting greater weight on inflation data to set the tone for the next policy move.

If CPI slows on a month-over-month and year-over-year basis, markets may price in a higher likelihood of a September cut — potentially lowering yields, weakening the dollar, and boosting gold. Conversely, a surprise upside in CPI could reignite rate-hike fears and pressure gold in the near term.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.