- English

- Italiano

- Español

- Français

Analysis

Big Themes for 2024 - Will Chinese Market Finally Outperform In 2024?

.jpg)

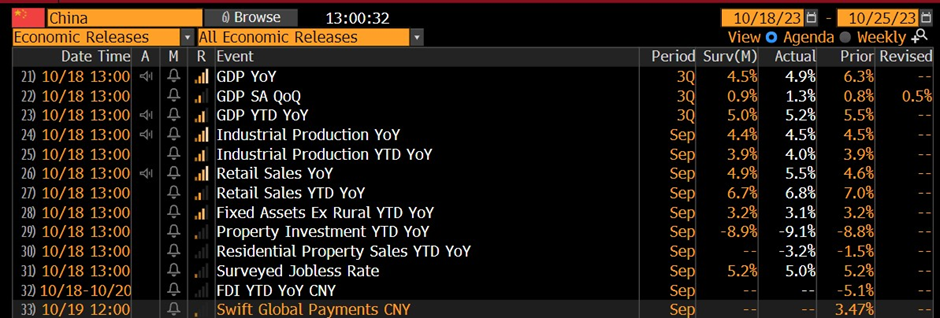

Review 2023

Reflecting on 2023, China made numerous efforts towards economic recovery, including two rounds of reserve requirement ratio and interest rate cuts, easing real estate policies, issuing an additional one trillion RMB in government bonds for local governments, and actively stabilizing the RMB. These measures played a role in stimulating credit demand, maintaining the purchasing power of the sovereign currency, and boosting market confidence. The third quarter saw a 1.3% adjusted GDP growth QoQ, exceeding expectations. Industrial production and retail sales also showed a rebound in the latter half of the year, but economic outcomes still lag behind government efforts. CSI 300, as a general proxy of the Chinese stock market, decreased by 13% YTD, while CN50 shrank by 13.5% and the Hang Seng Index fell by over 17% since the beginning of this year.

Four key issues China is facing

China faces four key issues in 2023. First, deflation. Throughout the year, China's CPI and PPI remained at low levels, with state-owned and central enterprises leading wage cuts, further exacerbating the "deflation" dilemma. This year, a trend towards consumer downgrading became evident, despite the central bank maintaining a high double-digit growth rate in money supply. This resulted in a "liquidity trap," signaling ongoing economic risks.

Second, high local government debt. By the end of 2022, urban investment bonds hit 65 trillion RMB, equivalent to half of last year's GDP. Reducing local debt burdens, like lowering interest rates or allowing local government debt restructuring, is crucial for 2024.

Third, demographic challenges and labor market pressures. China is now experiencing negative population growth, aging, and high youth unemployment. The pandemic backlog of graduates strains the job market, with youth unemployment rates conservatively estimated above one-quarter.

Fourth, unresolved real estate market risks. Defaults by major developers lowered housing demand, creating a surplus. National Bureau of Statistics shows a 4.6% drop in commercial housing sales and a 9.1% fall in real estate investment in the first three quarters, making inventory reduction a 2024 priority. As a spillover effect of the poor property market, the financial sector faces rising bad asset risks. Balancing residents' loan willingness with high deposit levels is another focus for next year.

Looking ahead to 2024

Most of the challenges outlined earlier are set to be tackled in 2024, with several persisting over many years. As its global peers begin to consider easing policies from initially high interest rate levels, a pertinent question emerges: is China poised for an upward trajectory in 2024? Furthermore, given the significant rate spread and low valuation of China, if economic conditions enhance, might we witness a surge of international capital into the Chinese market?

To answer these two questions, the Central Political Bureau meeting on December 8 emphasized strengthening macroeconomic policies and continuing proactive fiscal and prudent monetary policies. My view is that maintaining economic stability is a priority, with fiscal policy leading in 2024 through tax cuts, subsidies, and government bonds, alongside monetary easing, including possible further interest rate cuts.

Investors are keen on the future risk market performance. China's stock market in 2024 hinges on the real estate market's recovery, corporate earnings, and valuations. A continued relaxed monetary policy and moderate RMB depreciation could boost the stock market.

In the FX market, the RMB, influenced by exports and reserves, may remain under pressure despite global interest rate cut pricing. A weaker currency could boost export competitiveness and help China counter deflation, aligning with economic needs. China's recovery impacts its trading partners and risk currencies. Eurozone recovery could benefit from China's demand, and the Australian dollar may see range-bound trading in the next year.

Recognizing achievements and being vigilant about economic risks in an uncertain geopolitical landscape, China's response to the issues above, and an open mindset are key for 2024 profitability.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.