What is spread betting?

It’s not a case of win or lose

The term ‘spread betting’ can initially throw up the wrong impression. This is because the word ‘betting’ is commonly associated with gambling. Although there are some similarities between the two, such as the tax benefits, spread betting is a form of trading and investing.

At your local bookies or on-line betting shop, every bet that you undertake will result in a ‘win or lose’ outcome. This is known as fixed-odds or parimutuel betting.

This is not the case in spread betting. In spread betting you are speculating on the move of the underlying asset. If you are correct, you will see the value of your portfolio (trade) rise. If you are incorrect, the value of your portfolio will fall.

The ‘bet’ is placed between yourself, and your dedicated broker.

Figure 1 spread betting versus gambling

Trading on the underlying asset

Spread betting is known as a derivative. According to Investopedia, ‘a derivative is a financial security with a value that is reliant upon, and derived from, an underlying asset’.

When the FTSE100 rises, the UK100 spread betting index will also rise in unison.

Unlike buying shares through your bank or stockbroker, you never own the underlying asset.

The spread

So why ‘spread’ betting?

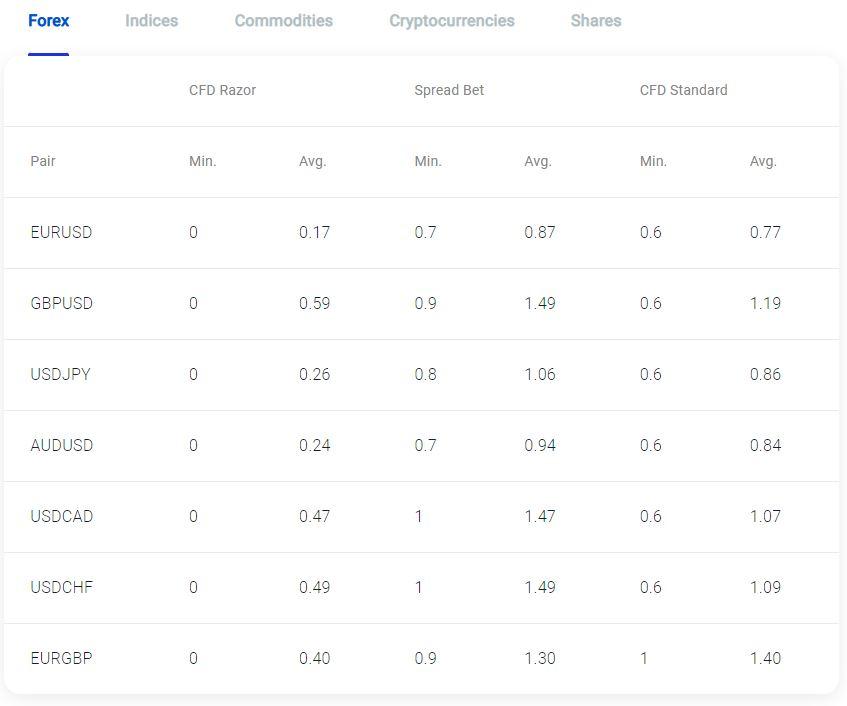

When you place a spread bet, there are two prices to every quote. They are known as the offer, where you can buy, and the bid, where you can sell. The difference between the two prices is known as the ‘spread’.

Figure 2 Pepperstone forex spreads 05/09/2022

How to place a spread bet

The first thing that you need to decide is which market or asset you want to place your trade.

The second is to open a trade ticket and decide what direction you expect the asset to move in. This will either be to Buy (go long) or Sell (go short).

The third is the amount you want to trade. This is an important factor that needs to be understood. This is NOT your overall stake but how much you are trading per pip or point.

The fourth is your stop loss and limit order. This is where you will cut your losses should your trade go wrong, and where you look to take your profit if your trade should go right. Although it is not a necessity to place these orders at the outset of a trade, it is regarded as ‘good money management’ to do so.

Advantages of spread betting

Like placing a bet through your on-line bookie, profits made from spread betting are exempt from capital gains tax. This will depend on your personal circumstances. It should also be noted that you cannot offset your losses against your tax liabilities.

You will often hear trades talk about the use of leverage. This gives you the ability to trade in larger positions than your normal deposit would allow.

A retail trader is offered 30:1 leverage. For every pound, dollar, or euro that you have in your trading account, you can trade 30 times that size in the markets.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.