- English

- 中文版

US CPI review - The mother of reversals in markets - but why?

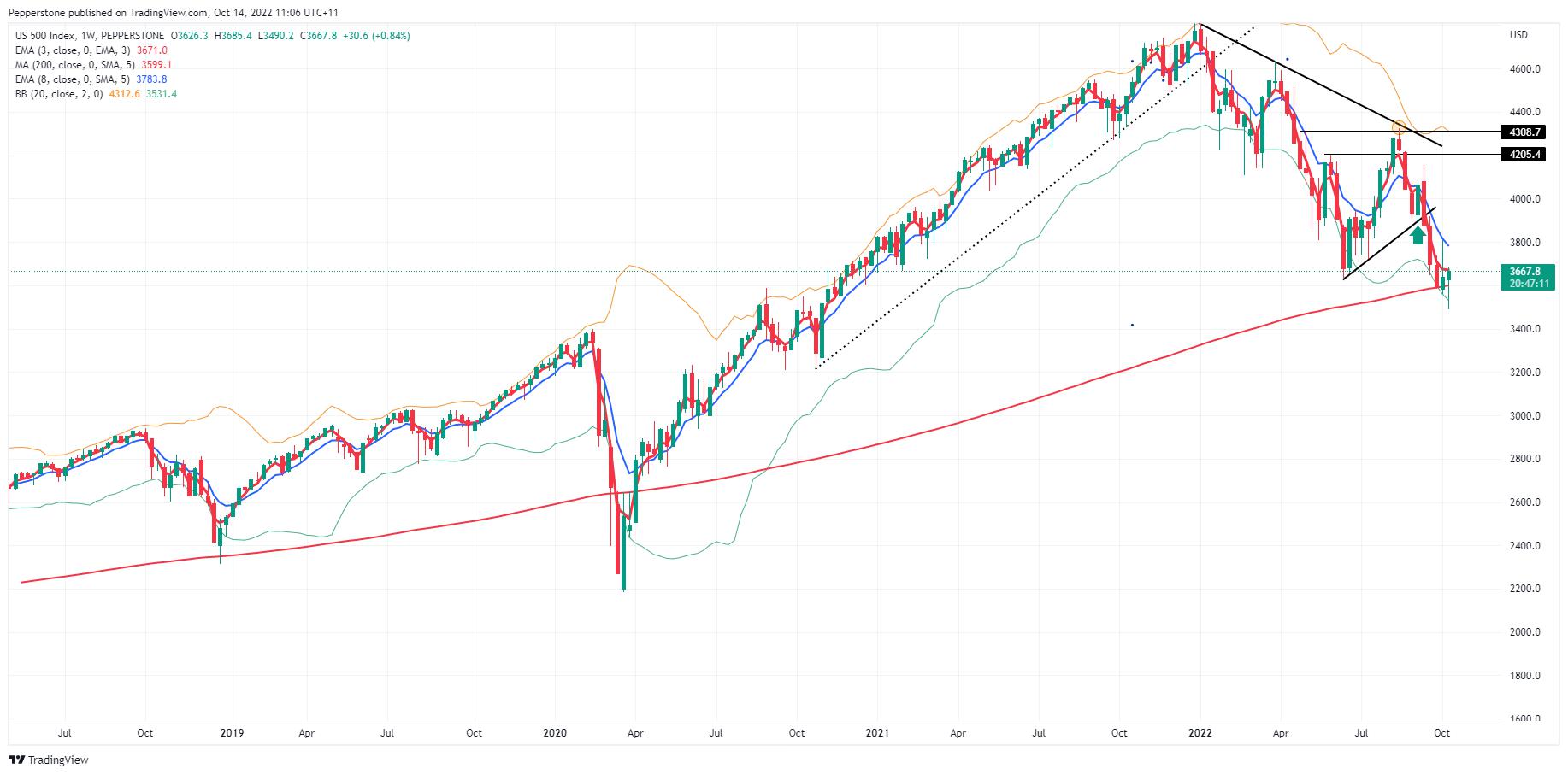

It’s been a crazy day in the markets – the US500 traded its third biggest range of the year, with the low coming in just around the 50% retracement of the pandemic rally, while some have lent against the 200-week MA which has defined the rally since 2011. The question after such as big counter move, driven largely by a position adjustment, poor liquidity and changes in hedging flow is whether the market builds on this or will the shorts establish new positions at higher levels.

The tape will tell…..

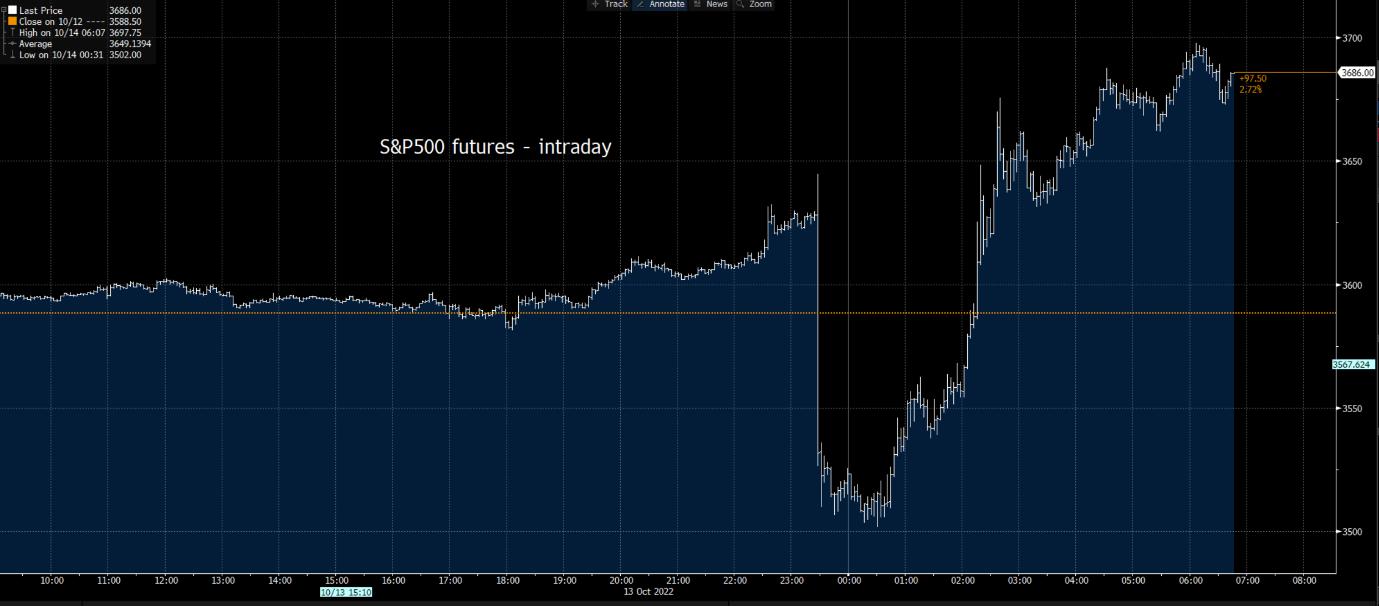

The US core CPI print came out topside at 6.6% – this was the risk flagged in our recent US CPI playbook, where the market has been treated time and again to hotter than forecast inflation reads – after a 45minute period we saw a monster reversal in risk, highlighted by a near 6% rally off the lows in the US500. The cause of the reversal is the subject of much debate – some have talked about various components in the inflation basket giving hope of a topping process. Some have focused on headlines that the ECB were modelling a lower terminal rate, while headlines that the White House were looking at targeted tariff relief were also in the mix. A reported buy program in US Treasuries may have helped and as UST yields eased lower, we saw short covering in equity markets play out in equity and this was seen case-in-point with the NYSE TICK index pushing into +1949.

The lesson once again is that flow drives markets and we must be dynamic to react to the moves. If you chose to be involved with a market in and around a major data release it pays to be in a position to react – stops can help but there is nothing like seeing a flow-based move and being able to manage the exposure accordingly.

The fact is when we get the key data release when options dealers hold a massive short gamma exposure and the market is very short of equity (long USDs) and it doesn’t take much to see a big squeeze on no real news. Equity trades higher and dealers hedge their delta by buying back equity futures contracts. It sounds complicated, and it takes some study, but when we add in poor liquidity in the underlying it’s this very factor that set the trading environment and our position sizing.

Equity and risk FX may have seen a huge reversal but when we look at the US rates market we see the purest reaction and the US CPI moves held – we now see 78bp of hikes priced for November FOMC, 66bp for December and the fed terminal rate is now priced at 4.9% - on any other day when combined with the US 2yr Treasury closing +17bp at 4.46%, we’d have seen risky asset under pressure and maintain that bear move into the close - but this time the short covered and its resonated across markets.

The science behind positioning is one GBP traders know only too well. Talk of another U-turn from Kwasi Kwarteng has clearly impacted and offered tailwinds to a market keen to fade USDs as risk came into the market. 30yr gilts closed -27bp at 4.55% and GBPUSD rallied in appreciation with 1.1380 the high. Eyes fall on the 5 Oct high of 1.1495, which we’ll need follow-through buying in the session ahead for the bears to get a chance into this former supply zone. GBPAUD is also ripping, having broken the April-July highs and now eyes 1.8000.

Eyes on USDJPY with price having taken out the 1998 high of 147.66 – arguably the cleanest expression of US rate differentials the question is where do the BoJ/MoF intervene? I say 150, but this is where we’ll see breaking headlines that Japanese officials are “checking FX levels”.

Looking ahead – on the docket we get earnings from JPM, Citi, MS. We see China CPI/PPI, the end of BoE temporary bond buying, US retail sales/Uni of Michigan inflation, and the G20 finance minister meeting - Keep your friend close but your stops closer.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.