CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

A Traders’ Week Ahead Playbook – You can't get any more bullish than all-time highs

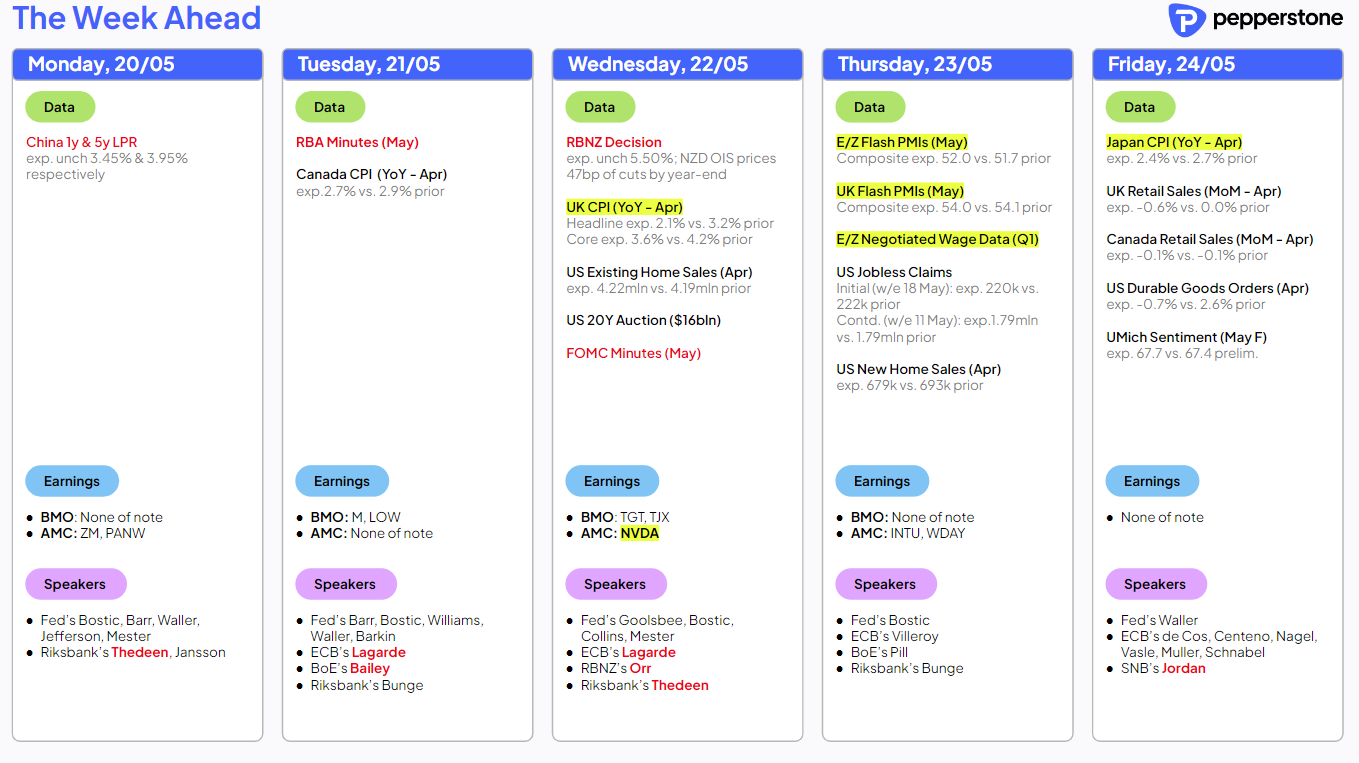

- Key event risks for the week ahead.

- Nvidia’s Q125 earnings, a key driver of equity markets this week.

- Fed speakers could move markets – Powell, Waller, and Jefferson in the spotlight.

- US equity markets at all-time highs – fatigued, but well-supported.

- Copper, gold, platinum, and silver are all on fire.

The key event risks for traders this week

We get UK, and Canadian CPI, and will keep a beady eye on the narrative out from the RBNZ meeting, which will keep rates hold but guide on the future direction of rates. We also get manufacturing and services PMIs in the US, UK, Australia, and Europe.

UK CPI (due Wed at 16:00 AEST) could get the GBP moving – in either direction – with UK swaps market pricing a near 60% probability of a 25bp cut in the 20 June BoE meeting, and 55bp of cuts by December, and with core CPI expected to fall to 3.6% y/y (from 4.2%) and headline CPI eyed at 2.1% y/y, a lower-than-forecast CPI print could cement a June cut in the market eyes. For those wanting to trade GBP downside, short GBPNZD was the play last week, although, with the RBNZ meeting due on Wednesday, an extension of this trade has risk.

Nvidia should beat but by how much?

Q125 earnings from Nvidia could get the AI-related semis and the NAS100 firing up (or lower), and even set off moves across other markets too. When the options market prices an 8.6% move on the day of earnings, if this implied move proves to be correct, that’s a staggering $195b in market cap gained or lost in a likely 60-minute window. It would also equate to a -/+0.5% move in S&P500 futures in the after-hours session.

We know Nvidia will likely beat the sell-side (investment banks) consensus estimates for revenue, EPS, and gross margins - they always do - but it’s the extent of the beat that matters. Q125 sales are eyed at $24.61b, with Q225 sales guidance expected to come in around $26.72b – one suspects they’ll need to hit us with sales of $26b+ for Q125 sales and $29b for Q225 sales respectively, with CEO Jensen Huang with inspiring guidance to get this pumping like we saw in February.

Fed speakers to watch out for

The message last week from the Fed was one of patience and this message is likely what we’ll hear from Fed speakers this week as well. Chair Powell, Fed board member Waller and Vice-chair Jefferson will be the central focus here, and their views on inflation and policy could move markets, although broadly, markets feel comfortable with the current pricing of 43bp of cuts priced by December, and we see US 2yr Treasuries holding a range of 4.89% to 4.70%.

Last week’s US CPI was encouraging and while this week’s US PMI data could move the dial, notably, if the services print were to surprise and pull below 50 (consensus is at 51.4) it could lift volatility and promote USD sellers. That said, it feels like the market is looking forward to the nonfarm payrolls print on 7 June as the next big piece of the macro jigsaw.

US data has been missing the mark on a consistent basis since mid-April and that has led some to say the US economy is moving towards a ‘soft landing’ environment and away from a ‘no landing’ dynamic. Add in solid earnings beats and growth, a renewed belief in the ‘Fed put’ and a world with a huge appetite to sell volatility (the VIX now sits at a lowly 11.99%) - and we have the S&P500, Dow and NAS100 at all-time highs.

This is a tough market for those in short positions for more than an intraday day trade, and those positioned for downside would be hoping that Nvidia disappoints in a big way. Nvidia are not a company I would typically bet against, so even though the various US indices look tired, the platform is set for further highs and pullbacks should be shallow.

This is true of the HK50/CHINAH indices too, which have had another incredible week of gains. Data in China is lacking this week, so we are fully at the mercy of liquidity and flows. 20k is the near-term target for the HK50 index, but I would consider switching some of HK50 exposure towards the mainland equity markets and the CN50 index, which has broken out and outperformed HK equity on Friday.

We’ll see if some of the goodwill towards China can spill over into the ASX200, which saw supply above 7850 last week – should the ASX200 kick through 7860 early I would be looking for a re-test of Thursday’s highs (7900) and even new all-time highs above 7910.

Copper on fire

The action continues to be in the metals complex – the space is red hot. Copper closed 4.1% higher on Friday, taking the gains for the week to 8.3%, and for the trend-followers and momentum traders, the daily chart is a thing of beauty. Many know the story on reduced copper supply, and those highly focused on the copper scene would be aware of the massive short covering seen in CME futures positioning since mid-February (-42k contracts to stand at +72k) and the widening premium of CME copper to LME copper to $1041 - but the move in copper is momentum 101 and discretionary and systematic players have had to chase.

For FX traders, this move in copper remains a huge tailwind for the CLP (Chilean peso), where USDCLP has fallen 9.4% since mid-April.

Market players chasing silver, platinum and gold

The chase higher from various market players is also true in silver, which had its best week since August 2020, helped by a monster move of 6.5% on Friday, which took price through to the best levels since Feb 2013. Platinum has participated with an 8.8% weekly gain, while gold closed at a new closing high, and eyes the all-time intraday high of $2431.52 – a weekly close above here this week and the FOMO chase could be real.

The question of exactly what is driving the gold move above $2400 is one we hear frequently. The fact we saw US real rates (i.e. US bonds adjusted for expected inflation) rise 3bp higher on Friday – typically a headwind for gold - yet gold rallied 1.6% details that there are other factors than rates driving gold flows – these include a broad base rally in metals, central bank buying, increasing Chinese gold holdings (relative to its international reserves), a hedge against ballooning government deficits; it’s all there and it seems we always have to pick a reasoning behind a move after the fact.

I have little idea how anyone trades gold short-term from a purely fundamental standpoint. My view is to be a slave to price action, react, align with the short-term trend, and cut quickly when the move goes against you.

Anyhow, another big week of market themes and risk to have on the radar. Good luck to all.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.