CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

A Traders’ Playbook; Compelling opportunity in a low vol world

Trading views

We come into the new trading week with several major equity indices losing steam, and with the VIX index closing at new cycle lows. Short exposures seem hard graft with volatility so low, but we have some defined levels to set risk to for those positioning for drawdown –EUSTX50 – 4350, GER40 -16,000, US500 – 4540 and NAS100 – 15,628 – an upside break though in the US equity indices and headlines of new all-time highs will likely make the front pages.

EURUSD daily

The USD etched out a small gain last week, but the fortunes of the DXY reside in how EURUSD reacts at the March uptrend support and the 25 Aug pivot low (1.0765). With rates markets sensing many G10 central banks are done hiking, relative expectations of growth are pivotal in driving exchange rates. EURCHF is a classic relative play, and this cross feels like we break the downside levels of 0.9520 soon enough.

I like USDCHF higher too, while GBPUSD could well be breaking support at 1.2550 soon. The AUD should get increased focus this week, although traders have a firm eye on China while managing RBA meeting risks.

Commodities should be on the radar, with SpotCrude on a tear and many are questioning how long it takes for crude to test $100. I’m not going to call it, but the skew in risk is for higher levels and we’re certainly seeing a more bullish tone in the options world, with growing open interest to buy $100 Brent calls. We also see a steeper Backwardation between front-month US crude futures and March 2024 futures (TradingView code - NYMEX:CL1!-NYMEX:CLH2024). A steeper backwardated futures curve offers increased positive carry for market participants, making long crude exposures even more compelling.

Gold bulls have been frustrated with price rejecting the 61.8 fibo of the July–August sell-off. However, this is where we can look at gold ex-USD and see some solid trends and upside momentum. For those who like momentum, put XAUAUD, XAUCHF, XAUJPY, XAUGBP, and XAUEUR on the radar. Staying in the space and I see sugar is doing everything right – I fancy this higher and into $27.30.

Good luck to all.

The marquee event risks for the week ahead:

US Labor Day (Monday) – Should ensure a quiet start to the trading week.

China (Aug) new yuan loans (no set date) – the July credit data came in at RMB345b, which was the lowest level since 2009, and contributed to weakness in Chinese markets (and China proxies like the AUD). As we assess the increased news flow on policy support, we should also see higher credit data.

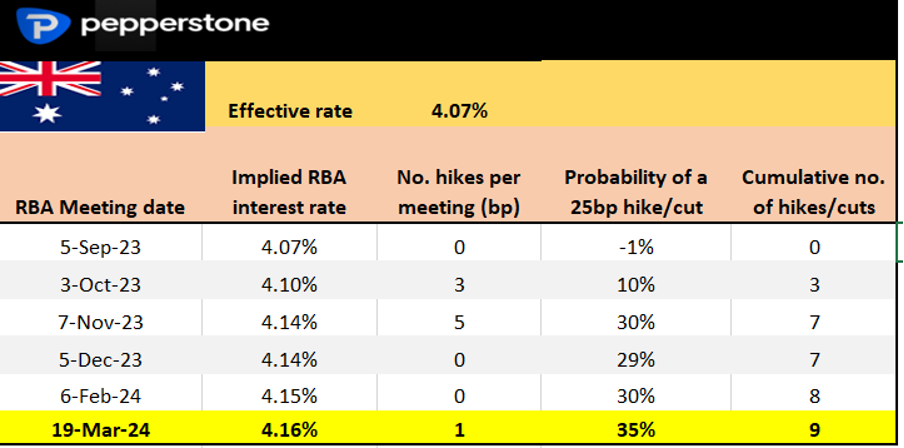

RBA meeting (5 Sept 14:30) – Rates pricing portrays a high conviction call for the RBA to keep rates at 4.1%. The central bank is data-dependent and on recent current data flow, they should be on hold for an extended period, although there is debate whether they could still hike in November – the Q3 CPI print would be the trigger there. The AUD will react to the statement momentarily before reverting to watching China’s news flow. With one eye on foreign economic trends, the key dates for Aussie domestic data going forward:

- 12 Sept – Westpac consumer confidence/NAB business confidence.

- 14 Sept – Aussie jobs

- 27 Sept - Aug monthly CPI

- 3 Oct - RBA meeting

- 19 Oct – Aussie jobs

- 25 Oct – Q3 CPI

RBA pricing – market expectations for the RBAs cash rate

Banco Central de Chile (6 Sept 07:00 AEST) – With subdued growth and headline inflation in freefall. the debate for this meeting is whether the bank cuts rates by 75bp or 100bp. After an 11% rally through June-August, USDCLP has since been consolidating around 850 and range trading strategies are currently working well – the CLP bulls will want copper into $3.90 (200-day MA) and a higher conviction tape in Chinese equity markets.

Australia Q2 GDP (6 Sept 11:30 AEST) – The market eyes GDP at 0.3% QoQ / 1.8% YoY – GDP is not a data point that typically moves markets, but a big downside surprise (QoQ growth closer to 0%) may see the headline writers increase the debate around a 2024 recession.

BoE Governor Andrew Bailey testifies to Parliament (6 Sept 23:15 AEST) – Gov Baileys speech shouldn’t be market moving, especially after BoE chief economist Huw Pills speech last week has set market expectations. The UK swaps market ascribes an 88% chance of a 25bp hike from the BoE on 21 September. GBPUSD eyes the 25 Aug low of 1.2547, where a break opens a move to 1.2400.

US ISM services – 7 Sept (00:00 AEST) – The market expects the index to fall to 52.5 (from 52.7) – hard to know if this will promote volatility as the market cherry-picks when to react to this data point. Any number below 50 could promote USD sellers. We also get the US Beige Book four hours after the US service-sector data, although I see a low risk that the Beige Book proves to be a volatility event.

Bank of Canada meeting (7 Sept 00:00 AEST) – The market ascribes a 5% chance of a hike at this meeting, and only 6bp are priced through to January. The tone of the statement will likely be the driver of the CAD. Upside risks remain in USDCAD, with 1.3650/1.3670 targets.

China trade balance (7 Sept - no set time) – While expectations can hardly be called inspiring, the market looks for improvement, with exports eyed to fall 9.8% YoY (from -14.5% YoY in July). Imports are expected to print -9% (from -12.4% YoY). The China trade data has been a key focal point for the China economic watchers, but with fiscal stimulus now being unleashed into the economy and yet to be seen in the statistics, one questions if the market is less sensitive to the outcome this time around.

RBA gov Lowe speaks (7 Sept 13:10 AEST) – It’s unlikely outgoing RBA governor Lowe will say anything which won’t be expressed in the RBA statement, and new intel is needed to change the view that the RBA are on hold for a period. A sentimental speech, but debatable if proves to be a vol event.

China CPI/PPI – (9 Sept - 11:30 AEST) – Will we see a second month of a decline in CPI? Given the data comes out Saturday there could be small gapping risks for China proxies (AUD & NZD)

ECB speakers – see schedule below – with swaps market now pricing a 25% chance of a hike from the ECB on 14 Sept and with EURUSD testing June trend support, the various ECB speakers could be a highlight this week, with Lagarde the keynote.

Fed speakers – Fed speakers in the week ahead could perhaps be less impactful than their ECB comrades - still some names to put on the risk radar.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

_(1).jpg?height=420)

_(3).jpg?height=420)