- English

- Italiano

- Español

- Français

Analysis

February 2025 US Employment Report: Labour Market Ticking Along But Risks Remain

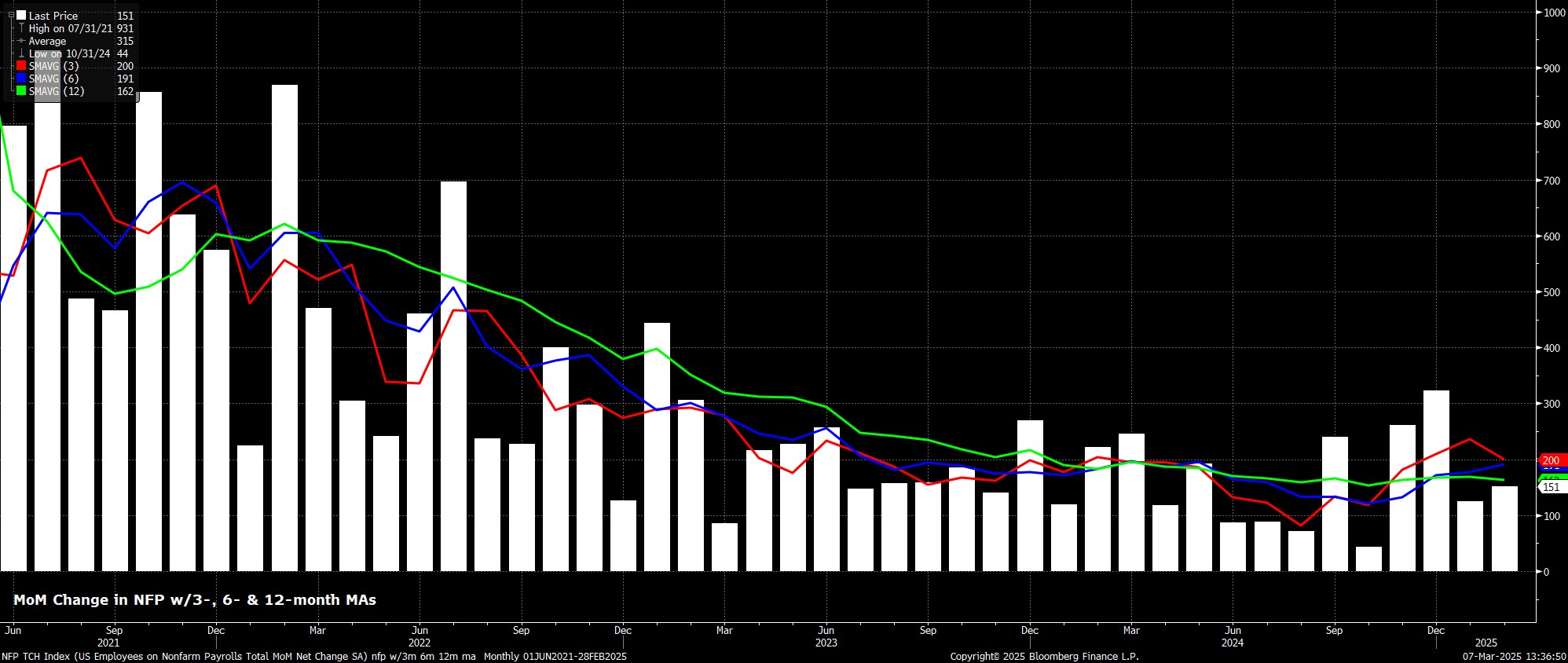

Headline nonfarm payrolls rose by +151k last month, roughly in line with consensus expectations for a +160k increase, and well within the comically large forecast range of +30k to +300k. Concurrently, the prior two payrolls figures were revised by a net -2k, in turn seeing the 3-month average of job gains dip to 200k, though this remains well above the breakeven pace of jobs growth required for employment to keep pace with the expanding size of the labour force.

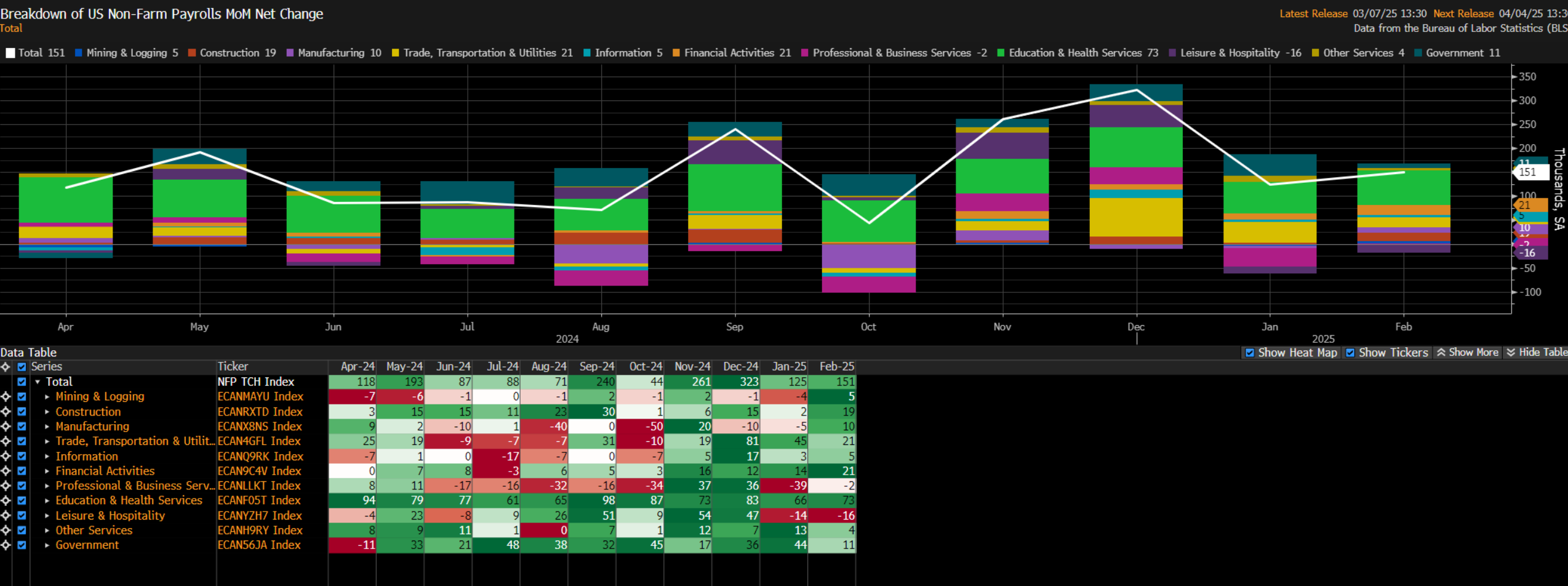

Looking under the bonnet of the payrolls print, the sectoral split pointed to job gains again being relatively broad-based in nature, with only Education & Health services losing employees for the second straight month. Government payrolls, meanwhile, fell just 10k, with the figures not accounting for recent federal layoffs.

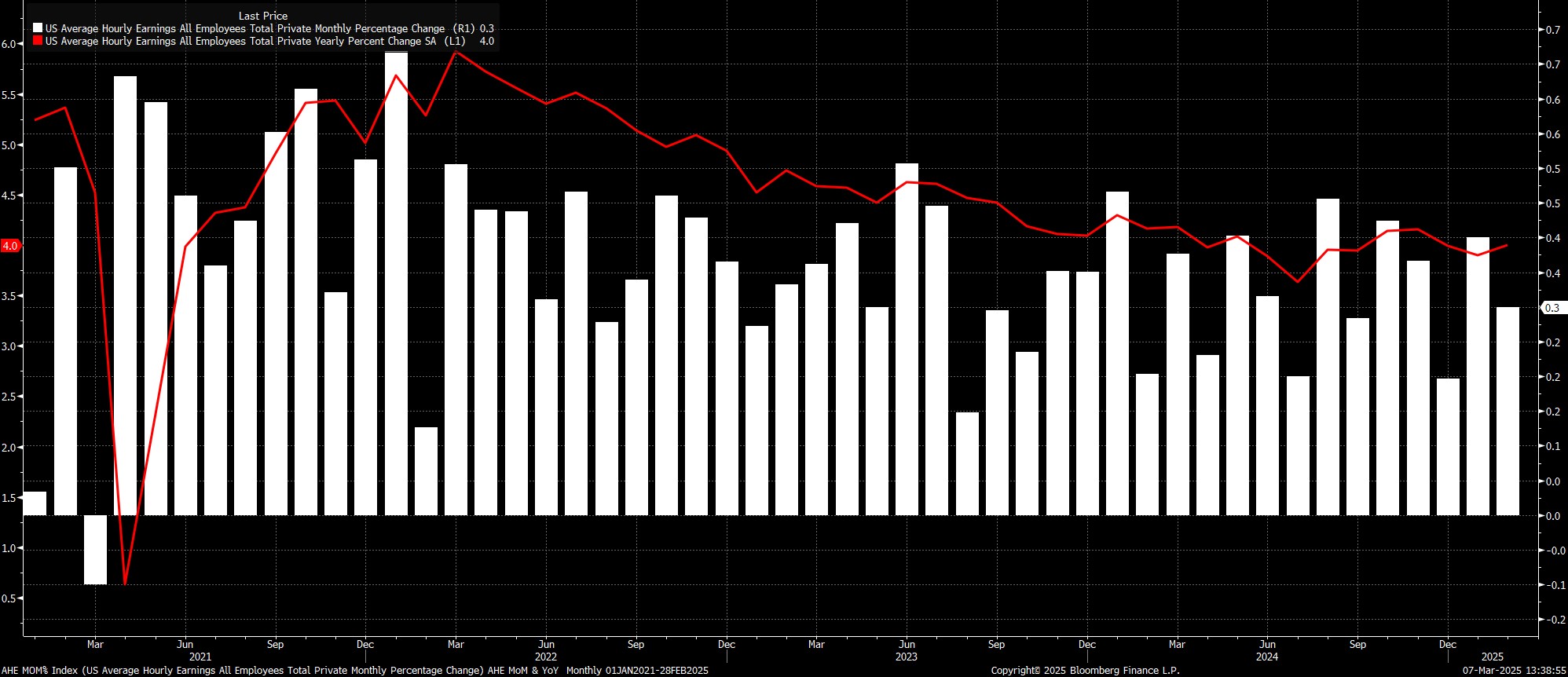

Staying with the establishment survey, the labour market report showed a cooling in earnings pressures, which remain relatively contained. Average hourly earnings rose 0.3% MoM last month, down from the 0.5% MoM pace seen in January, which in turn took the annual pace of earnings growth to 4.0% YoY.

While a degree of this cooling in earnings pressures will be due to January’s weather-related weakness being unwound, data of this ilk will serve to reinforce the long-standing views of FOMC policymakers who believe that, at present, the labour market is not a source of significant upside inflation risks.

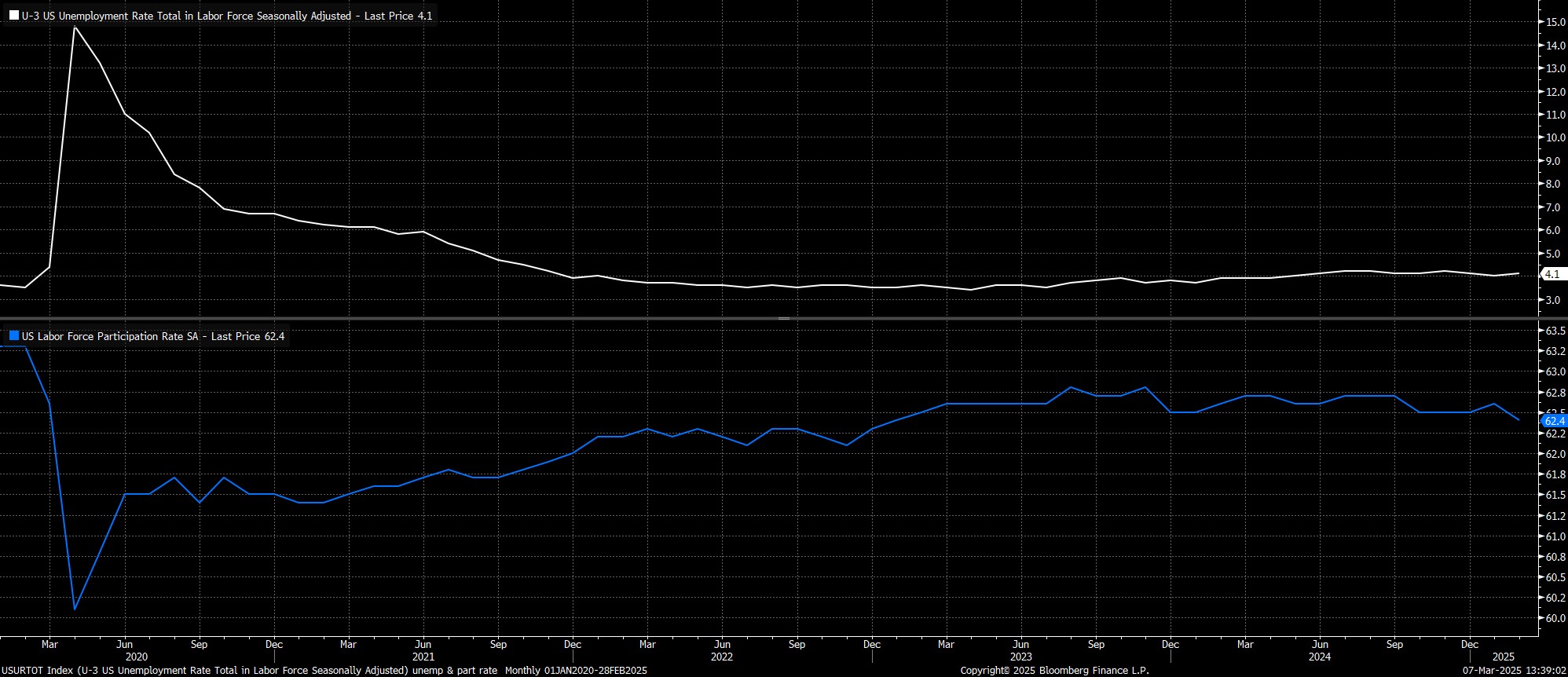

Turning to the household survey, data showed unemployment unexpectedly rising to 4.1%, as labour force participation dropped 0.2pp to 62.4%, the lowest level since early-2023. Underemployment, meanwhile, shot higher to 8.0%, from a prior 7.5%.

One must continue to accompany these figures with a bit of a health warning, however, with the HH survey having been extremely volatile this cycle, struggling with falling survey response rates, and having difficulty in accounting for the changing composition of the labour force.

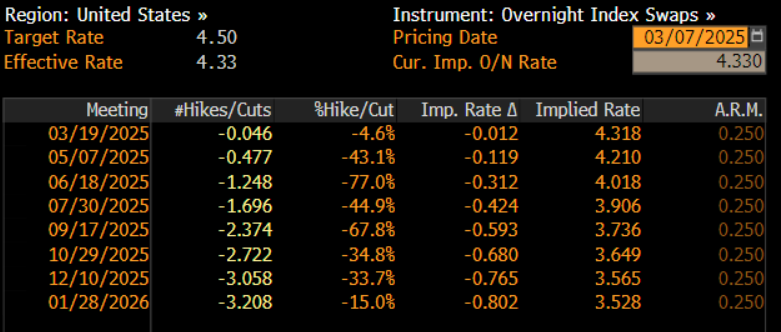

As the solid-enough labour market report was digested, market-based rate expectations repriced very modestly in a hawkish direction. The USD OIS curve continues to fully discount the next 25bp Fed cut at the June meeting, though now sees around 74bp of easing by year-end, compared to 71bp pre-release.

Taking a step back, the February jobs report seems unlikely to substantially move the needle from a Fed policy perspective, with the FOMC firmly on hold amid the present elevated degree of uncertainty, taking stock not only of the impacts of the Trump Administration’s fiscal policies, but also seeking evidence of further disinflationary progress before taking further steps to remove policy restriction.

While the direction of travel for rates remains lower, a cut in the first half of the year still seems a tough ask, for the time being, particularly amid the huge degree of uncertainty which continues to cloud the outlook, and the volatility with which fiscal, and other government policies, are being made at the present time.

More broadly, while the jobs figures were solid enough, they are not enough on their own to allow participants to set aside ongoing growth worries. Tariff headlines, and associated government policy uncertainty, will remain the main drivers of market sentiment for the time being, while risks to the labour market remain tilted to the downside, not forgetting the impact of federal layoffs as part of Elon Musk’s DOGE initiative, which should feed in from March onwards.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.