Since shoring up the public finances in the aftermath of Truss’ aforementioned short-lived premiership, by reversing almost all of the measures announced by predecessor Kwasi Kwarteng in the disastrous ‘mini-budget’ last September, markets have been soothed – gilt yields have retraced significantly from the highs seen across the curve, while the GBP has recovered solidly from the record lows printed against the dollar last autumn.

_D_2023-03-13_20-53-45.jpg)

Despite these market moves, and the restoration of confidence in the UK’s reputation for fiscal responsibility, fiscal headroom for significant policy measures remains limited. Furthermore, the political will to unveil major policies at this juncture is also likely limited, given that the Chancellor would receive more ‘bang for his buck’ at the ballot box by waiting until the next Budget, in a year’s time, and just six months from the likely date of the next general election, to unveil vote-winning policies.

With this in mind, expectations are low for any significant policy announcements, with a relatively unfavourable set of OBR forecasts also likely to cap any desire to announce anything too drastic. That said, it seems near certain that Hunt scraps (again) the proposed rise in fuel duty, while also both increasing the amount of support provided under the Energy Price Guarantee, and extending its operating horizon into the spring.

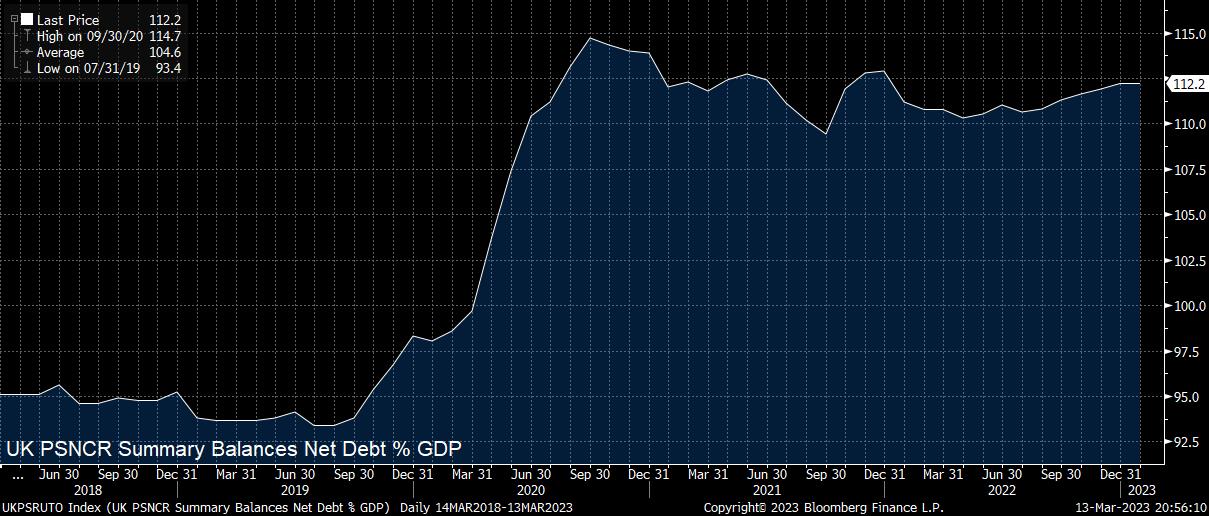

Public sector pay will also be in focus, given the numerous strikes that continue to take place, and with inflation remaining north of 10%. It remains unclear what degree of pay increase may be unveiled, however anything in excess of a 3.5% increase would likely necessitate fiscal tightening in other areas. Furthermore, with a £5bln increase in defence spending having already been trailed, markets are likely to pay close attention to any other spending promises, especially with concern persisting over elevated public borrowing levels.

As for the market reaction, given the low expectation for significant changes, and likely desire within Government to reserve major action for closer to the next election, catalysts stemming from the Budget are likely to be relatively limited.

However, with the market remaining on alert for news stemming from the SVB collapse, volatility is likely to remain elevated for the foreseeable future. Looking at cable in particular, through a pure technical lens, the 50-day moving average at 1.2130 stands as immediate resistance, before a potential challenge of the 1.22 handle. To the downside, the 50-day moving average, and 1.20 figure, stand out as immediate support levels, with the 200-day moving average lurking around a big figure below.

_2023-03-13_20-51-27.jpg)

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.