CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

Gold Outlook: Bears in Control, but Don’t Count Bulls Out Yet

.jpg)

Over the past week, gold has extended its losses, breaking below the key psychological support level at $3,300. Optimism around tariff agreements and a powerful rally in U.S. equities have significantly diminished gold’s appeal. That said, rising market expectations for a July rate cut, growing concerns over the Fed’s policy independence, and a weaker U.S. dollar continue to offer a supportive backdrop.

Looking ahead, in addition to ongoing trade negotiations, investors should closely watch this week’s U.S. jobs data and the Sintra forum, both of which could offer clearer guidance on the Fed’s rate path - and potentially shift gold market dynamics.

Breaking Key Support: Technical Warning Signs Emerge

Turning to the XAUUSD daily chart, gold has extended its retreat from mid-June. With bearish momentum building, prices last Friday closed below the 50-day moving average for the first time since January—breaking a key area of technical support. The $3,300 level failed to hold, with the metal finishing the day below it. As of Monday’s early trading, gold was hovering around $3,270.

Should bearish pressure persist, support might emerge near the $3,170 range lows seen in mid-April. Conversely, if bulls regain control and manage to reclaim $3,300 and the 50-day MA, that could mark the start of a recovery.

TACO Returns and Stock Rally: Multiple Headwinds Weigh on Gold Prices

While the rapid de-escalation of geopolitical tensions in the Middle East was the spark for this leg lower, what’s really driving the sustained downtrend is a combination of easing trade friction and surging equity markets – both are undermining demand for safe-haven assets like gold.

On the trade front, the TACO appears to have worked once again. Last week, Bessent called removal for retaliatory tariffs under Section 899, only to later say on Friday that a deal might be reached before Labor Day (Sept. 1) - making the July 9 tariff pause deadline more of a formality. Both the U.S. and EU have expressed confidence in reaching a deal before the deadline, even though talks between the U.S. and Canada have hit a snag over digital services tax issues. Overall, the improving tone on trade is easing market anxiety and weighing on gold.

The rebound in sentiment has also spilled over into equities. The Nasdaq and S&P 500 have now posted gains for seven straight days, with both indices refreshing record highs. Similar momentum has been seen in the Nikkei and Germany’s DAX 40. Investors appear to be shifting from defensive selling to FOMO, further dimming gold’s appeal.

Fed Turns More Dovish: Rate Expectations Become Key for Gold

Still, gold isn’t out of the game. There’s another side to the coin. Several Fed officials -including Bowman and Waller - have adopted a more dovish tone recently. While May’s core PCE inflation came in at 2.7% YoY (slightly above expectations), the three-month annualized rate dropped sharply to just 1.7%, reinforcing expectations for rate cuts later this year. The market-implied probability of a July cut rose from 13% to 18% following the data. The increased likelihood of lower rates is a tailwind for gold, which offers no yield.

Another factor supporting gold is growing concern about the Fed’s independence. The White House has been attempting to exert influence over monetary policy, with Trump threatening to nominate Powell’s successor before October. If a “shadow chair” is appointed early and begins to steer policy before Powell’s term officially ends, it could seriously undermine confidence in U.S. monetary policy. Such a scenario would boost safe-haven demand and further accelerate the global trend of de-dollarization - both positive for gold.

Add to that a softer dollar and falling real yields, and the opportunity cost of holding gold drops even further. Meanwhile, central banks continue to accumulate gold reserves, helping form a firm price floor.

In short, gold is under pressure and currently testing key technical support levels. The fading of tariff tensions and booming equity markets have drained safe-haven flows, but Fed’s dovish tone, trade friction, and dollar weakness are still helping to underpin prices. I’m personally leaning toward buying the dip for now - but if prices break below $3,280, I’ll reconsider.

Nonfarm Payrolls Key Variable; Sintra Forum May Spark Volatility

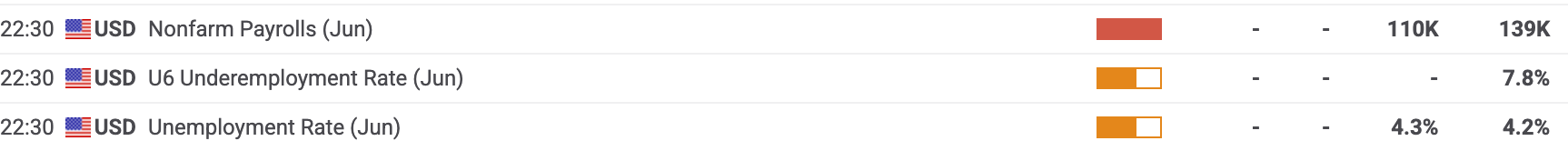

For the rest of the week, Friday’s nonfarm payrolls report will be the most important. The market expects an increase of 110,000 jobs, well below last month’s 139,000, and a slight uptick in the unemployment rate to 4.3%.

Given that the Fed is actively evaluating when to begin cutting rates, markets may be more sensitive to downside surprises than upside ones. If the headline figure falls below 100,000 and the unemployment rate ticks up to 4.4%, the July FOMC meeting is more likely to be a “live” one or at least paving the way for a September cut.

Also worth watching is the Sintra forum, running Monday through Wednesday. ECB’s Lagarde, Fed Chair Powell, alongside three other major central bank governors, will be speaking. Their views on inflation risks, slowing growth, and tariffs - plus their signals on rate paths - could all trigger further volatility in gold.

As gold market volatility heats up and key events unfold, seize the moment with Pepperstone’s gold CFDs - now offering spreads reduced by up to 30% to explore market opportunities.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.