- English

- Italiano

- Español

- Français

Analysis

Banxico Delivers Third Rate Cut in 2024, Replicating August’s Dose

Reasons Behind the Cut

Banxico’s decision is based on three key factors that have allowed the central bank to continue the normalization of the cost of money in Mexico. First, the U.S. Federal Reserve (FED) has also begun to normalize its monetary policy, cutting its rate by 50 bps, a move that positively influenced Banxico’s decision. While there is no explicit synchronization between the two institutions, they historically tend to act in parallel. The FED’s more aggressive approach has given Banxico greater room to maneuver, minimizing the risk of exchange rate volatility.

The second key factor is the inflation trajectory in Mexico, which has resumed a decelerating trend. During the first half of September, general inflation dropped to 4.66%, while core inflation stood at 3.95%, both below market expectations. This price decline has allowed Banxico to act with more freedom in cutting rates without compromising its goal of maintaining price stability.

Finally, the Mexican peso, which had been under pressure from internal political factors, has shown greater stability in recent weeks, trading below the psychological level of 20 pesos per dollar. This exchange rate stability is a factor that facilitates Banxico’s monetary policy actions without increasing volatility in local financial markets.

Outlook for Inflation and Growth

In its statement, Banxico slightly revised its inflation forecasts for the end of 2024 downward. General inflation is now expected to close the year at 4.3%, a tenth less than the previous forecast, while core inflation was adjusted to 3.8%. These adjustments indicate growing confidence that the disinflationary trend will continue, as long as global and local risks do not significantly alter macroeconomic conditions.

However, despite this favorable outlook for inflation, economic growth prospects in Mexico remain moderate. Economic activity has shown signs of slowing, and Banxico acknowledges that both internal and external risks persist, which could affect the recovery. Global risks include geopolitical tensions and inflationary pressures, while internally, political uncertainty and weakness in key economic sectors continue to limit growth prospects.

Implications for Future Monetary Policy

The 25 bps cut was approved by most Banxico board members, with the exception of one member who voted to keep the rate at 10.75%, reflecting that there is not yet unanimous consensus on the appropriate pace for monetary policy normalization. Nevertheless, Banxico has left the door open for future adjustments, stating that upcoming decisions will depend on the evolution of economic data, both in terms of inflation and growth.

It is important to note that the current cut comes in a context of still restrictive monetary policy. Despite the recent reductions, interest rates in Mexico remain at relatively high levels. This suggests that although more cuts are anticipated in the near future, Banxico will proceed cautiously to avoid unanchoring inflation expectations.

Technical Analysis USD/MXN

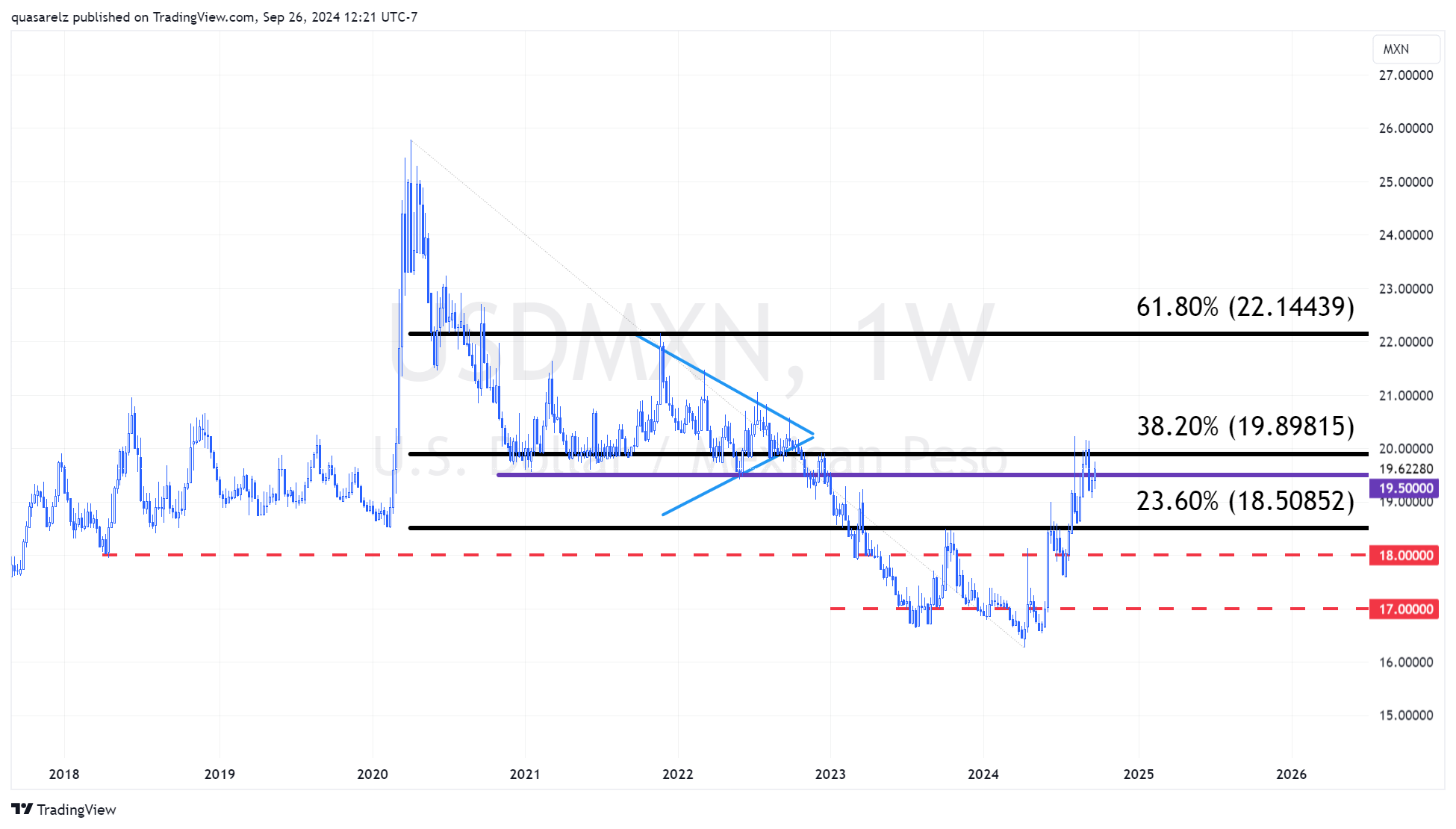

Weekly USD/MXN Chart

Following Banxico’s decision, the Mexican peso (MXN) found initial support, though part of the momentum has been limited, with USD/MXN respecting the 19.6 level. From a technical perspective, the pair continues to operate at levels not seen in several years and awaits greater clarity to determine if the profile will continue its upward trajectory.

The initial relevant resistance is located at the 38.20% Fibonacci retracement, around 19.9, an area that coincides with the key psychological level of 20 pesos per dollar. If this area is breached, the Mexican peso could face a delicate situation, with the next significant resistance level at 22 pesos per dollar. .

Conclusion

Banxico’s decision to cut its interest rate by 25 bps is an important step in its monetary normalization process, influenced by both external factors, such as the actions of the FED, and the internal environment of lower inflation and greater exchange rate stability. Despite positive signs regarding inflation, economic risks persist, and the governing board has made it clear that its future decisions will depend on the evolution of macroeconomic data. In this context, Banxico reaffirms its commitment to ensuring price stability while continuing to support economic growth in an increasingly complex global environment.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.