CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

WHERE WE STAND – Right then, quite a lot to digest after a long weekend here in the UK.

- Friday’s US labour market report was a solid one, with headline nonfarm payrolls having risen +177k in April, earnings growth cooled to 0.2% MoM, and unemployment having held steady at 4.2%. In ordinary times I’d be throwing around the ‘goldilocks’ narrative, and praising how resilient the jobs market remains. These aren’t ordinary times, though, and that report is very much one that represents a slowdown ‘delayed’ as opposed to ‘averted’, with downside risks prevalent. Still, it substantially lessens the case for Fed cuts in the short-term, and I still see the FOMC on hold at least until summer is out

- Weekend news flow was heavy, with developments in the crude complex of most interest, amid reports OPEC+ have agreed a 411k bpd output hike for June, are set to do the same in July, and will likely continue at such a pace until all of the voluntary 2.2mln bpd cuts are unwound by the autumn, unless compliance improves. Clearly, added to ongoing jitters over the dismal demand outlook, this creates a perfect storm for crude, putting the bears in control, and making further downside the base case. OPEC+, meanwhile, very much seems on its last legs at this stage, and could well dissolve entirely within a year or so, as a war for market share forms up along the lines of USA vs. Middle East (‘OG’ OPEC) vs. RoW (Russia, Kazakhstan, etc.)

- The biggest weekend story, however, was Warren Buffett’s announcement that he’ll step down as Berkshire Hathaway CEO at the end of the year, after six decades at the helm. The word ‘legend’ is bandied around far too much these days, though little else sums up Buffett’s career. The announcement, truly, marks the end of an era as the ‘Oracle of Omaha’ bows out

- As for the new trading week, tariffs remained front and centre as proceedings got underway, with President Trump announcing a 100% tariff on films entering the US from overseas. Not only does this represent a distinct souring of the trade tone, compared to the relative positivity of the last couple of weeks, it also represents a notable escalation in the trade saga, which had previously been confined to goods, but now appears to be broadening to include tariffs on services too. Given that the US is a huge net exporter of services, retaliation on this front is yet another downside risk to add to the list. Anyway, the broad point here is that tariff incoherence, and uncertainty, isn’t going away any time soon

- In terms of other catalysts yesterday, April’s ISM services PMI report pointed to a more rapid pace of expansion than expected, with the index surprisingly rising to 51.6, though a fair chunk of this upside felt like tariff front-running, as opposed to some kind of boom in economic activity. More worryingly, the prices paid metric rose to 65.1, its highest level in over two years, and another impediment to the idea of any Fed cuts in the short-term, as the risks of ‘stagflation’ continue to grow

- Naturally, that saw sentiment pressured as the week kicked off, and a bit of a resurgence of the ‘sell America’ vibe that was so pervasive at the start of next month, as stocks on Wall Street, Treasuries across the curve, and the greenback, all faced rather stiff headwinds. Gold, in contrast, vaulted higher, shining once again, as bullion reclaimed the $3,300/oz handle

- In the short-term, my views remain the same; fading upside in a complacent equity market amid continued trade uncertainty, and huge downside economic risks which have yet to be adequately discounted. I also remain a dip buyer in gold, and a rally seller in the dollar

- Over a longer horizon, I remain of the view that the ‘sell America’ trade has more room to run, with US assets set to underperform RoW peers, amid the erosion in institutional credibility, and erratic nature of policymaking from the Trump Administration, which will both provide ample encouragement for institutional investors, and reserve asset allocators, to continue to trim their US exposures, while also not being in any rush whatsoever to come back. As I’ve noted many times before, paradigm shifts such as this don’t happen over days, instead taking months if not years to pan out in their entirety

LOOK AHEAD – As London returns from the long weekend, a busy week now awaits.

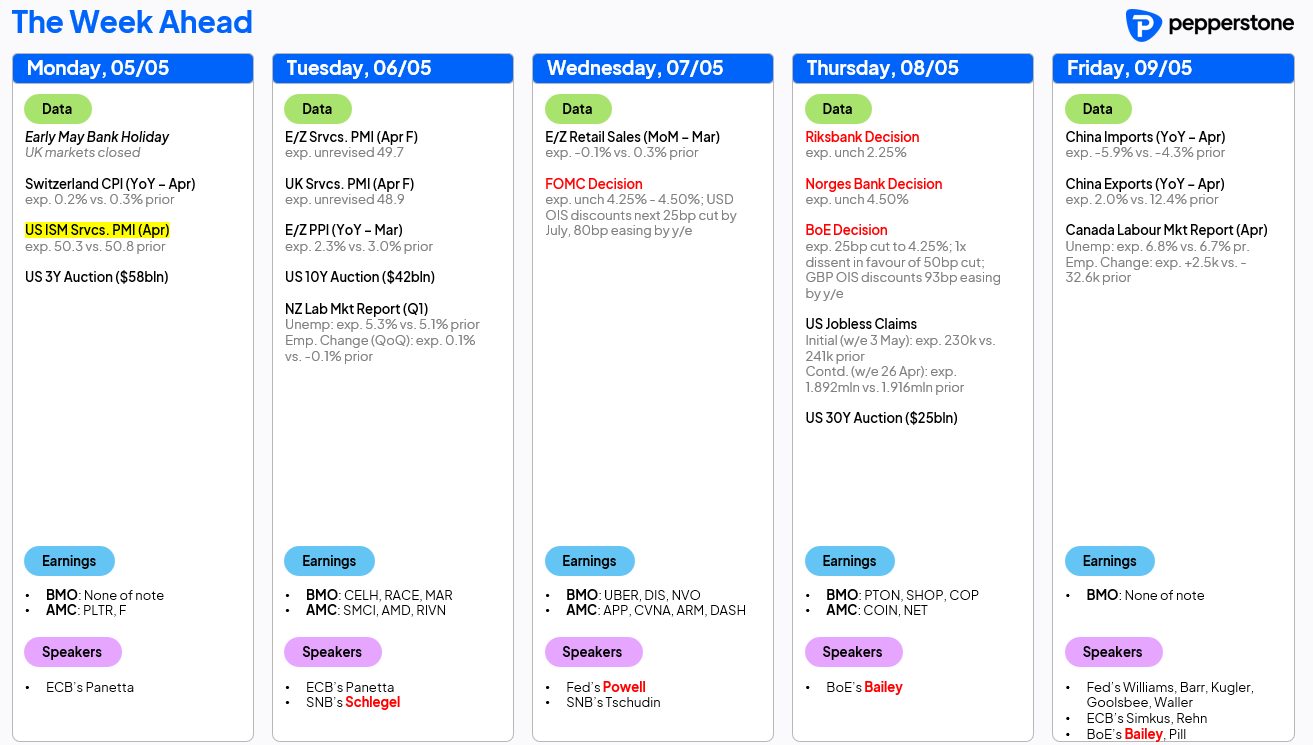

Four G10 central bank decisions highlight the docket, with the FOMC kicking things off tomorrow. All policy settings should be held steady, though Powell & Co will likely emphasise growing risks to the economic outlook, and the increasing likelihood of the dual mandate goals coming into conflict, while reiterating a ‘wait and see’ approach to policymaking moving forwards. Furthermore, Powell should, and likely will, play any questions on politics with a decidedly ‘straight bat’.

On Thursday, the Riksbank and Norges Bank are both set to leave policy steady, while the BoE should deliver a 25bp cut. The ‘Old Lady’ is also likely to open the door to a faster pace of policy easing going forwards, as downside growth risks mount, and amid a lower than expected inflation profile. I’d wager on cuts at the May, June, August, and September meetings now, taking Bank Rate to 3.5% by the end of summer.

Elsewhere, a chunky week of Treasury supply awaits, while the corporate issuance slate could also be a heavy one, after Apple kicked things off with a four-parter yesterday. On the data front, trade figures from China are the main event, and could well show the initial impacts of the effective Sino-US trade embargo that is now in place.

As always, the full week ahead docket is below.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.