- English

- 中文版

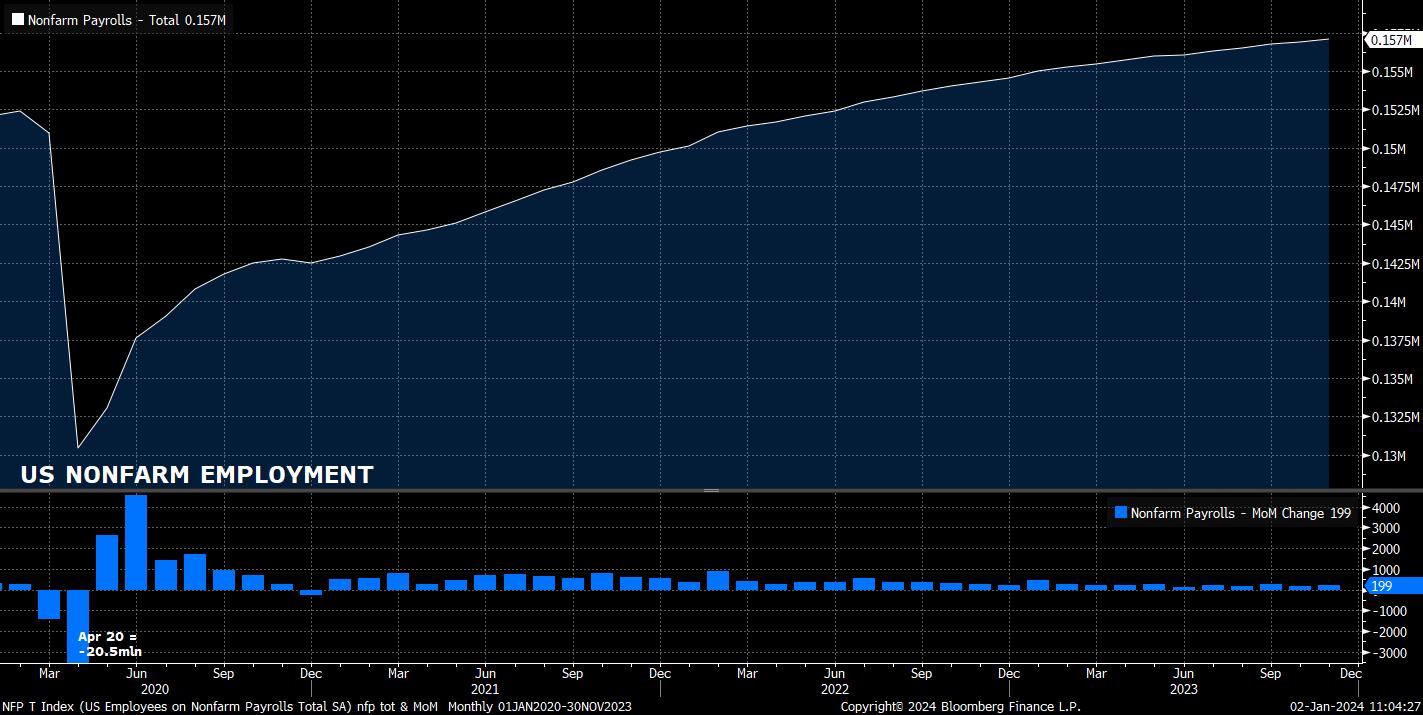

Headline nonfarm payrolls are set to have risen +170k in the final month of 2023, a modest cooling from the +199k seen in November, though still representative of a strong pace for the late-cycle US economy, while being just a touch below the 3-month moving average of 204k. However, as is typical with NFP, the range of estimates is wide, from +80k to +200k, though only around half the usual number of estimates have been submitted to Bloomberg at the time of writing, owing to the Christmas and New Year holidays.

Leading indicators for the jobs number are somewhat mixed. Initial jobless claims remained largely unchanged at 206k in the survey week, however continuing claims rose to a one-month high 1.875mln during the same period, up 14k week-over-week, with said high likely representative of distorted data over Thanksgiving. For all practical purposes, continuing claims can be said to be at their highest level since late-December 2021, implying that it is taking significantly longer for those losing jobs to find new employment.

Meanwhile, the latest ISM manufacturing survey will not be released until Wednesday, while the comparable services figure is due on Friday afternoon, after the jobs report drops, and thus holds no predictive value this time around. The same can be said for the monthly ADP employment report, which actually now displays a negative correlation with the official BLS payrolls figure. In layman’s terms, the ADP figure isn’t worth the paper that it’s written on in terms of predicting the official print.

There are some other important themes one must consider in advance of the jobs number being released. Firstly, is the potential impact of festive hiring around the Christmas period, particularly in the retail and hospitality sectors. Though the BLS do attempt to smooth out the impact of said hiring via seasonal adjustment, there is still potential for noise to be introduced to the data.

Furthermore, one must recall that the November employment figure was boosted, to the tune of around 30k, by the return of striking workers, primarily in the auto manufacturing sector. This had the impact of artificially flattering the headline payrolls print, with ‘true’ job creation likely lying closer to 160k, implying that the trend of moderating employment growth is continuing.

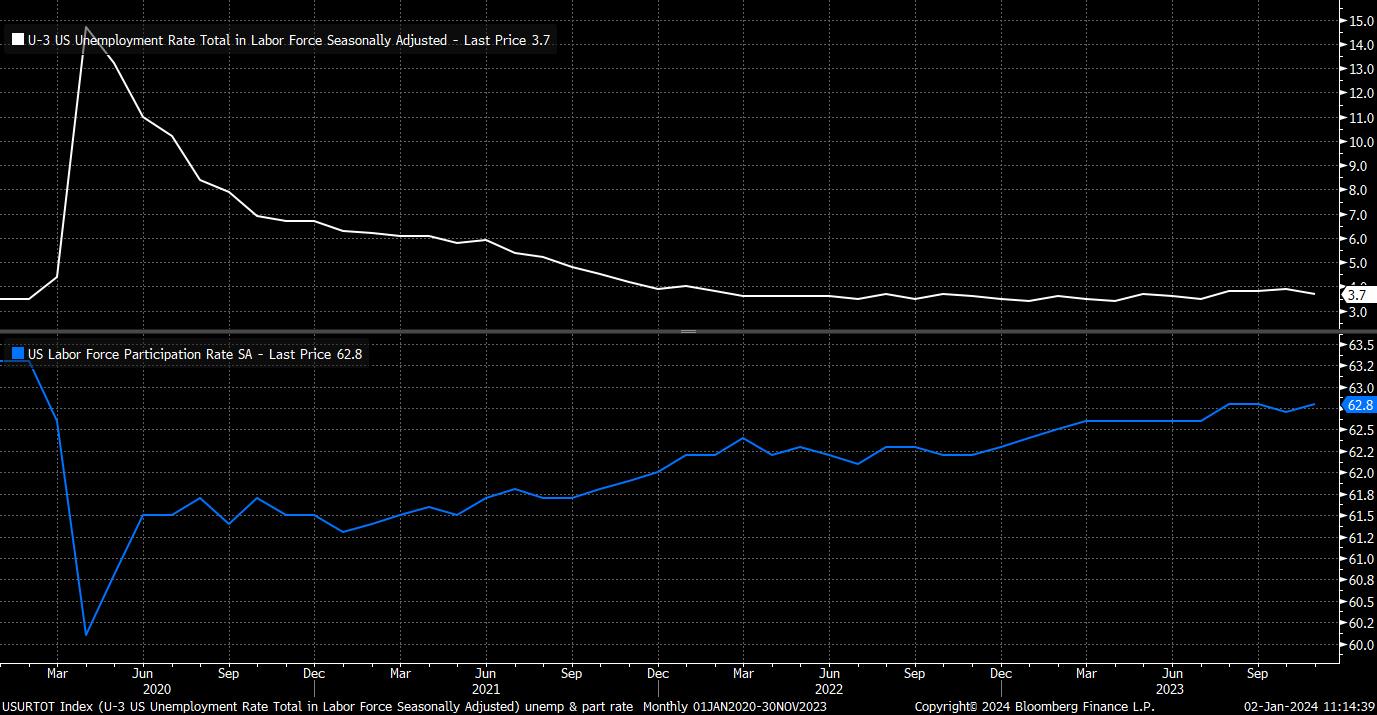

Elsewhere in the labour market report, unemployment is expected to remain unchanged at 3.7% in December, having notched a surprising 0.2pp fall a month prior, though the rise in claims alluded to above does suggest a risk of unemployment ticking a touch higher to round out the year. The same can be said of underemployment, where the U-6 rate fell to 7% in November, though labour force participation is likely to remain at a cycle high 62.8%.

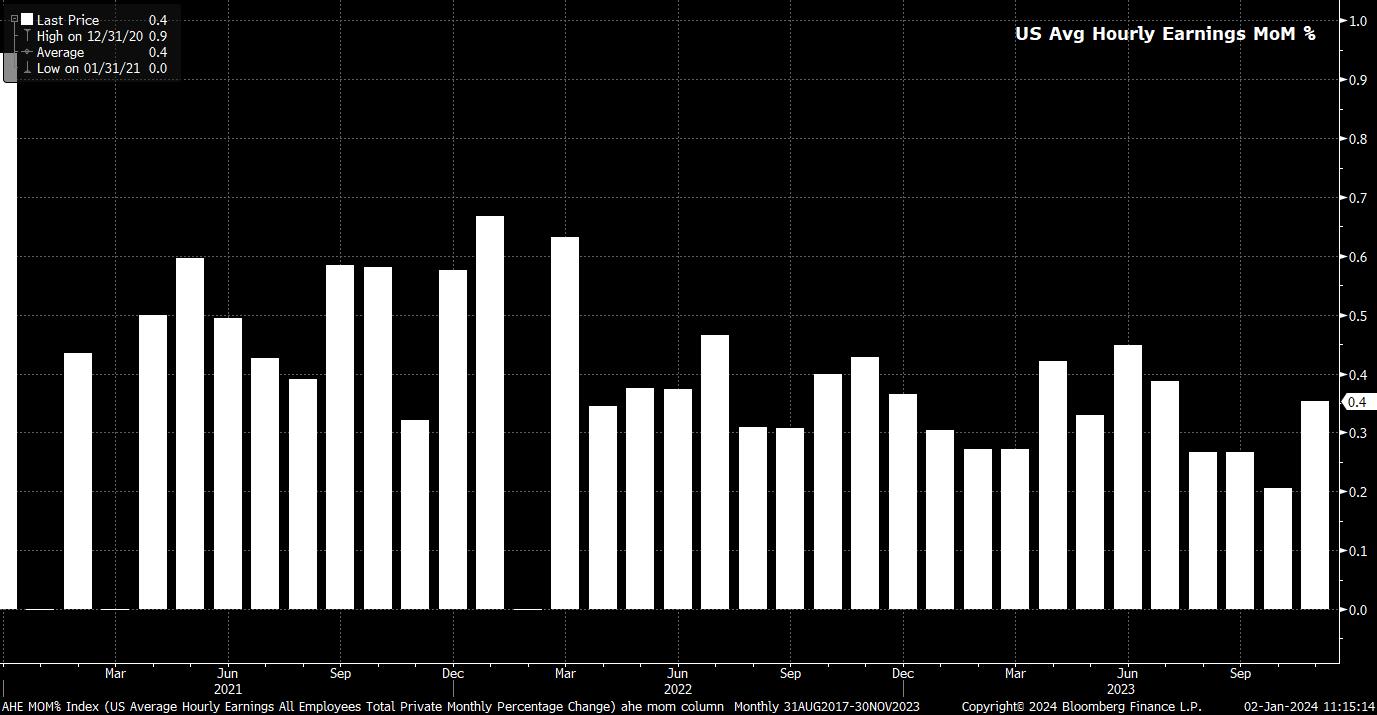

Average earnings, meanwhile, are set to have risen 0.3% MoM in December, just a touch cooler than the 0.4% MoM rise seen in November, the fastest pace since July. Risks, however, are tilted to the upside, with the labour market remaining relatively tight, thus continuing to exert upward pressure on wages. Annual, earnings growth should cool 0.1pp to 3.9% YoY, though the bulk of this modest decline owes to base effects, and thus is of limited value when looking forward.

For financial markets, it is important to view the jobs report through the lens of where consensus, and therefore pricing, lies for the year ahead. As noted, expectations continue to lean heavily towards the idea of the US economy achieving a soft landing, whereby inflation returns to the 2% target, without a significant decline in economic output, or dramatic deterioration in labour market conditions.

Furthermore, traders have also become increasingly confident that the FOMC will significantly lower the fed funds rate this year, spurred on by Chair Powell’s dovish pivot in December, with OIS now implying over 150bp (i.e. six 25bp cuts) over the next calendar year – admittedly, this pricing does appear a tad over-the-top at this stage, particularly with the ‘dot plot’ pointing to just half that magnitude of easing.

With the above in mind, the balance of risks points to a more sizeable USD rally on a stronger than expected jobs report, than a decline in the buck on a softer print, with the bar for a further dovish repricing of the aforementioned OIS curve being a relatively high one at this stage. This point equally applies to Treasuries, especially at the front-end, where the scope for substantial further gains in the immediate-term may be relatively limited, likely requiring more concrete evidence of an economic slowdown for the bulls to further flex their muscles.

Finally, for equities, the early part of 2024 is likely to be a classic case of ‘good news is bad news’ – and vice versa – whereby upbeat economic data results in a hawkish reassessment of policy expectations, thus exerting downward pressure on riskier assets. Nevertheless, over the medium-term, the ‘path of least resistance’ continues to lead higher, with the S&P 500 just a whisker away from an all-time high, and a break above that level likely to entice further longs to enter the fray.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

.jpg?height=420)