Trading the RBA August 2025 Meeting: Market Reactions, Trader Positioning & the Road Ahead

The economist community was somewhat more accurate than STIRs traders, with 5 of 32 economists surveyed by Bloomberg calling for the RBA to keep interest rates unchanged in July – even then, the central view from these out-of-consensus calls was that the RBA would cut rates in August.

The call to hold rates in July, therefore, was seen as a shock to many, but as detailed in the RBA’s July policy statement, the bank saw a move in rates as more of a timing issue, and not a directional one. The RBA also made it clear that their call to hold rates was premised on wanting to clear new information on the economy, and for further evidence that “inflation remains on track to reach 2.5% on a sustainable basis”.

Q2 CPI – A green light to cut in August

That call put the emphasis on the Q2 trimmed mean CPI print (released on 30 July), the outcome of which came in at 2.7% y/y - Granted, it was a tick above the RBA’s own inflation forecast of 2.6% y/y, but it was close enough and importantly represented a 20bp reduction in the pace of price pressures from Q1. With the June unemployment rate rising 20bp to 4.3%, the RBA has the intel it needs to make an informed decision, and with this hurdle behind us, the RBA looks set to ease the cash rate by 25bp next week.

The RBA are not here to make friends

I would argue that in the July case study, Aussie rates traders had priced a high conviction for a cut, largely because they had positioned for it sometime before the meeting, but upon doing so, received no push back from any of the RBA officials through their public communications. Naturally, this disconnect would have led to a degree of P&L damage to STIR traders accounts, but importantly the market has not taken the July episode to mean that the RBA have a genuine forward guidance/communications problem – that would have been the case if the RBA had explicitly endorsed a cut in the July meeting - but in essence, this was more a failing of the market to understand that the RBA are not there to get traders positioning back onside. The RBA are not the Fed.

This time around, and after the Q2 CPI release, traders have been treated to guidance from RBA Deputy Gov Hauser, who endorsed the Q2 inflation data as a “welcome” development… In RBA lingo, this is as defined by way of guidance as we can expect.

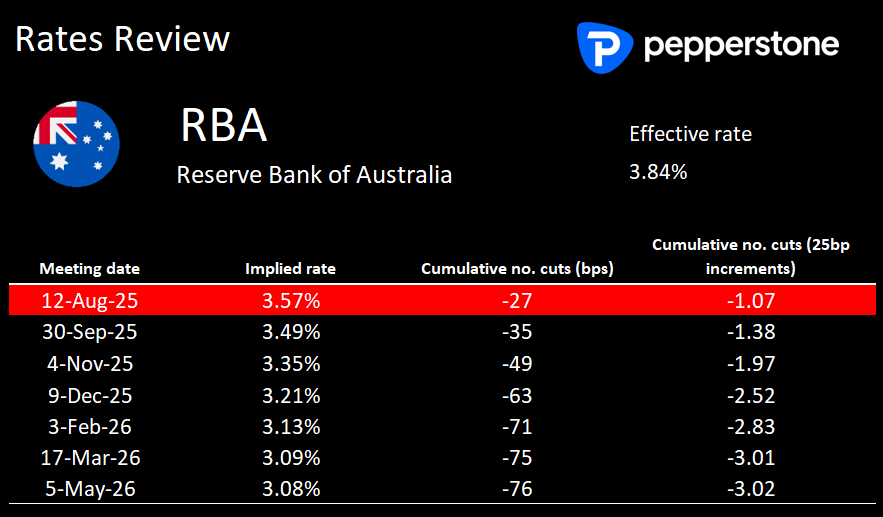

Aussie interest rate swaps imply a small chance of a 50bp cut

Aussie interest rate swaps pricing now ascribes a 25bp cut at a 107% probability - essentially, a 25bp cut next week is 100% priced, and there is a small premium for a 50bp cut. Of course, a 50bp cut next week is not really on the cards, and a 50bp cut would be at odds with the RBA’s mantra of reducing the cash rate to neutral in a gradual and steady manner. However, some will still have the May meeting in mind where a 50bp cut was considered by RBA officials.

We also see that there is full consensus among the economist community, with all 21 economists surveyed by BBG offering no deviation away from the 25bp cut.

Never say never, but this time around, if the RBA didn’t cut, it would be seen as a major shock and would make the job of pricing future policy outcomes and risk a true challenge. Depending on the statement and their rationale for holding, this outcome would result in the AUD spiking 60-80 pips higher, and the ASX200 sold off to the tune of 0.8% to 1%+ – again, an outcome that seems very unlikely.

Market expectations post the August RBA meeting

Looking further ahead, and following the likely 25bp cut next week, we also consider that Aussie IR swaps imply that the RBA cut the cash rate by a further 37bp through the balance of CY2025. With the RBA set to meet on 30 Sept, 4 Nov, and 9 Dec, the current pricing implies another 25bp cut in November with a 50% implied chance of one more 25bp cut by year-end.

The markets pricing for the low point (or ‘terminal’) for the RBA’s cash rate in this easing cycle is seen at 3.10% - this matters for Aussie assets, as it helps conceptualize where the cost of credit could land, while also guiding to the markets perceived pricing of future recession risk – if the RBA are seen stopping at what is considered to be a neutral policy setting, one can argue that is a positive for Aussie equity risk (neutral on the AUD). Conversely, should market pricing of the RBA terminal cash rate fall below 3% in the weeks ahead, it would signal a belief that the RBA may need to move into a more stimulatory setting, suggesting a tougher economic climate ahead.

Holding Aussie risk over the RBA meeting

All things being equal, the AUD and AUS200 should not be too affected by a 25bp cut – it is fully priced. The tone of the statement, and Gov Bullock’s presser, is therefore key in determining the reaction in Aussie markets, and how that reconciles with the pricing for further easing through 2025. The probability is that is the RBA remain firmly data dependent, and wont deviate from its measured pace in reducing the cash rate towards neutral, which isn’t too far away, while the new economic projections (seen in the RBA’s SoMP) won’t be altered to any great degree… this suggests holding AUD and equity risk over the meeting is less of a concern, but it is still a risk that need to be managed, and will attest to in July, the RBA are not here to please traders.

Good luck to all, and Giddy Up Australia

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.