CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

Gold Outlook: New Highs Within Reach, Eyes on Non-Farm Payrolls

.jpg)

Since late April, gold’s much-anticipated trend rally has returned, surging last week on robust bullish momentum and approaching historical highs. Multiple factors are currently supporting gold, including Powell’s dovish shift, challenges to Fed policy independence, heightened global geopolitical tensions, and sustained, substantial buying from the Chinese market. With U.S. non-farm payroll data approaching this week, this key indicator could act as the main catalyst for short-term gold movements.

On the XAUUSD daily chart, bullish momentum continues. Prices have broken above the $3,450 high of the April trading range, closing up about 2.3% last week to a fresh record. Gold is now testing the $3,500 level. While RSI suggests the market is approaching overbought conditions and short-term retracement is possible, holding above this level could open the door for further gains. Key support levels at $3,450 and $3,400 provide additional buffers for market volatility.

In my view, the recent breakout in gold prices can be analyzed from three dimensions: the policy environment, geopolitical risks, and market structure.

Rate-Cut Expectations and Safe-Haven Demand

Despite U.S. core PCE rising 2.9% year-on-year in July - the highest since December 2024 - Powell’s dovish signals at Jackson Hole have gradually lifted market expectations for Fed rate cuts. Several officials highlighted that a weakening labor market could accelerate rate cuts, with a 25-basis-point “preemptive” cut now widely priced in. As a result, the U.S. dollar remains subdued and 10-year real yields have fallen, enhancing gold’s appeal as a non-yielding asset.

However, the recent strength in gold is not only due to a weak dollar; it has also performed strongly against most G10 currencies. This reflects gold’s multiple safe-haven attributes.

Over a longer horizon, the U.S. economy’s stagflationary traits are becoming more pronounced, increasing demand for uncertainty hedges and solidifying the foundation for gold’s bullish trend.

Meanwhile, the Fed’s independence faces mounting challenges. Last Friday, the U.S. held an emergency hearing on the potential dismissal of Fed Governor Cook, with a ruling expected no earlier than this Tuesday. Should Cook be removed, Trump would hold a majority on the seven-member board, paving the way for more aggressive rate cuts. This policy uncertainty further boosts gold’s safe-haven appeal, reinforcing the bullish policy-driven support alongside rate-cut expectations.

In addition, geopolitical risks remain elevated. The Russia-Ukraine conflict has expanded, while U.S.-Europe disagreements on defense spending, trade negotiations, and Iran policy continue to surface. Additionally, new hotspots could emerge in the Middle East and the Caribbean. Under Trump’s unilateral diplomatic approach, global instability is rising, further highlighting gold’s defensive qualities.

Chinese Buying and Systemic Capital Flows

Beyond safe-haven demand, inflows from the Chinese market are also an important driver of gold’s strength. Shanghai gold prices have been steadily rising, boosting domestic activity and influencing CME gold futures and XAUUSD through arbitrage and cross-market pricing mechanisms.

At the same time, Chinese regulators have tightened restrictions on stock financing, with margin levels approaching the highs seen during the extreme market volatility of 2015. Against this backdrop, retail investors and some institutions may gradually shift their focus from highly leveraged equities to relatively independent, value-preserving precious metals.

This capital migration implies that the gold market not only gains new incremental buying but may also create a systemic, cross-market capital flow effect. In the short term, it provides solid support for bullish sentiment; in the long term, it may amplify gold price volatility globally.

Non-Farm Payrolls: Key Short-Term Indicator

Overall, the driving chain behind gold’s rally is well-formed: policy expectations, independence risks, geopolitical uncertainty, and Chinese capital flows converge. Ahead of Friday’s key U.S. employment data, short-term gold is difficult to push down, and new historical highs are possible.

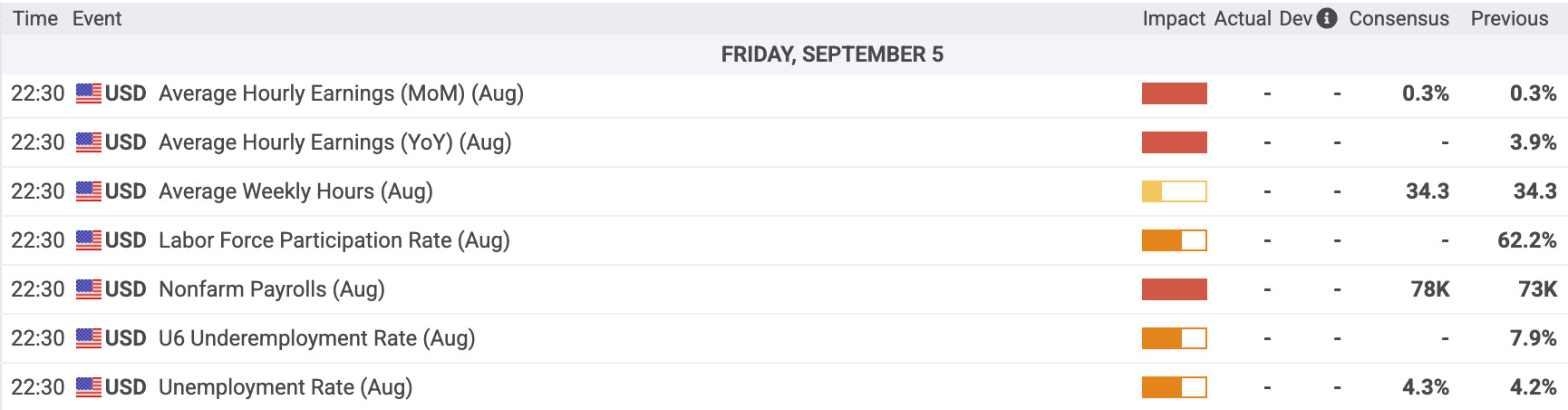

Looking ahead, U.S. non-farm payrolls will be the market focus this week. Expectations are for about 75,000 new jobs, with the unemployment rate slightly rising to 4.3%. If data meets or slightly exceeds expectations, gold volatility may be limited, as a 25-basis-point rate cut is already priced in.

However, if job growth is below 50,000 and unemployment rises further, concerns over a U.S. recession and additional Fed cuts could increase, pushing gold higher. Conversely, if data is significantly stronger than expected, gold may face short-term pressure, though safe-haven buying may support high-level consolidation.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.