the USD has found its form and this one-way movement is the flow of capital aggregating to promote a rampant bull trend – Hedge funds and CTAs (Commodity Trading Advisors – trend followers) would be all over this move, and anyone who subscribes to buying strong and sell higher – Momentum is the strategy here and we’re seeing the biggest one-day gain in the USD since the June FOMC meeting, with the biggest percentage moves vs high beta FX (NZD, MXN, NOK).

The question for intra-day traders is can momentum morph more into a short-term mean reversion play? Or, can we run both concurrently?

EURUSD daily

(Source: Tradingview - Past performance is not indicative of future performance)

EURUSD has broken 1.1600 and trades the lowest levels since July 2020 – what’s interesting is the 1.1900 double top neckline (1.1663) has now been taken out and this targets 1.1420. One could take the timeframe out and see an even larger double top in play that argues for 1.1100 – that’s a big move and it won’t happen overnight, if at all. The USDX (USD index) has taken flight, as one would imagine given the EUR commands a 57% of this basket - we’ve seen the USDX smash the 20 August high and the 94 figure.

Options traders are buying downside volatility and the premium for 1-week or 1-month put EURUSD volatility has ramped vs calls – it tells a lot about sentiment. US Treasury bonds are largely unchanged on the day, but USD real (inflation-adjusted) yields have been risen 27bp vs German real 10-yr bunds through September, and this is putting real tailwinds into the USD.

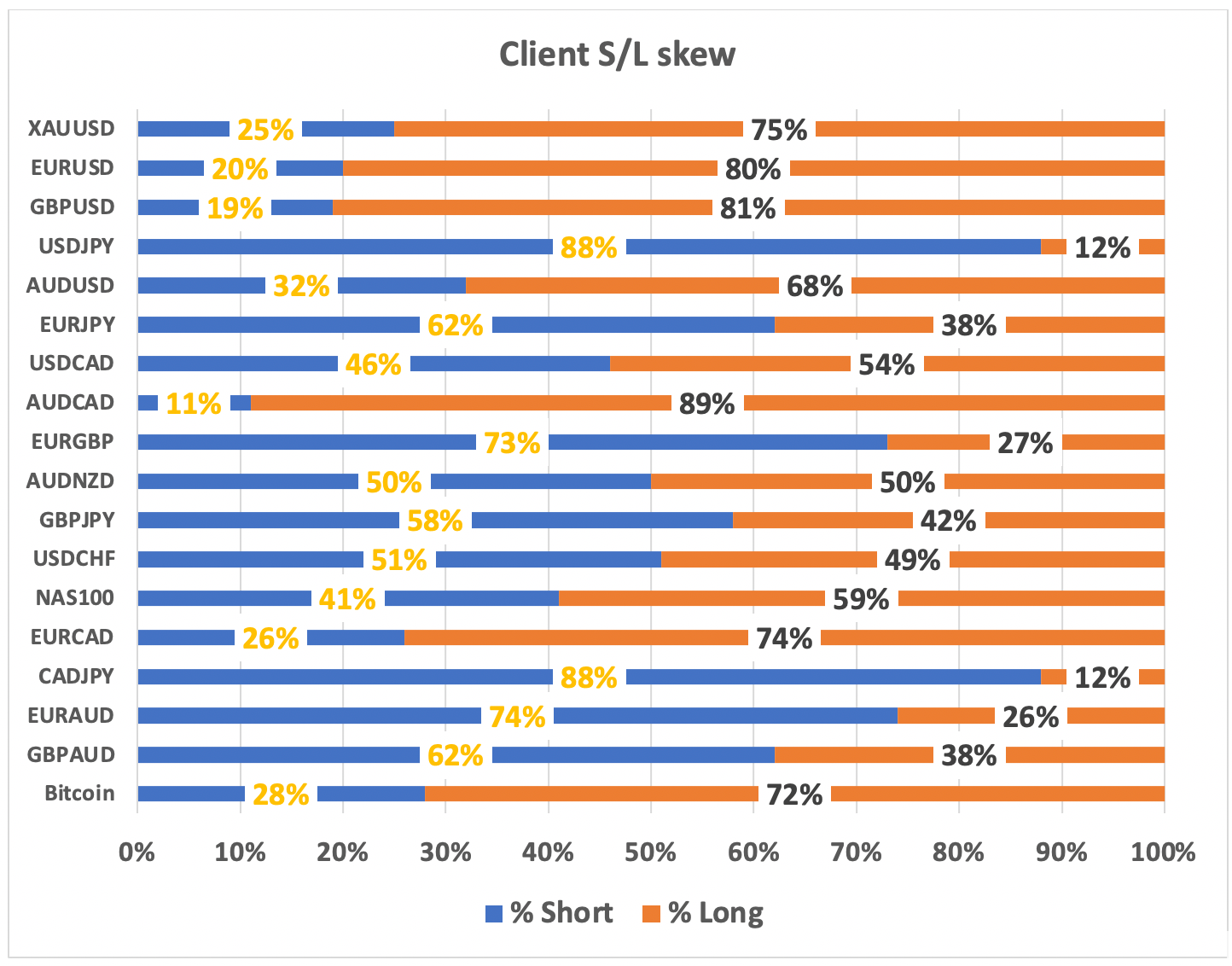

USDJPY has broken the double top at 111.68 and is pushing the 112 figure – the Feb 2020 spike high of 112.22 offers the bears some hope that better supply may be seen into here – everyone is shouting, “grossly overbought”, a situation of client base are sympathetic to, with a sizeable 87% of all open positions in USDJPY now held short in this pair.

(Source: Pepperstone - Past performance is not indicative of future performance)

GBPUSD has been given a solid workout, with 1.3400 in its sights. However, the net result now is our clients are all in on the counter-rally, with 81% of open positions now held long.

(Source: Citi - Past performance is not indicative of future performance)

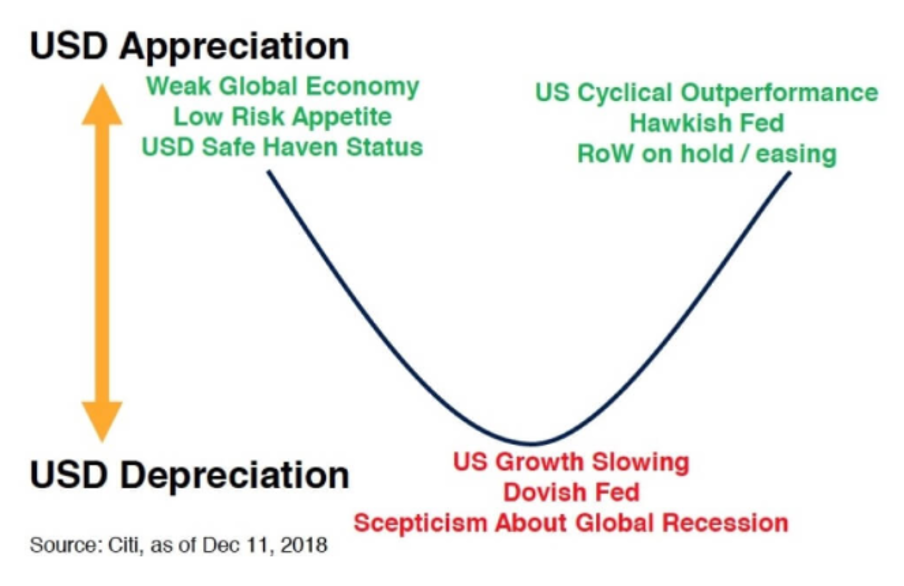

Flow and technicals aside, fundamentally, we’re effectively seeing both the left and right side of the USD ‘smile’ theory’ working in earnest (see above) – On the left side we’ve got stagflation concerns rising in markets – let’s call it ‘stagflation lite’ for now, but the moves in commodities have not been driven so much by the perception of demand. However, by supply-side constraints, which is not overly risk positive – either way we’ve seen some a modest lift in inflation expectations, while growth remains in question.

On the right side and while we’ve seen other central banks talking about normalisation of policy – notably from the Norges Bank and BoE – it’s the Fed that is the price maker and when they’ve made it clear they will taper in November, and the market sees a connection between tapering and rate hikes, which are priced to start lift-off in December 2022.

Some are talking about month and quarter-end flows and maybe there is some truth to that. But it’s hard to quantify. USDCNH has moved modestly higher and while EM FX hardly seeing a vol move, we're seeing sellers and traders are rolling out of higher carry EM currencies.

The wash-up for me is it’s clearly hard to chase the move in the USD from here, unless you’re governed by rules (systematic) and it seems logical to consider the intra-day mean reversion play. We may see USD longs covering through Asia, but the preference here is to stay with the USD flow for now, at least into the new quarter and short-term look to reload EURUSD shorts into 1.1640/50 and USDJPY longs into 111.50/60.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.