- English

- Italiano

- Español

- Français

Analysis

The Rise of Ethereum: Core Drivers Pushing Prices to New Heights

Ethereum's Market Capitalisation and Dominance

- Market Cap: Ethereum's market capitalization has surged to a record $509 billion, driven by strong and trending price action and increasing adoption across sectors.

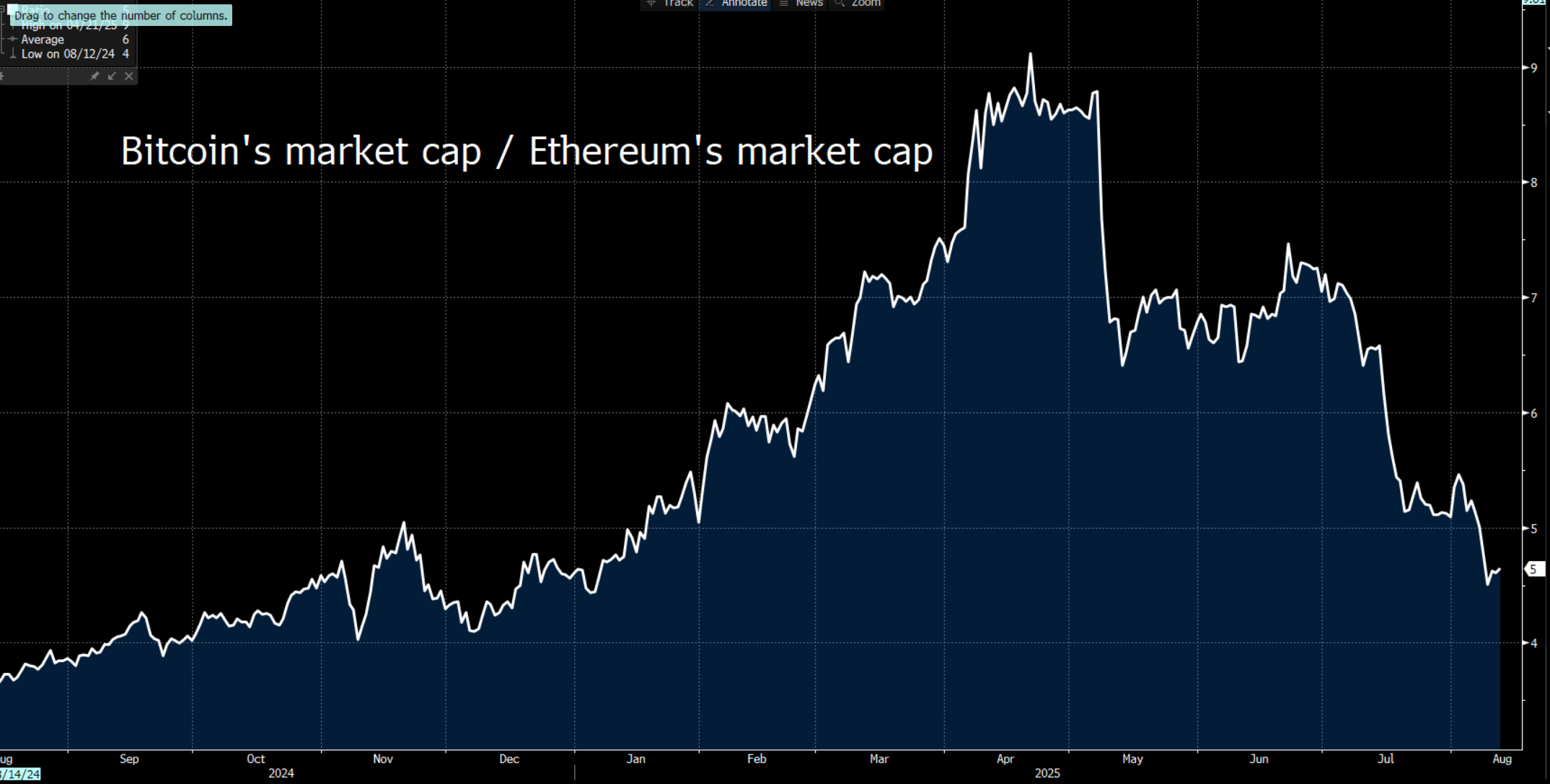

- Bitcoin vs. Ethereum: The market cap ratio of Bitcoin to Ethereum has decreased from 9.1x to 4.7x, highlighting the relative interest in Ethereum vs Bitcoin, and its importance in the overall crypto market. Bitcoin's dominance now stands at 59%, reflecting a shift toward more diversified crypto plays.

Key Catalysts Driving Ethereum's Price

Several factors have been instrumental in Ethereum's price rally and trader's need to consider if they will remain an ongoing driver for ETH appreciation.

GENIUS Act and Stablecoin Regulation

The GENIUS Act, which provides clarity on stablecoin regulation, has had a significant impact on Ethereum and the confidence from insto players to accumulate Ethereum. Stablecoins like USDT, USDC, and DAI are issued as ERC-20 tokens on the Ethereum blockchain. With the act's passage, institutional adoption of Ethereum has risen, with the regulatory environment around stablecoins is now clearer.

Ethereum ETF (ETHA) Inflows

As the chart (source: Bloomberg) shows, we've seen consistent daily inflows into the the iShares Ethereum ETF (ETHA), with only two net outflow days since June. This has created a positive correlation between daily returns of Ethereum, further pushing the price upward.

'Crypto Treasury' Companies Increasingly Accumulating Ethereum

- A new wave of crypto treasury companies has emerged, with listed equity plays increasingly accumulating Ethereum on their balance sheets, a move away from Bitcoin's dominance in this space.

- These crypto treasury players (or what should be seen as Ethereum treasury) companies have bought 1.7% of all ETH in circulation, with projections suggesting that over the next 12 months, these entities could accumulate 8-10% of the total Ethereum supply. With many now seeing these listed equity plays as a leveraged bet on Ethereum, and with the recent normalisation of NAV (Net Asset Value) multiples (i.e. the equity market cap / the value of Ethereum held on the balance sheet), some see these equity plays as a more compelling vehicle to play ETH than the spot ETFs.

- Bitmine Immersion Technologies and Sharplink Gaming are among the biggest players, with nearly $8 billion worth of Ethereum held on their balance sheets. SBET report earnings on 15 August, and for those deep in the ETH scene, the earnings announcement and guidance should offer increased visibility on this obvious tailwind to the Ethereum price.

Momentum Buying and Institutional Flows

- Leverage-driven momentum buying from both retail and institutional investors continues to fuel Ethereum's rally. As traders chase price continuation, Ethereum's upward momentum puts a break of 4400 in play, an outcome that would see further interest to chase the move higher.

The Technical Review

- Current Price Action: Our client volumes traded on Ethereum have really kicked up and have been the center of debate from crypto ballers, with the price breaking the December 2024 high of 4105 and trading at the best levels since December 2021. 76% of all open client positions are currently held long (74% on BTCUSD), and while the price is now consolidating after the 30% rally since reversing off 3400 on 3 August, or even 214% since the April lows, consolidation with the price holding above the breakout highs is typically a bullish development, with the ensuing price action skewed for a continuation of the primary trend.

- Price Consolidation: Holding above $4,100 would indicate continued bullish potential. A move back below this level could risk momentum-based long positions being cut back and unwound.

Summary

Ethereum's price surge is driven by favorable regulatory changes, increasing institutional adoption, and growing corporate treasury investments. With a solid ecosystem underpinned by stablecoins, ETFs, and momentum buying, Ethereum’s upside potential remains probable.

Can these fundamental drivers continue to support….? We shall see, but from a pure momentum and price continuation perspective, an upside break through 4400 would be there for the chasing.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.