CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

Could stagflation be the smoking gun for higher volatility in markets?

The S&P 500 continues to be a central focus here, where as long as the index is above the 50-day MA we tend to see ‘buy the dip’ strategies working well. For example, in this dynamic when we’ve seen the 2-day RSI head below 10, it tends to be the trigger for mean reversion trades and the index has pushed back to the 10-day EMA 86.11% off the time.

*I have back tested S&P 500 futures, using data back to 2000 and this would have resulted in 108 trades being placed.

So, as long as price holds the 50-day MA then buying weakness is the way to go it seems.

(Source: Tradingview - Past performance is not indicative of future performance.)

We obsess on risk – mostly around what can go wrong, but also what can positively impact – it’s important to keep an open mind when trading discretionary. With that in mind, I, like many in the macro world, are watching the divergence between growth expectations, consensus earnings forecasts and ultimately price action. We know Q3 has been far weaker than many had expected with Delta playing into behaviours – that is not just in the US but globally – we’ve seen a few prominent economists and Morgan Stanley, Goldman’s and JPM cutting Q3 GDP estimates (due 28 October) well below the consensus call of 6%, with various Nowcast models seeing US Q3 GDP at 3.4% to 3.6%.

The view is that growth will snap back into Q4 and that Q3, therefore, marks the low point.

The street widely believes that Delta is close to peaking, and while there is a lag effect consumption should come roaring back. The idea of a lag is key because we ask whether we indeed do get a snapback in US payrolls at the 8 October meeting? Clearly this is key to cement a Fed taper in November/December. Most economists feel we will see a better jobs print – indeed, the price action in the bond market on Friday suggested investors saw last week’s payrolls impacted by factors that won’t be as prevalent in the September NFP (due 8 October).

But how long can the data roll in on the weaker side and traders continue to say “this was affected by Delta, Q4 will be better”.

Next week we get US PPI and CPI, and producer prices are expected to increase 40bp to 6.6% - we’ve seen a strong and positive response in wages, but we also know that central banks, notably the Fed, are watching unit labour costs (think remuneration/output) most closely. However, if business inputs are rising then inflation expectations will grind higher.

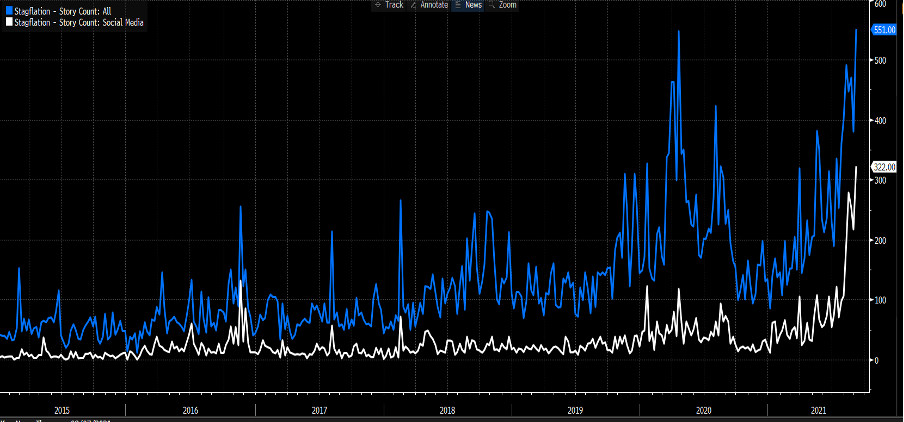

Blue – story count on Bloomberg, white – story count on social media

(Source: Bloomberg - Past performance is not indicative of future performance.)

In a world where inflation expectations are sticky and near-term growth expectations are slowing, the word ‘stagflation’ is being used far more liberally – there are plenty of articles that have pondered on the subject, in fact, running the story count we see articles on stagflation are through the roof - the idea of central banks normalising policy into an emerging environment of stagflation may not sit well with bond or equity investors.

If you sit in the camp that growth is due to snapback in Q4 then you’ll look through this period of Delta-induced economic weakness and not be overly concerned with stagflation. However, if Q4 numbers start to come down one has to believe S&P500 2021 consensus EPS of $2.02 and next year’s estimate of $2.21 could be at risk. Could that cause volatility to rise across asset class?

As long as the S&P500 holds the 50-day MA then buy the dip strategies should continue to work, but a close through the moving average and we may well see the markets talk themselves into a more pronounced drawdown. It’s cheap to own portfolio protection – maybe it's time to put the VIX index on the radar?

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.