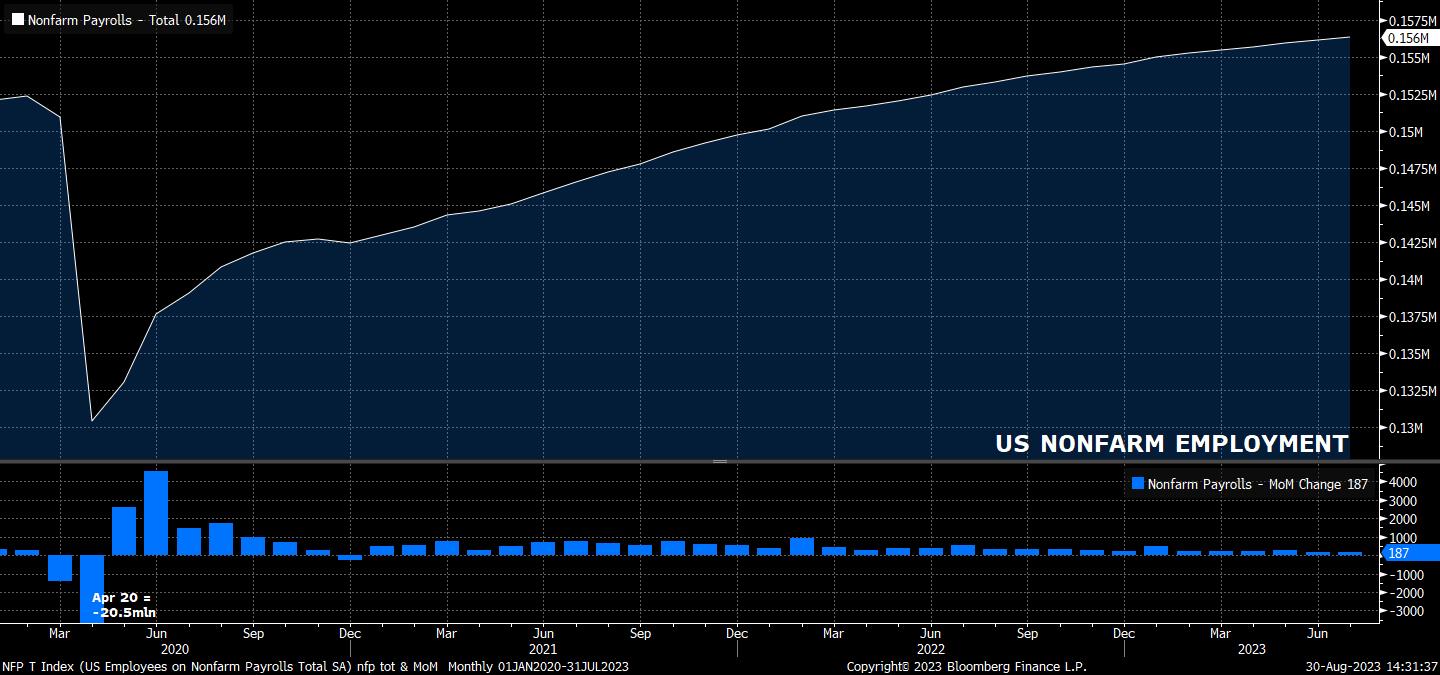

Economists expect headline nonfarm payrolls to have risen by 170k last month, a modest cooling compared to the 187k pace seen in July, and somewhat below the 6-month average of 222k.

However, context is key here. With the economy late in the cycle, the pace of jobs creation will naturally slow. In any case, a print around the 170k mark would be above the six-month average seen in the year prior to the pandemic (approx. 150k), and considerably above the 70-100k jobs required simply to keep up with working-age population growth. Of course, it’s also important to recall that the FOMC actively want to see the labour market soften, hence a slowdown in payrolls growth is not all bad news.

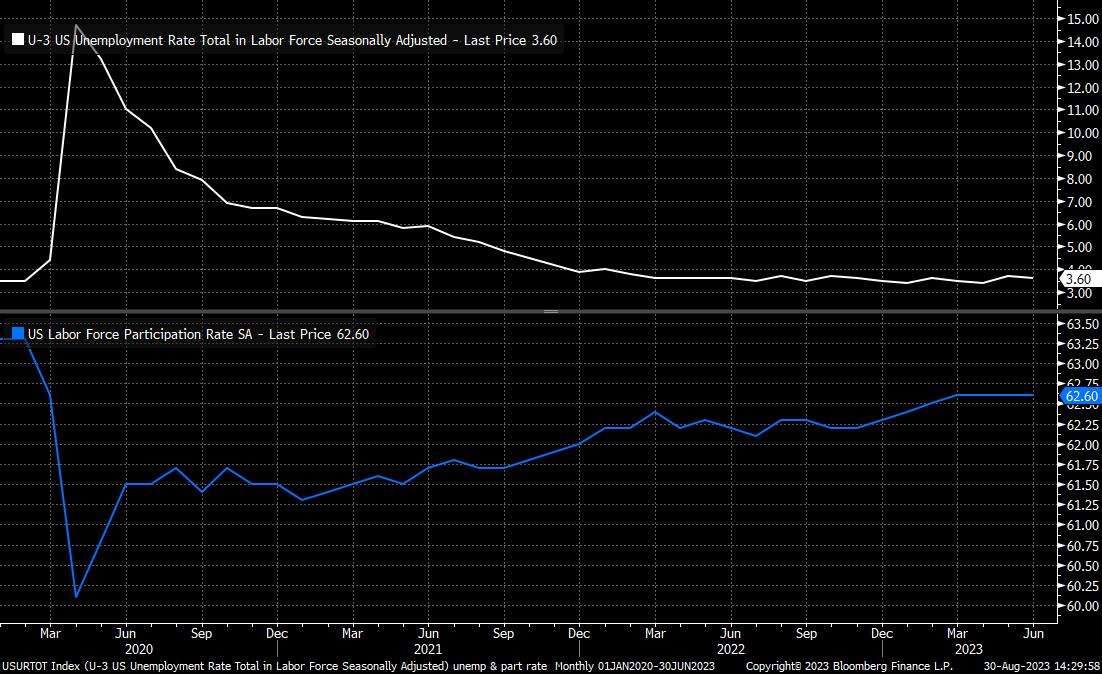

As always, one cannot simply watch the payrolls figure in isolation. Other areas of the report are also set to point towards a tight labour market – unemployment is set to remain at 3.5%, participation is seen holding at 62.6%, while investors will also look for prime age (25-54 yrs old) participation to remain close to the 83.5% cycle highs. Combined, this all points to remarkable labour market resilience, despite 18 months’ worth of policy tightening.

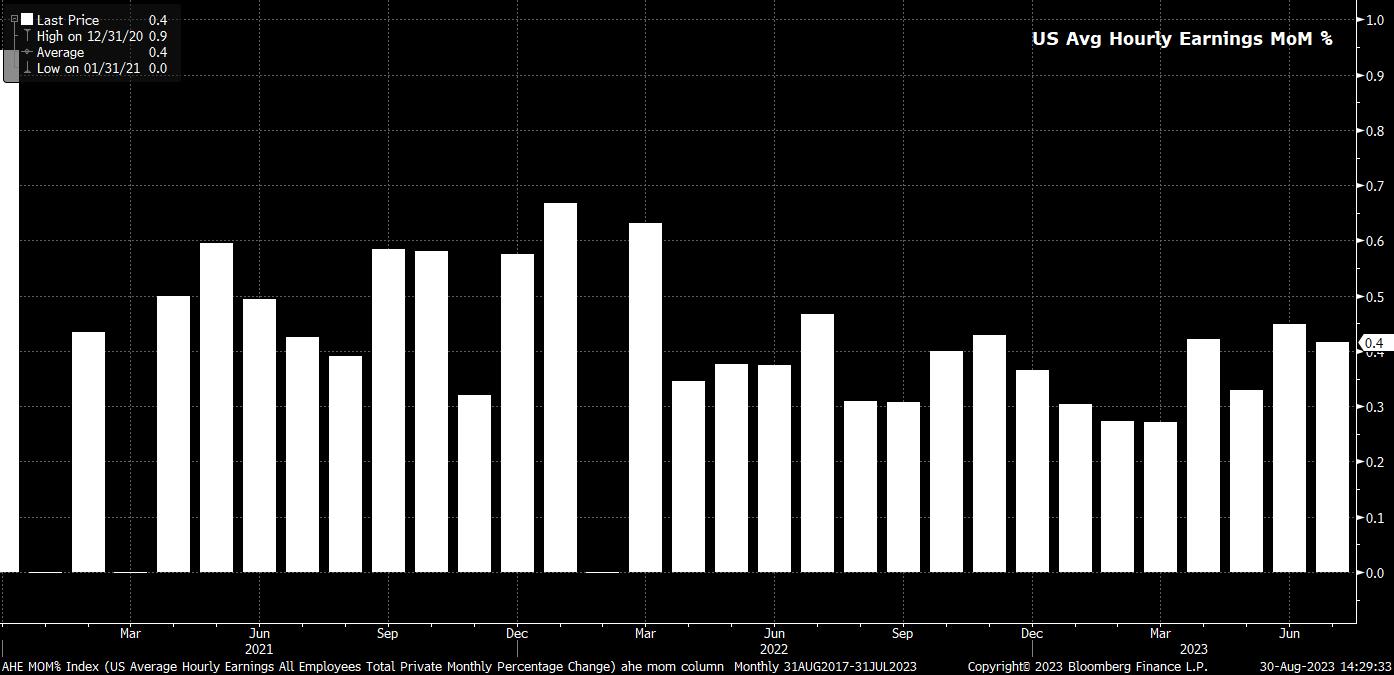

This is also continuing to exert upward pressure on earnings, which are expected to rise 0.3% MoM, taking the annual pace a notch lower to 4.3% YoY – this would, however, still represent real earnings growth of just over 1% YoY. It is this, as opposed to other areas of the labour market report, that policymakers are likely to watch most closely, given the implications that real wage growth may have in terms of the stickiness of inflation, particularly core prices.

Nevertheless, while lose attention will be paid to the earnings print, the immediate policy implications of the data are likely to be somewhat limited. After a rather uneventful speech at the Jackson Hole Symposium from Fed Chair Powell, the September FOMC decision is likely to follow a similar script, with the Committee seemingly unlikely to deviate from their current data-dependent stance, while maintaining a distinct tightening bias, leaving the option of another hike before year-end on the table.

Markets are currently onboard with that view, pricing just an 8% chance of a 25bp hike in September, along with a one-in-three possibility of such a move at the November meeting.

In the shorter-term, however, the immediate market reaction to the payrolls print is likely to be similar to that seen in the aftermath of the JOLTS data earlier this week, where bad news proves to be a positive for risk, as a result of a potential dovish repricing, and vice versa. It should be noted, though, that the payrolls report drops on a Friday before the Labor Day weekend in the US, potentially thinning liquidity and reducing trading activity both around, and after, the number.

For the dollar, the 200-day moving average, at 103.10, and the 103 figure below, are the key support levels that the bulls will seek to defend, and may mark something of a ‘last chance saloon’ for USD longs, given the closing break made of the upward trend (since mid-July) a little earlier in the week.

_D_2023-08-30_14-28-18.jpg)

In the equity space, meanwhile, the S&P 500 continues to pivot around the psychologically key 4,500 handle, with the 50-day moving average just below at 4,489. A break below this level could open the door to a return to the 4,400 mark, while upside resistance stands initially at 4,585, before 4,630.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

_(1).jpg?height=420)