- English

- Italiano

- Español

- Français

Analysis

Gold Outlook: Caught between Policy Crosscurrents and Data Resilience

.jpg)

Gold extended its choppy trading pattern from mid-April last week, with bearish pressure dominating the first half. A series of developments - including shifting White House rhetoric on EU tariffs, resilient U.S. data, changing market sentiment on Treasuries, and legal challenges to tariff legitimacy - have all contributed to the recent price swings.

On the 4-hour XAUUSD chart, gold remains range-bound between $3,170 and $3,430, with choppy decline still in control. Although bulls staged a strong intraday comeback on Thursday, briefly pushing prices above the descending channel formed earlier this week, sellers quickly regained dominance the next day, driving gold back below the 50-period moving average and reinforcing the bearish bias.

Unless prices can reclaim and hold above the channel breakout level and the moving average, the lower boundary of the channel and the mid-April lows near $3,170 could emerge as key support. On the upside, the 76.4% Fibonacci retracement of the early May downtrend may act as a significant resistance zone.

The frequent reversals in gold highlight the current tug-of-war between mixed news and data flows, with neither bulls nor bears able to establish lasting control.

Policy Fog Deepens: Tariffs and Legal Risks

Early last week, the White House pushed back the start date for new EU tariffs from June 1 to July 9, while advisor Hassett hinted that the U.S. might be open to making further concessions beyond the proposed 10% baseline. Yet just as risk sentiment appeared to be stabilizing, headlines emerged that the U.S. Court of International Trade had moved to halt Trump’s global tariffs.

Although Trump immediately announced an appeal - meaning the tariffs remain in effect for now - the legal complexity surrounding the court’s final ruling, the practical pathway for tariff enforcement, and the broader economic implications make pricing these risks extremely difficult for most traders, particularly those without legal expertise.

For gold, this legal limbo - combined with Trump’s potential “Plan B” options and their implications for the midterm election outlook - injects further policy uncertainty. Moreover, the possibility of suspended or significantly reduced tariffs raises fresh concerns over ballooning U.S. deficits, which could in turn support gold from a safe-haven demand perspective.

Tax Cut Bill to the Senate: Another Source of Ambiguity

Beyond tariffs, Trump’s “One Big Beautiful Bill” - now in the hands of the Senate - adds another layer of uncertainty. With a U.S. debt redemption peak approaching in June, any lack of clarity on fiscal direction could rattle markets and push demand toward defensive assets.

Markets are already anticipating hurdles for the tax bill in the Senate, especially due to proposed Medicaid cuts. If these provisions are watered down or replaced with more expansionary measures, it could widen the fiscal deficit in the short term. Once the tariff pauses end, added fiscal stimulus could increase policy volatility and force the Fed to reassess its rate path. In such a scenario, gold would likely find support.

Resilient Data, Steady Fed - Not a Golden Combo

That said, not everything is bearish for gold. Recent U.S. data painted a mixed but relatively resilient picture. Consumer confidence saw a strong rebound, and while durable goods orders dropped by 6.3%, the decline was slightly less severe than expected.

Moreover, despite greater market attention on longer-dated bonds, this week’s auctions of 2-, 5-, and 7-year Treasuries were solid across the board, leading to a pullback in yields and easing earlier market anxiety.

Given that inflation and labor market risks tied to tariffs have yet to fully materialize, Fed Chair Powell reiterated the Fed’s cautious, wait-and-see stance. From a rate perspective, gold - being a non-yielding asset - faces limited appeal under such conditions.

Outlook: Broad Range to Hold, Eyes on ISM and NFP

Looking ahead, we expect gold to continue trading within the $3,170 - $3,430 range. Uncertainty around the legal path of U.S. tariffs and the trajectory of the tax bill will likely keep gold supported on dips, while resilient U.S. data, the Fed’s reluctance to shift dovish, and some gold selling from China on Friday may cap upside momentum.

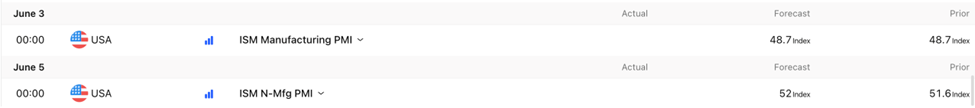

Aside from updates on tariffs and the tax bill, this week’s ISM manufacturing and services PMIs will be closely watched, with forecasts at 48.7 (unchanged) and 52 (up from 51.6), respectively. Stronger-than-expected prints—particularly if the manufacturing index climbs back above 50 - could ease concerns around recent uncertainty and cap gold’s upside.

Of course, the main event will be Friday’s nonfarm payrolls report. The market consensus is for 130,000 new jobs, down significantly from the prior 177,000, with the unemployment rate expected to hold steady at 4.2%.

If the labor data proves resilient, fading optimism around tariffs and tax cuts could prompt a further rebound in risk assets and weigh on gold. Conversely, if headline job gains fall below 100,000 and unemployment ticks higher, growing pressure on the labor market could start to ripple into consumption - and a gloomier economic outlook may help lift gold prices.

As gold market volatility heats up and key events unfold, seize the moment with Pepperstone’s gold CFDs - now offering spreads reduced by up to 30% to explore market opportunities.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.