CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

Broad Expectations – Of 94 economists polled by Bloomberg, eight have a 75bp (or 0.75%) hike as their call and 86 are calling for a 50bp hike. The market places a 97% chance of a 75bp hike.

Managing the risk

It’s the meeting everyone has on their radar – implied volatility in equity and FX is elevated and rising, and the market will be hanging off every word Fed chair Jerome Powell has to say - it's a genuine risk event for traders to consider.

Traders must consider their exposures over this meeting and while position sizing is always of paramount importance, now, more than ever traders need to be in front of their screens. When we see a potential volatility shock, this is risk management 101, traders who get this right survive and potentially thrive.

The Fed previous guided the market to a 50bp hike but since its blackout period (which restricted its communication) we’ve had a huge 8.6% inflation print and both bonds and equities have been smashed – the USD is trading at 20-year highs, with big moves vs high beta FX – NOK, AUD and NZD and GBPUSD shorts are homing in on 1.2000. The market knows the Fed is violently engineering a negative wealth effect, which will impact demand and that means the ‘Fed put’ is no longer in play.

Traders question whether the Fed show any concerns about market drawdown and the tighter financial conditions, or in fact, welcomes it – risk assets could take their cues from this vibe.

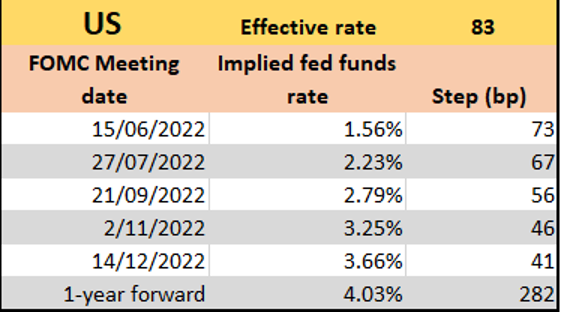

As the WSJ noted, the new US CPI print allows the Fed to break away from its prior guidance (for 50bp) and the interest rate markets have completely bought into the idea that we’ll see a 75bp hike – this is fully priced into markets. We can also see a 67bp hike priced for the July meeting. This takes the fed funds rate into the so-called ‘neutral rate’ (the level of the fed funds that is estimated to be neither accommodative nor restrictive) – this is the level the fed funds really need to be and quickly.

(Source: Pepperstone - Past performance is not indicative of future performance.)

A 50bp hike should therefore promote a weaker USD, but how equities trade on this outcome is not immediately clear – in theory, it should cause a rally in stocks, but this is genuinely unclear. The market could easily see a risk that the Fed is falling further behind the inflation curve and going into further risk aversion mode.

Economic and fed funds projections

Traders will be watching for the Fed’s economic projections – expect a solid decline in GDP expectations for 2022 (from 2.8% towards 2%). Watch the Fed’s unemployment forecasts for 2023, as this could offer real guidance on a potential recession and it would not surprise if the Fed took its estimate for 2023 from 3.5% to 3.8% - the market could react to this. On inflation, it will not surprise to see a material lift in core inflation in 2022 from 4.1% to over 4.5%.

The Feds dot plot will get the focus too – the current projection for the fed funds rate sits at 1.9% for 2022, 2.8% for 2023, 2.8% for 2024 and the longer-run estimate is 2.4% - if the Fed hike by 75bp then 2022 estimate should lift above 3%.

Summary – the question I ask is if I were to obtain the Fed statement and Jay Powell’s script prior to anyone else would I be guaranteed to make money from it? – I’m not sure I would. The market wants answers on its commitment to smash inflation and whether there is any concern for the market drawdown – it feels the risks are titled to further downside in risk assets.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.