- English

- 中文版

The UK prompts something of a head-scratcher at the moment, which stems from the market’s, and the sell-side’s, view on how the UK economy is likely to evolve over the remainder of 2024.

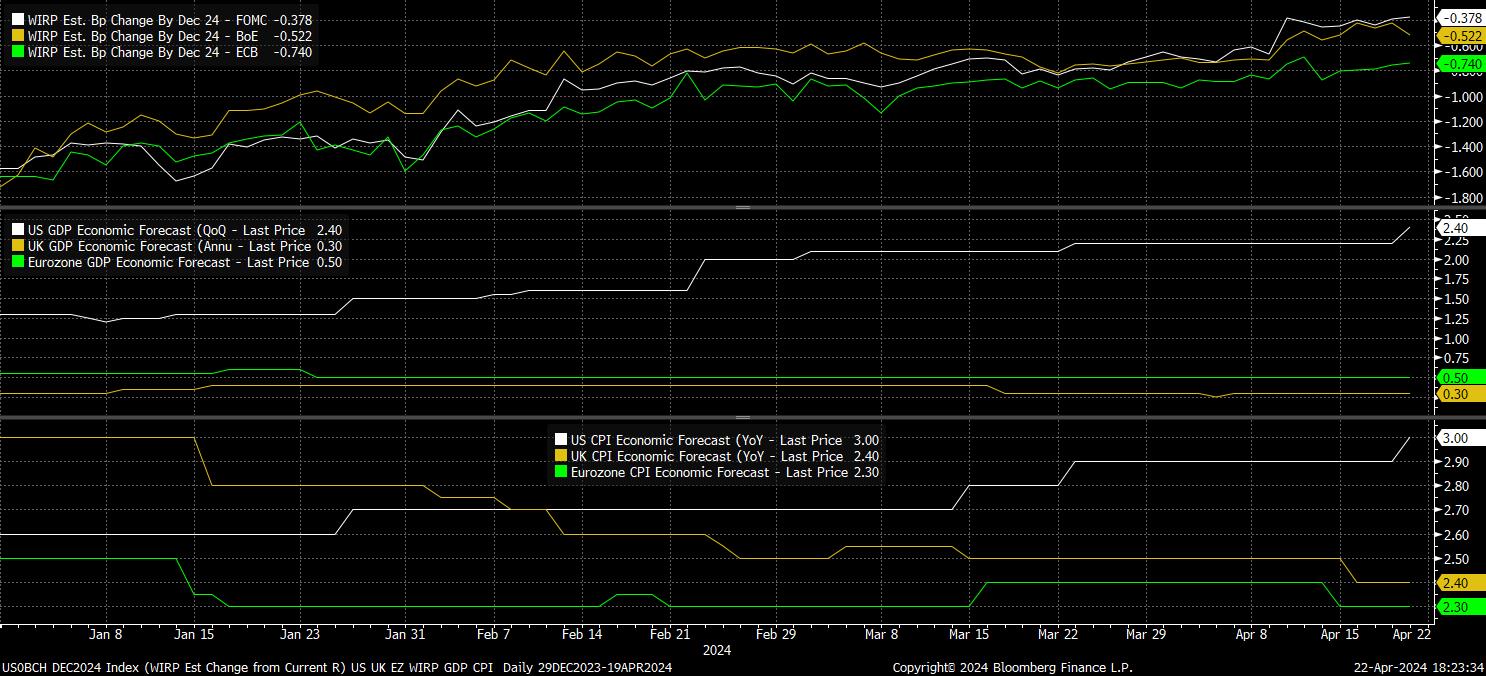

From a monetary policy perspective, swaps price an outlook broadly in line with that priced for the FOMC – seeing just over two 25bp rate cuts from the ‘Old Lady’ this year, only marginally more dovish than the policy path priced across the Atlantic.

However, from an economic perspective, the outlook – according to both incoming economic data, and sell-side consensus expectations – appears much more akin to that of the eurozone, with growth set to remain relatively anaemic, and inflation set to fall towards the 2% target in much more rapid fashion.

This raises a few interesting points.

Firstly, at a basic level, is it the market, or is it economists, that are likely to be proven right?

- At a glance, incoming evidence would argue that the economist community probably have this one spot on at the moment; inflation is rapidly on its way towards 2%, and should achieve said target in the spring by virtue of the feed-through of falling energy prices, while unemployment ticked up to a six-month high in the three months to February, as the labour market continues to gradually loosen.

- In addition, typically hawkish BoE Deputy Governor Dave Ramsden noted last week that the balance of risks to the inflation outlook now “tilts to the downside”, while also being “more confident” that inflation persistence is easing. Given that, particularly internal, MPC members speak rarely compared to their peers at the Fed or ECB, these comments seem both deliberate, and significant, in laying the groundwork for a rate cut as soon as the June MPC meeting. Mention of policy remaining restrictive, even when rate cuts begin, in the March MPC minutes, serves to further reinforce this view.

- Were a cut to be delivered in June, it seems likely that the MPC would want to proceed beyond that point at a relatively cautious pace. Quarterly cuts seems a logical pace, albeit this would mean delivering said cuts at meetings following the release of a Monetary Policy Report, rather than in conjunction with each forecast round, as we are likely to see with the ECB. In any case, quarterly cuts from June would take us to 75bp of cuts to Bank Rate by year-end.

But, how could the market be right?

- Thankfully, the MPC have been relatively clear in explaining the factors that they are watching when determining policy shifts, namely – “indications of inflationary persistence”, tightness in the labour market, wage growth, and services price inflation

- It doesn’t, then, take a PhD to deduce that stubborn services prices (above the MPC’s most recent forecasts), elevated earnings growth and/or a renewed labour market tightening, may well delay rate cuts. Hard data, however, is not currently moving in this direction, while leading indicators show relatively little risk of it doing so.

- Alternatively, perhaps the market could be right if one views the UK economy through a different lens – one where potential growth is substantially lower than in the US, as the labour force increasingly shrinks, but one where inflation is structurally higher than in other DMs, not helped by the longer-term trend of GBP weakness importing further price pressures. Naturally, folk would rush to scream ‘stagflation’ in such a scenario, which is far from the base case.

What if neither the market, nor economists, are correct?

- This would likely only be the case were some sort of financial, or geopolitical, accident to occur. In the former situation, cuts would likely be much deeper, and much quicker, than currently priced – with central banks, including the BoE, having this option in their ‘back pocket’ were it to be required, with inflation, essentially, back to target.

- Geopolitical flare-ups would likely be much more difficult to contend with, though policymakers have, and likely would again, look through the temporary inflationary impacts of any potential surge in oil prices.

Lastly, what does this all mean for the GBP?

- In the base case, markets are priced too hawkishly compared to what the MPC are likely to deliver, with the GBP OIS curve seeing just a 60% chance of a June cut, and pricing just a one-in-three chance of 3x 25bp cuts this year.

- A dovish repricing would, naturally, apply further downward pressure to the GBP, particularly as Fed policy risks tilt increasingly hawkish at the same time.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.