I still sit in the camp that there is far more to play out in the 2019-nCov scare, and the impact on Chinese economics will be real, although its the duration of the scare which will dictate confidence and the draw on discretionary spending, although most believe the authorities will meet any worsening of economics with a determined fiscal and monetary response.

If we look around the traps the question of whether we have priced in peak virus concerns is one that is keenly debated. In fact, while it’s a small move in the grand scheme of things, the fact USDCNH has moved 0.3% lower, and CNHJPY +0.4% higher on the session, largely underscores the backbone to risk here. It also offered FX traders a small window to hit the bid on MXN and BRL positions, with small buying in RUB and COP too, with WTI and Brent crude gaining 0.9% and 0.5% respectively.

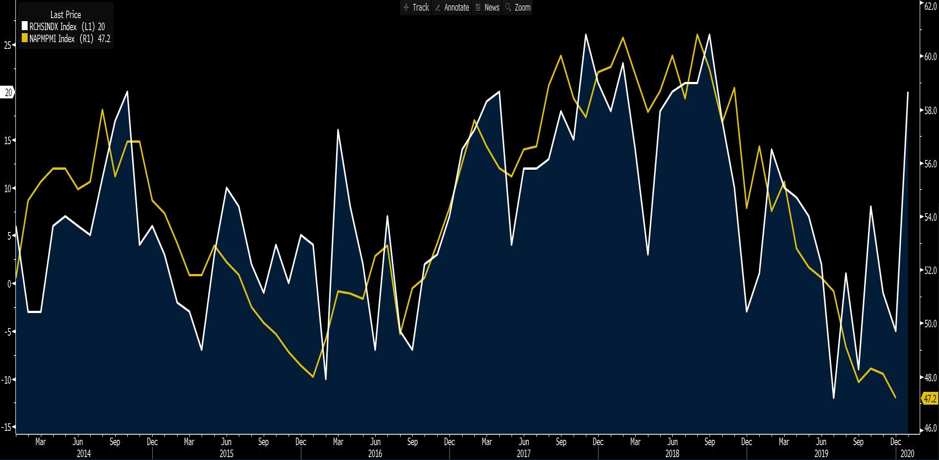

The USD index is largely unchanged, but then so too, EURUSD sits glued to 1.1015, tracking a range on the session of 1.1025 to 1.0998, and this horrific range just remains the poster child of low FX volatility. I am surprised we’re not seeing more of a bid in the USD though, but the flows in the US Treasury market have not been too intense and we’re only seeing small selling across the curve, with 2-year +2bp and 10s +4bp. Consider the data though, with the Dallas Fed manufacturing index at -0.2 vs consensus of -2, while the Richmond Fed manufacturing smashed consensus at +20 vs -3. We once again go into the influential ISM manufacturing report (4 February) with even more belief of a turnaround in US manufacturing, as the Bloomberg chart below suggests.

We should also look at the US CB consumer confidence report, which was a solid beat at 131.6. If the Fed is going to cut rates this year, I feel it would need to be driven by either a rapid tightening of financial conditions, leading to a fall in inflation expectations and there are no signs that will play out. Or, we see genuine cracks appear in the labour market.

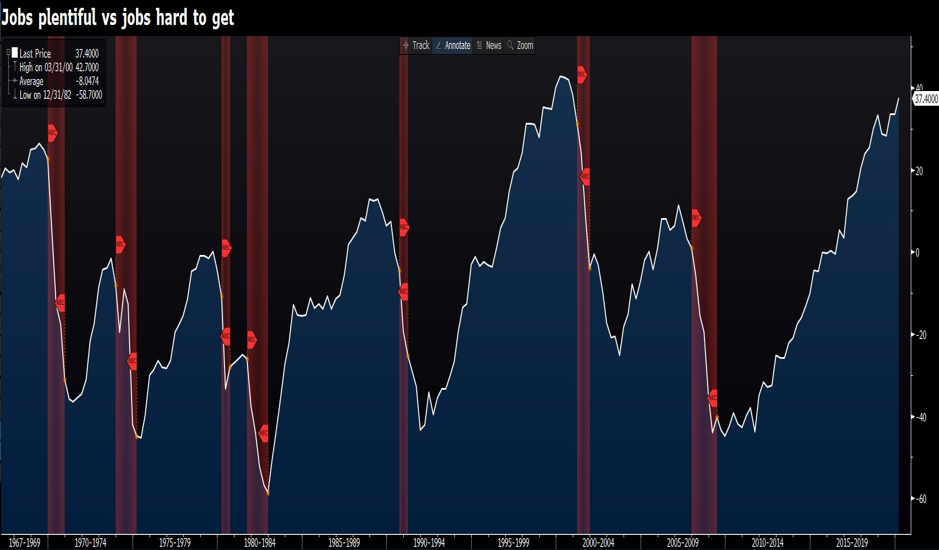

My two preferred leading indicators on the US labour market are the weekly jobless claims, with a sharp rise (and the rate of change is key) in the four-week moving average of claims, pulling above the three-year average, subsequently leading to a rise in the U3 unemployment rate. The other is the component of the CB consumer confidence report which asks recipients if they see ‘jobs plentiful’ or ‘hard to get’. As we see from the spread of the two variables, those who responded still see ‘jobs plentiful’ and times are still clearly good. It’s when this index rolls over, with increased (relatively) respondents saying they are struggling to find work that we see periods of recession – as portrayed by the red shaded areas. That clearly isn’t playing out yet, and the index is indeed not far from the record high set in March 2000.

Eyes on the FOMC meeting

It’s hard to see the Fed doing too much in this environment, and if we look at moves in USD crosses. and vols more broadly, it feels that on balance tomorrows (6:00am AEDT) FOMC meeting will not be a vol event and more of a snooze fest. That said, there is some conjecture if we get a lift to the level the Fed pays select financial institutions to hold capital on its balance sheet (IOER), and we should also consider that rates markets have priced in around 28bp (just over one cut) of easing by December, so the USD will be partly cushioned by any concerned rhetoric.

Liquidity is everything to markets

Fed chair Powell will likely be heavily probed (during his Q&A session at 06:30am AEDT) about the future of its repo and US Treasury Bill purchases and this could get focus from traders given the recent expansion of the Fed’s balance sheet and rise in excess reserves have largely been seen as responsible for the rally in equities and credit, while acting as a modest headwind for the USD. We don’t expect liquidity to just disappear, but the market will be keenly trying to understand how these dynamics look past April. One to watch.

Equities regain their mojo – for now

The data flow and the idea that some brave souls are preferring to move back into risk (peak nCov?) has seen equities higher, and while S&P500 and NASDAQ futures were already 0.5% higher when Asia closed, we saw prices really accelerate from around 22:15 AEDT, resulting in various US indices pushing into Fridays close and thus closing Mondays opening gap. Gaps are there to be filled, of course, but it’s how price reacts when we get there that dictates and often offers great insight – so it’s make or break time for risk. Either way, Asia will feed off the fact that S&P500 futures are 0.9% higher than where we closed in respective cash markets yesterday, with cyclicals easily outperforming defensive names, lead by a solid 2.4% gain in semiconductors.

ASX 200 to open 45-points higher, eyeing CPI

By way of a guide, Aussie SPI futures are 45-points higher from the ASX 200 cash close, so it’s to be a bright and breezy start for those who bought into yesterday's sell-off. However, we ask whether the feel good factor will advance, with traders buying into the opening strength or tactically fading the opening strength. It should offer decent insight into sentiment on the ground. We also have the affair of Aussie Q4 CPI, even if this is more of a rates and AUD story, and with the market looking for headline CPI of 0.6% QoQ (1.7%y Oy) and trimmed mean +0.4% QoQ (1.5% YoY), it would need to be a fairly horrific number to get the market believing we will see a rate cut next week, when the implied probability of a February cut sits at 22%.

That said, if we see headline at 0.8% QoQ it could see some covering of AUD shorts and the ASX200 will face a headwind of say 10-points of so. One to watch, as the market is still on the track that a cut will come by May or June.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information provided here, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.