- English

- Italiano

- Español

- Français

Analysis

Fiscal recklessness from the US, Japan and many other developed market governments is at the heart of this trade. And even though governments showing a lack of concern to balance future expenditures to revenues is not new, what was recently seen as an outlier position, the view to position portfolios to hedge the rising threat of debasement is becoming more of a momentum position, where, in the case of Bitcoin, it seems the chase could be on.

The Red Flag - A rising Bitcoin price concurrently with the USD and real rates

The fact that we see gold and crypto moving concurrently with a rising USD, higher US real rates and nominal US Treasuries, is a clear red flag. It tells us that the market is becoming progressively concerned, not just with the debt dynamics in the US, but in Japan threats of a new supplementary budget, when the fiscal deficit is already running at 6% of GDP, and the BoJ has cut back on bond buying, could be an issue. In China, federal government debt levels may be comparatively low relative to many Western government levels, but authorities there are about the break away from their imposed fiscal limits and increase spending to raise animal spirits.

However, arguably the overriding influence in a world of fiscal largess is that of the US government. One just has to scroll through the IMF’s recently published semi-annual 'Fiscal Monitor' to see why the US is front of mind.

Reading the report, it won’t surprise anyone that the US is the bottom of the pack when it comes to advanced economies’ government balances - where the US currently runs a fiscal deficit of 7.6% of GDP for 2024, and some 1.8ppt greater than the average of the G20 nations. Trump set to increase expenditures and debt levels This concern is then given real legs with the prospect of a Trump presidency and even more so on a ‘red wave’ scenario, with many pulling out charts that overlap the Bitcoin price to Trump’s perceived odds in betting markets of becoming president in the upcoming US election.

Trump set to increase expenditures and debt levels

This concern is then given real legs with the prospect of a Trump presidency and even more so on a ‘red wave’ scenario, with many pulling out charts that overlap the Bitcoin price to Trump’s perceived odds in betting markets of becoming president in the upcoming US election.

(Source: Bloomberg)

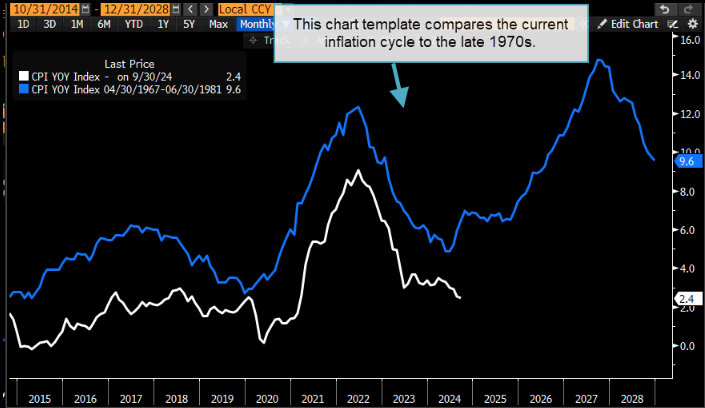

With various agencies and economic think tanks modelling Trump’s proposed fiscal stimulus measures set to increase debt levels by a further $7.5t over the next decade, it’s not hard to see why some fear a re-run of the 1970s - where US inflation fell sharply but then rebounded back to 15%. The notion that a significant increase in US debt levels will result in the US Treasury Department having to issue increasing levels of Treasury issuance, would mean the Fed would be lent on to keep interest rates low, either by maintaining an easing bias or even reverting to buying long-end bonds through QE.

Should market measures of inflation expectations start to rise sharply, then this would put the Fed in a clear predicament, and it’s a dynamic that no central bank would want to face.

So, voila, you have an element of the market looking to hedge out these risks, and it's not as if Kamala Harris is campaigning on austerity either. And, while she will struggle to pass any of her proposed fiscal policies through the Senate, if we were to see the US even remotely heading the way the Starmer government is going in the UK, then Harris will likely become one of the least popular newly elected presidents in US history.

The path of least resistance for Bitcoin

Importantly, few are giving up on the USD, and a simple observation of recent FX flows highlights significant inflows into the USD. However, that doesn’t mean investors and traders – for now – can’t own these debasement expressions and the USD concurrently – where the more pertinent question is how best to express that. In equity land, financials feel the love and have the wind to their backs, while it feels only a matter of time before gold pushes through $2758.49 (the ATH) and towards $2800.

However, it’s crypto and Bitcoin - the higher-beta expression of debasement and fiscal recklessness - that is really starting to really outperform.

Subsequently, we can see that inflows into various BTC ETFs have been consistently high since 11 October, with the 5-day average inflow at a record high of $298m. Drilling down, we see that Bitcoin hash rates, and network difficulty sit near all-time highs, as does the number of daily transactions.

With Bitcoin pushing above 70k, we’ve seen a 10% increase in BTC futures open interest on the day, and a near 200% increase in volumes through the crypto exchanges, with our own client flow in Bitcoin (and our suite of crypto) CFDs having kicked up.

New ATH’s for Bitcoin are not far off

The obvious question is whether this trend can build, and we see a new all-time high, which isn’t far off. In my thinking, this is not a trend to bet against at this juncture, as Bitcoin has a history of lasting price trends, where a body in motion can stay in motion.

It seems that unless Trump’s lead in the betting markets reverses sharply, with the implied probability of a red sweep pulling back from the implied 50%, then the man who wants to turn the US into the home of crypto, with promises of a punchy fiscal rollout, should keep the wind to the backs of Bitcoin and crypto more broadly.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.