CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

The economic data and broad event risk offer no major landmines for traders to get overly concerned by, and I think we need to look further ahead at the US nonfarm payrolls (9 Dec) and US CPI (13 Dec) reports for the big part of the macro jigsaw.

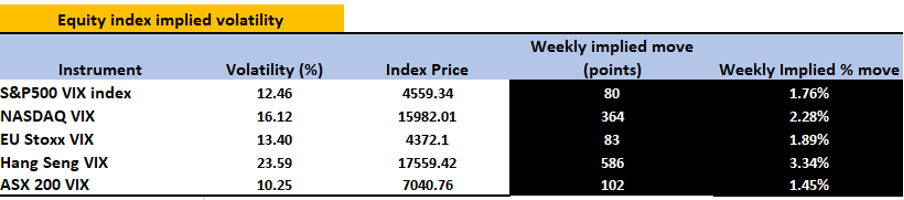

At this juncture, for traders who cut their craft on higher timeframes (4hr, daily, weekly) there doesn’t seem to be too many reasons to be aggressively short risk, and while price action will be dictated to by passive and portfolio flows, the news, and levels of implied volatility suggests if risky assets do kick then it could pay to chase.

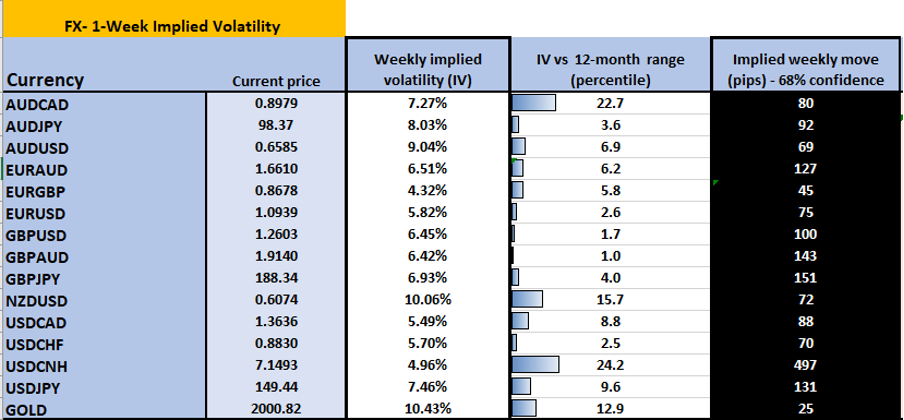

FX & gold implied volatility and implied move (higher or lower)

Equity implied volatility

The USD is central to broad market sentiment, and Friday’s close in the DXY below the 200-day MA may well be telling. With an eye on EU CPI, we focus on whether EURUSD can push through 1.0950/60, and USDJPY into 148, a factor which could see new cycle highs in gold with industrial metals also supported, although Chinese data could play a part in driving that trade.

I like USDCHF downside, with a stop above 0.8760. GBPUSD and AUDUSD also look like they could kick, although AUDUSD needs to push through the 200-day MA and then the 0.66 level.

Bitcoin is making another run at 38k, and after consolidation, we’ll see if price can continue its ascent since mid-October. Clients believe this to be true and are positioned accordingly and many will be thinking Bitcoin can start 2024 with 40 as the big number.

Good luck to all.

The marquee event risks for the week ahead:

China Industrial Profits (27 Nov 12:30 AEDT) – coming off a low base, we saw profits gain 11.9% yoy seen in September. There is no consensus to work off, so pricing risk on the data is a challenge, so the data is unlikely to see too great an initial reaction in markets.

US consumer confidence (29 Nov 02:00 AEDT) – the consensus is that we see the index come in at 101.0 (from 102.6). A print below 100 could further weigh on the USD.

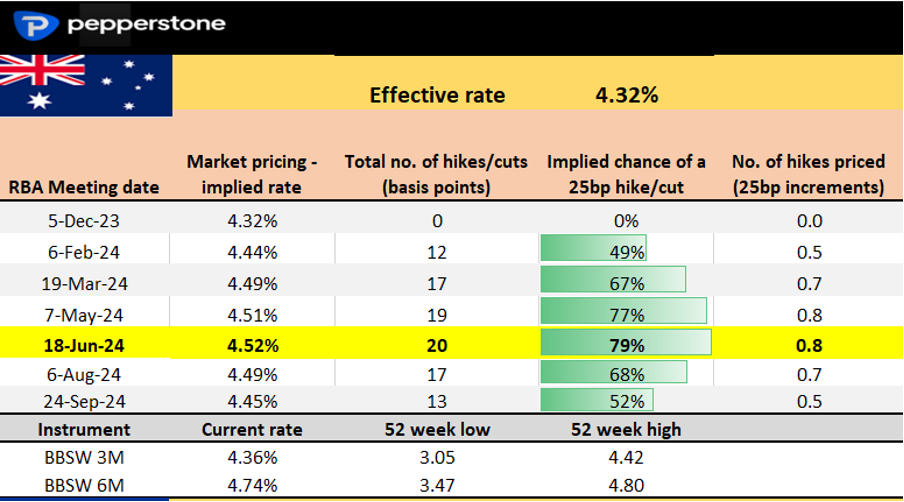

Australia monthly CPI inflation (29 Nov 11:30 AEDT) – the market looks for the monthly CPI read to come in at 5.2% (5.6%), with the range of estimates set from 5.5% to 4.9%. Few expect a hike from the RBA on 5 December, but expectations of a hike in the February RBA meeting are delicately poised at 50%, so the monthly CPI print could influence that call and impact the AUD vs the crosses.

RBNZ meeting (29 Nov 12:00 AEDT) – the RBNZ will leave interest rates unchanged at 5.5%, with the markets ascribing no probability of a hike here. In fact, the argument is more on the timing of the first cut, with a 33% chance of a 25bp cut priced by the May RBNZ meeting, and 55bp of cuts priced by end-2024.

Sweden Q3 GDP (29 Nov 18:00 AEDT) – the market looks for Q3 GDP to come in at -0.2% QoQ / -1.4% yoy. After recording -0.8% in Q2, another negative quarter puts Sweden in a technical recession and accelerates the need to cut rates, where we see the door open for easing from June 2024. This GDP print should also mark the low point, where GDP should be less bad going forward, which is part of the reason why the market has been better buyers of the SEK of late.

China manufacturing and services PMI (30 Nov 12:30 AEDT) – the market looks for the manufacturing index at 49.6 (from 49.5) & 51.1 (50.6). Keep an eye on copper over the data, and for a possible upside break of $3.80 and the 200-day MA – a scenario which would likely put upside risks in the AUD.

EU CPI (30 Nov 21:00 AEDT) – the market looks for headline CPI inflation to come in at -0.2% MoM / 2.7% (from 2.9%), with core CPI at 3.9%. The swaps market sees the ECB hiking cycle as firmly over and looks for the first cut in April, which may be a touch optimistic. We also see the hedge fund community heavily short of EURs, so if equities can squeeze higher then EURUSD should follow suit with moves accelerated on short covering.

OPEC meeting (delayed - 30 Nov) – Expectations of deeper output cuts are low, with most commodity strategists seeing a higher risk that the current output cuts are extended into 2024. OPEC+ could shock the market of course, but looking at the price action in crude it seems the market is positioned short of Brent Crude into the meeting and betting OPEC+ don’t step up its attempts to reverse the recent bear trend. A close above $83 could see shorts square and even reverse.

US core PCE inflation (1 Dec 00:30 AEDT) – the market looks for 3.1% on headline PCE inflation (down from 3.4%) and core PCE at 0.2% mom / 3.5% yoy (from 3.7%). We look at trends in service prices and services ex-shelter, where slower prices rises should cement the view of adjustment rate cuts from the Fed in 2024.

Canada employment report (2 Dec 00:030 AEDT) – the consensus is that we see 15k jobs created and the U/E rate at 5.8% (from 5.7%) – There’s not a lot to like about the CAD at present, although the market is seeing even less interest in the USD at present. A break of 1.3692 would be welcomed by USDCAD shorts, and the jobs print may influence that flow. In rates, we see the first cut from the BoC priced for April and some 74bp cuts priced by end-2024.

US ISM manufacturing (2 Dec 02:00 AEDT) – the market looks for modest improvement with the diffusion index eyed at 47.7 (46.7). I’m not expecting a huge reaction to this data point as we know manufacturing is weak and we won't learn too much here.

Central bank speakers

RBA – Gov Bullock speaks from Hong Kong (12:18 AEDT)

BoE – Ramsden, Haskel, Bailey (30 Nov 02:05 AEDT), Hauser, Greene

ECB – Lagarde, Deo Cos, Panetta

Fed – Goolsbee, Waller, Mester, Powell (2 Dec 03:00 AEDT)

BoJ – Adachi, Nakamura

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.