- English

- 中文版

European markets have lacked any kind of a pulse, but things do get a tad spicier this week with the event risk increasing, although, still unlikely to really kick life into these here markets - unfortunately.

A focus on Europe

As we saw in Fridays' Weekly Vol report, EURUSD weekly IV is incredibly low, and I can't help thinking this is partly down to a commitment from the Chinese to keep the yuan stable. Not just due to better liquidity from DM central banks. We do see a ST head and shoulders (H&S) in play on the EURUSD daily, and a break of the neckline would suggest a target of 1.0950. Although, this has been formed over days, whereas most pattern traders like H&S patterns to form over a far longer-term - We are working with scraps in EURUSD.

Price action and the level of IV does not suggest the market is overly concerned with the potential for the US to slap France with sizeable tariffs. Nor are they expecting big moves in price driven by the ECB meeting later in the week or manufacturing PMI data. It seems that on balance the narrative from the ECB of late has been one of optimism, that the outlook is stabilising, and we should hear that risks to their outlook are less pronounced.

While I don’t see it as a driver of volatility in FX, bunds or the DAX, the ECB have spilt ink getting economists ready for its review of their strategic policy objectives due to be launched this week and likely concluded at the end of the year. We’re talking changes to its inflation target, the effectiveness of its policy tools (do negative rates work?) and its communication channels. As I say, understanding the aim of a central bank’s policy directive is always important for fundamental traders, but this is a longer-term play, but one where we should get increased colour this week.

EURUSD aside, it’s the DAX setup which interests me more. The weekly chart, which I always like to start with to gain a sense of the rhythm and structure of the market, has broken to new highs and while I argued yesterday that the internals in equity markets are flashing red with signs of euphoria, the moves in DAX, one of my favourite indices for trading, is not showing any signs of worry and short positions are still swimming against the tide. The bullish outside week seen a couple of weeks ago has seen follow-through and, at this juncture, the bulls maintain control.

A focus on Japan

Staying on the central bank theme and we move to the BoJ meeting and given I have a soapbox, it still amazes me that in today’s markets, where we react real-time with algo’s faster than humans, there is no set time for a central bank meeting statement.

Again, the meeting is not likely a driver of volatility, and USDJPY has been driven more by US data, and the JPY being a funding currency in the now-heavily-utilised carry trade. Going forward into the Iowa caucus (3 Feb), if Bernie Sanders looks to be getting increased love in the primaries, and keep in mind he is expected to take both Iowa and New Hampshire, and challenge Biden for the Democrat nominee, then the JPY will start to get more of a bid.

As for today’s meeting, it's hard to believe the BoJ will be anything but dovish, but not enough to move markets. Japanese data has largely missed expectations of late, thanks again to its October sales tax hike and many are keen to see PM Abe roll out his economic fiscal stimulus. The fact that DM yield curves have steepened a tad of late, with USDJPY above 110 is also a positive for the central bank, and if we were seeing USDJPY at say 105, then we could be looking at the prospect of monetary easing.

For now, no changes are expected at this meeting, and in the absence of directly intervening in FX markets – something which would cause international condemnation (notably from Trump and the US Treasury) – changes to policy would do absolutely nothing to affect Japanese economics. The JPY really is a trading vehicle to express a view on the volatility and uncertainty in the backdrop we see through broader markets.

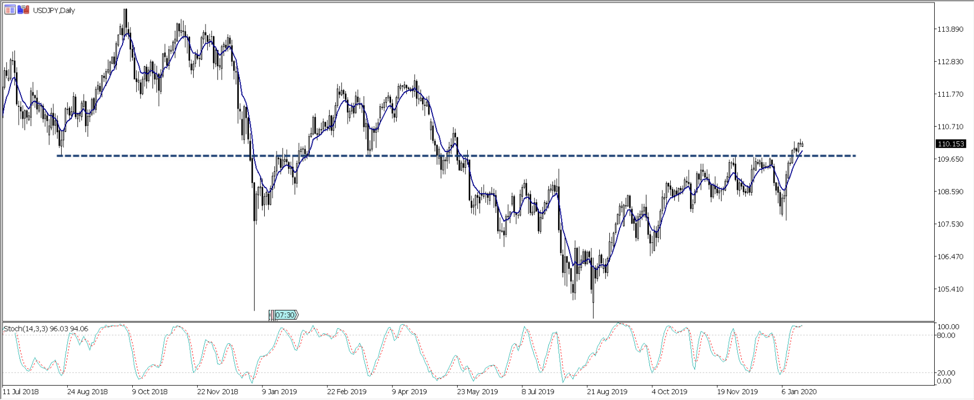

If I look at the set-up of USDJPY on the daily, it is one where I am loath to short at this stage, and while there is brewing indecision to bid up the pair from here, I’d like to see how price acts and reacts into 109.72.

A focus on the GBP

We don’t get the BoE meeting until the end of the month, but there is certainly a lot of interest from clients and the broader market to understand whether we get a cut from the BoE, a fate the markets are pricing closer to 70%. Obviously, the view is if the BoE do surprise and leave rates unchanged, GBP will have a short, sharp rally, as the anticipated 18bp of cuts are quickly priced out. Or, if we do get a cut, is this a ‘one and done’ in which case GBP buyers will be seen, something a lot of new FX traders find hard to grasp – that is, the idea of a rate cut and a rally in the currency.

It seems less likely we get a cut and an outlook suggestive of more, although one suspects they will be somewhat cautious in their outlook. An outcome where they give a view that more cuts are coming would take GBPUSD cleanly through rising trend support and the 23 December pivot low of 1.2904, adding more downside risk to GBPCHF, which has been my preferred GBP short.

This week, UK employment and PMI data could cement those expectations. However, my instinct tells me that the higher probability outcome here is even if we get a cut, it will be one and done, and therefore I am looking at levels from which to buy the GBP.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.