Industry leading liquidity

Liquidity – an important trading consideration

Perhaps the most important consideration, regardless of account type, is the liquidity conditions at the quoted or displayed buy and sell price. Liquidity is the ease at which a trader can get in and out of a position at the quoted price and without having to move down the order book to achieve a fill at the next best price.

Obtaining a worse price because the volume offered by a market maker or a liquidity provider to transact at the quoted price is lacking is called ‘slippage’ and will result in the trader paying a wider spread.

This happens far more frequently than many would believe, especially by smaller brokers running a zero-spread model. Where traders looking for a fill-in 0.1 of a lot of or greater may see their actual fill on the transaction wholly different from the price quoted on the platform.

In most cases, a trader will not reconcile the difference, but this slippage will add up as a cost on the portfolio, especially for traders transacting in size, which speaks to a lack of transparency in pricing and can damage the trust a client holds for their broker.

An example of the Pepperstone difference

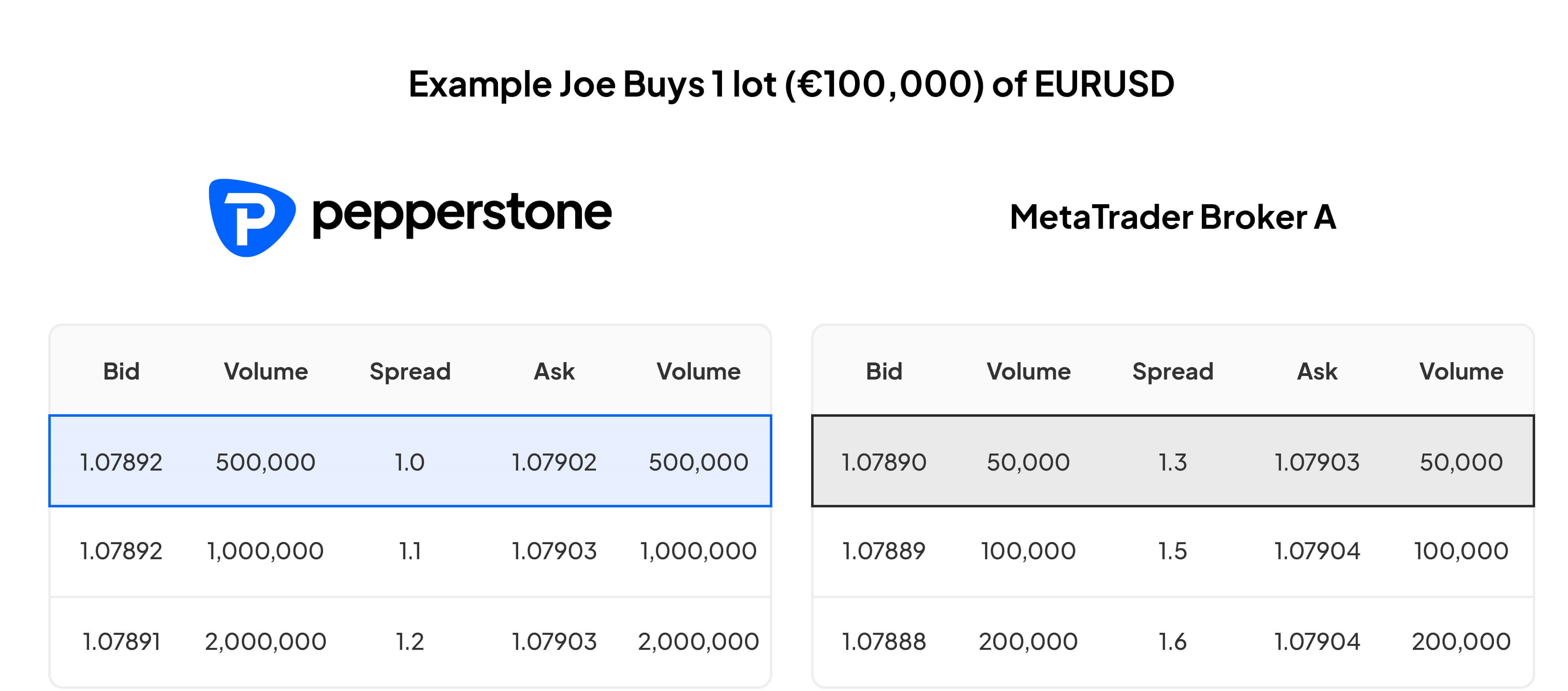

Say Joe wants to buy 1 lot (100,000 EUR) of EURUSD. With Pepperstone, Joe's order is executed at the quoted price of 1.07902. But with Broker A, the order is filled at the Volume Weighted Average Price (VWAP) of 1.07904, which deviates from the quoted price. This is because Broker A has thin liquidity, offering only 50,000 at the top of the book spread. Since Joe has bought 1 lot (100,000 EUR), the remaining portion of the trade (50,000) moves to the second layer of the order book offering 100,000 volume, and that’s the spread applied to the 50,000 volume traded.

The above table is for illustration purposes only.

With Pepperstone, the 1 lot order is executed at the quoted price of 1.07902. With Broker A, however, the volume isn’t there to facilitate the 1 lot request, so the order is filled at the Volume Weighted Average Price (VWAP) of 1.07904 instead of the quoted price.

This may seem like a small difference, but it highlights that the price Joe thought he had transacted at and the actual transaction fill may be different given the liquidity dynamics.

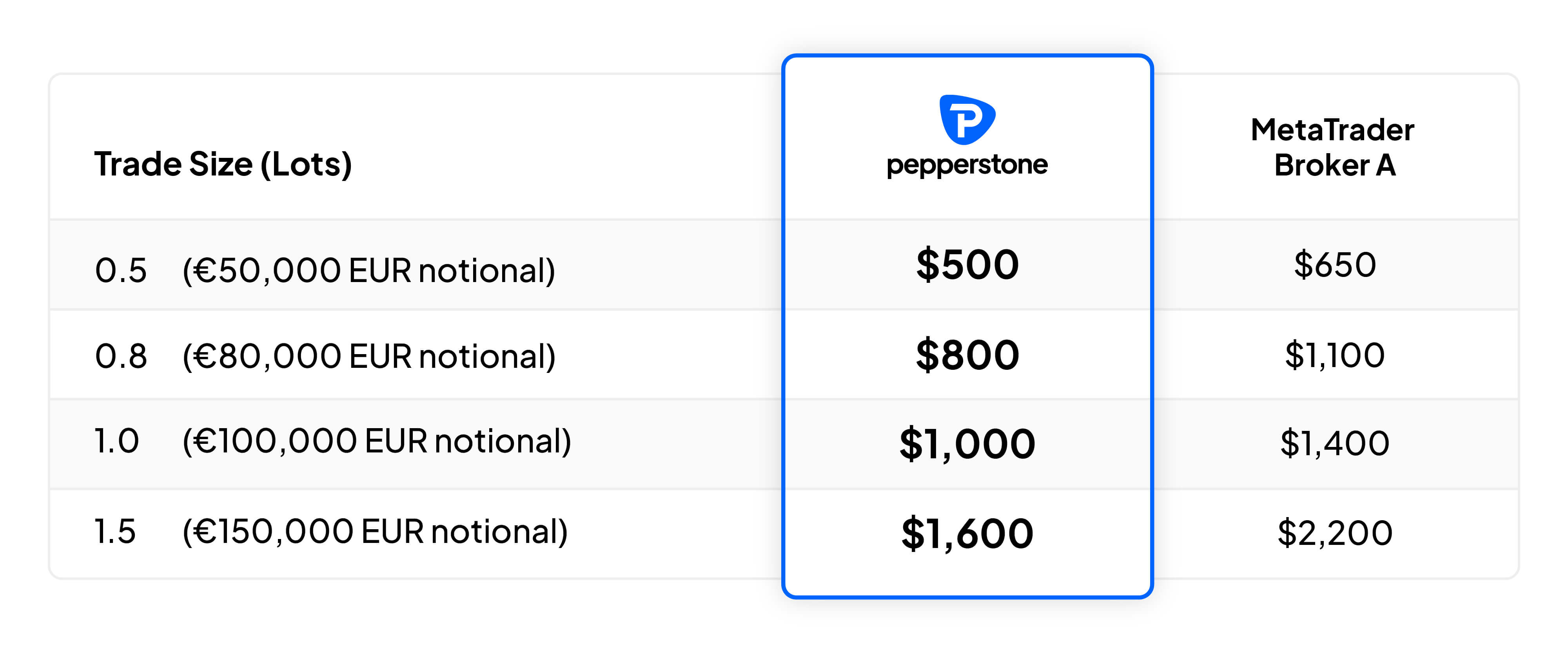

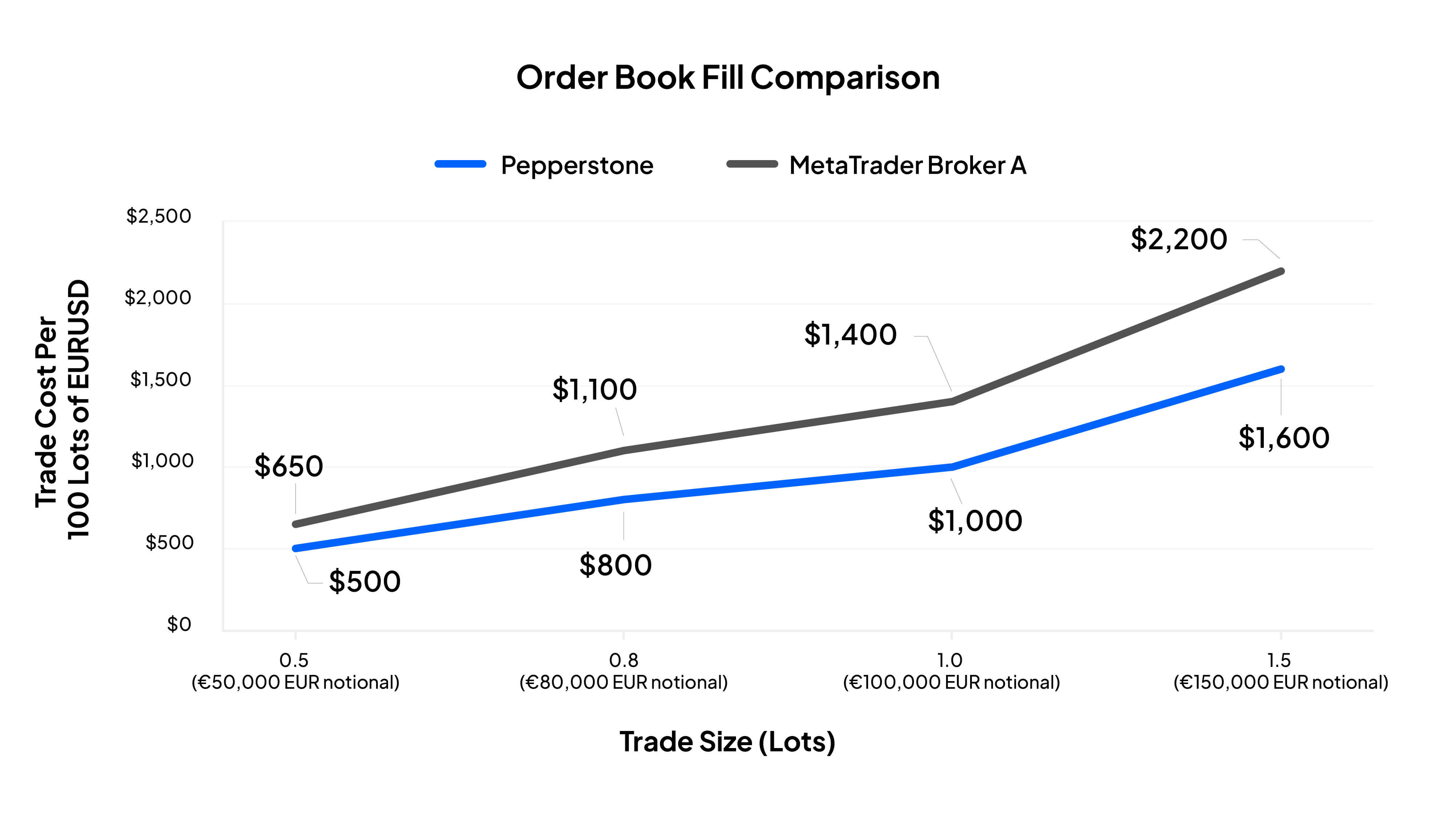

Consider how this scenario plays out over 100 trades. While the price and the bid-off spread will fluctuate (from this example), and liquidity will vary trade-to-trade, we can see how this plays out over time if we extrapolate the parameters in this example.

The above table is for illustration purposes only.

The above table is for illustration purposes only.

Pepperstone’s deep liquidity at the quoted price (also known as top-of-book liquidity) is industry-leading and considered one of the best in the business. Typically, if a trader wants to transact in a larger size, they will have a far greater chance to open and close a trade at the price they were quoted, than many other brokers.