- English

- 中文版

In FX, the USD is essentially flat, although buying has manifested in the JPY, particularly against the BRL and MXN. Yet, on the other side of the ledger the AUD and CAD have worked well, with the former a clear momentum play, but also getting a second wind from base metals, with copper gaining 2.7% and perhaps helping AUDUSD through the 50-day MA (0.6381). Even lumber futures have had a solid run, with a gain of 3.6% and if that’s a sign of the future prosperity of the US economy, then we must think there is a broad reflation theme going through various parts of the market. Consider then that 5-year breakevens are eyeing a new high in this run from 11bp and pushing up 5bp to 92bp.

Happy to stay long AUD for now, as further bearish positioning gets flushed out, but my hands are weak hands.

The move in the CAD is less clear given oil prices have been so volatile, with WTI -1.7%, while Brent crude is currently +1.1%.

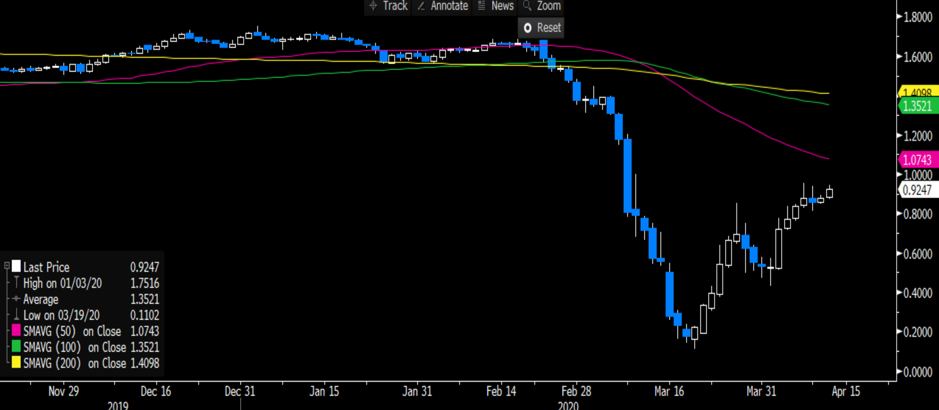

(US 5yr breakevens - i.e average inflation expectation over the coming five years)

"Source: Bloomberg"

Breakevens may be moving higher, but we’ve also seen a modest steepening of the (nominal) Treasury yield curve, especially as we head past 10s in into 30-year Treasuries, which is bullish risk. It’s interesting then we find the S&P 500 financial sector lower by 3.6% and this is made even more compelling as this is likely market pre-positioning for quarterly earnings numbers from JP Morgan and Wells Fargo in upcoming US trade. The market is certainly expecting fireworks for JPM, with the implied move on the day of reporting at 5.4%.

Earnings have certainly been a discussion point. I made reference to this yesterday, with a view on liquidity vs earnings and granted consensus FY20 EPS estimates have been lowered a touch in the last few days to $142, this call still feels too high. That said, many have talked about focusing more on the 2021 earnings at $172, and regardless of the near-term decline in consensus FY estimates perhaps it's 2021 where most are trading towards. It doesn’t necessarily feel like that today when we see the S&P 500 lower by 1% and small caps (Russell 2000) underperforming by 177bp. On a more bullish tone, the NASDAQ 100 closed +1.1%, with solid buying seen in Amazon, Tesla and Netflix.

Adding to the mild confusion we’ve seen the HYG ETF (high yield corporate credit ETF) -1.4%, with LQG ETF (investment-grade ETF) -1%. Given the moves last week from the Fed and Treasury alliance to move out of the risk curve and buy lower-quality assets, the falls here seem to be mostly profit-taking, with buyers eyeing further declines as a likely gift.

It leads us onto another discussion point made by Fed VC Clarida, who spoke on Bloomberg and which I thought was poignant given the set of circumstances. Clarida detailed that he was “confident the economy will recover, and the Fed can unwind emergency measures”, although “will keep rates at zero until the economy is back on track”. We consider a world where earnings are expected to fare better into 2H20, and certainly into 2021. Where growth will improve as we see the shutdowns reverse and oil prices rebound as OPEC slowly tapers its output cuts, potentially outpaced by the subsequent pick-up in demand. So, amid this backdrop, the central banks will be considering an unwinding of stimulus.

Imagine a world in 2021, where the Fed tries to unwind stimulus, even if economics are improving… that’s my thought of the day.

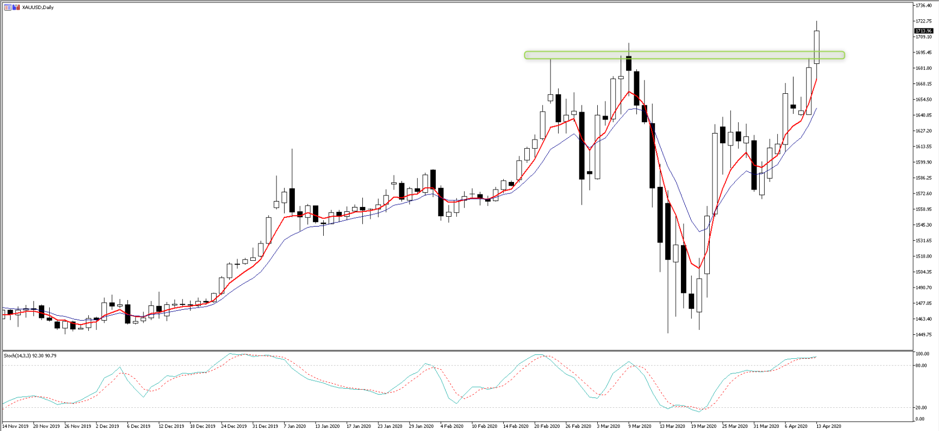

Gold looking tasty

As we touch on inflation it feels fitting to talk about gold. Not just because our flow here has been solid. But because we’ve now seen spot join the futures move and break to new cycle highs. 25-delta risk reversals have moved up to 2.71 vols, which shows some demand for call volatility (over puts), but there is very little in either futures positioning or the volatility spectrum that suggests gold is over-owned or over-loved here. I stay long, although, perhaps the greatest concern I have is whether being long gold is just too obvious as a hedge against all the madness in the world? For now, though, if inflation expectations are going higher, and real yield is anchored then I am a gold bull.

Spot gold

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.