Learn to trade

Both FTSE100 futures and FTSE100 CFDs allow you to get exposure to the 100 largest companies listed on the London Stock Exchange. There are some key differences between FTSE futures and a contract for difference. Let’s look deeper.

FTSE futures and how they are traded

A futures contract is an agreement between two parties to buy or sell a product or asset at a predefined price and date.

Popular futures contracts are based on Foreign Exchange, Commodities, Indices and Stocks. Futures contracts are traded on a futures exchange such as the Chicago Mercantile Exchange (CME) or, in the case on FTSE futures, the LSE and the Intercontinental Exchange (ICE).

Contracts, Codes and Expiration Dates

Although futures contracts are often offered with a monthly expiry, depending on the product, the most popular contacts are quarterly with the expiry being the third Friday of the third month. This is known as Triple Witching.

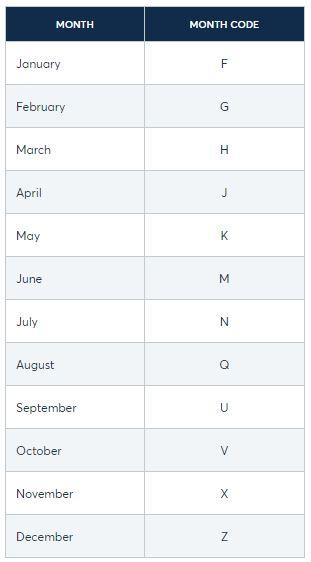

Each product and each month are defined by a unique code.

The FTSE100 December 2022 code is: XZ22.

X is the FTSE100 symbol. Z is the contract date. 22 being the year.

Figure 1 CME Group

Futures are traded in contracts. One FTSE futures contract has the value of £10 per point.

A CFD, contract for difference

Acontract for difference is a contract between a buyer and a seller that stipulates that the buyer must pay the seller the difference between the closing value of an asset and its value at the opening of the trade.

The main differences between FTSE futures and CFDs

The main differences between trading a futures contract and a CFD are:

- Futures market participants tend to be banks and large financial institutions

- Futures contracts have larger spreads but do not require overnight funding. This can make them the preferred choice for long-term speculation

- CFDs do not have expiration dates

- Trading futures can require larger margins or deposits

- Although there is the possibility of trading micro futures contracts, CFDs are generally more flexible when it comes to trade size

- CFDs are over-the- counter products (OTC). They are traded through network of brokers and not through an exchange

How to trade the FTSE with Pepperstone

You can get exposure to FTSE100 CFDs through Pepperstone. To get more information please click here.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.