- English

- 中文版

What is commodity trading?

Commodities form the backbone of our economies, underpinning critical sectors such as infrastructure, communications, energy, food, clothing, and more. As such, commodity markets play a vital role in modern life. These markets attract a diverse range of participants, including producers, consumers, end users, speculative traders, and investors worldwide.

Commodity contracts, which are the standardised units in which commodities are traded, are typically deliverable. This means the buyer must be able to take delivery of the underlying commodity at the conclusion of the contract, while the seller must be able to fulfil that delivery obligation.

In practice, however, physical delivery is usually limited to commercial traders and end users. Speculative traders generally close their positions or roll them forward well before the delivery date. Most retail traders, on the other hand, trade commodities using non-deliverable, cash-settled instruments such as Contracts for Difference (CFDs).

Why do people trade commodities?

Commodity prices fluctuate based on factors, such as supply and demand, geopolitics, the weather, the strength or weakness of key currencies, and macroeconomic data. Those price movements can be sharp and sustained, which makes commodity trading an attractive proposition for speculators, however, it is not without its risks.

How do you trade commodities?

To start trading CFDs on commodities there are just a few simple steps you need to take:

- You’ll need to open an account with a broker, such as Pepperstone, who will provide you with a choice of trading platforms, and access to CFD commodity prices.

- Once your trading account is open you can fund it by making a deposit.

- The next step will be to download the trading platform and then you can familiarise yourself with how it works.

- Once you are confident about using the trading platform you will be ready to start trading commodity CFDs.

- Pepperstone trades in what are known as commodity CFDs, or Contracts For Differences, which are cash-settled and non-deliverable.

- That means you can trade long or short with equal ease, and don't have to worry about the ownership or delivery of the underlying commodities.

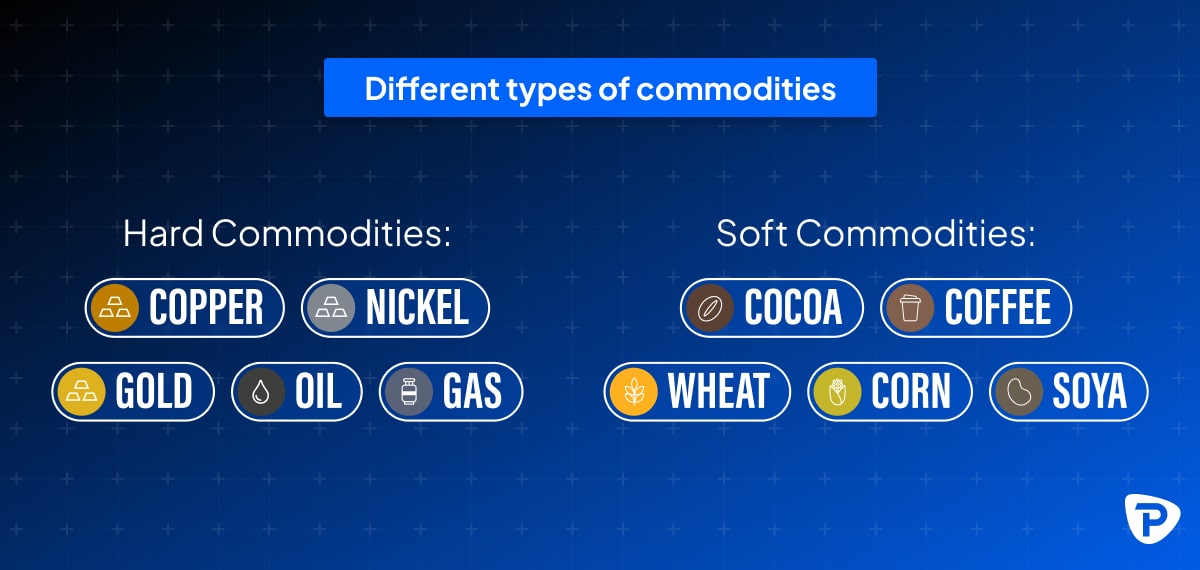

What are the different types of commodities?

Commodities can be divided into two main groups, known as hard and soft. Hard commodities include things like copper, nickel, gold, oil and gas, and other industrial materials. Whilst the soft commodities include foodstuffs and ingredients, such as cocoa, coffee, wheat, corn, and soya. As well as cotton and livestock.

What are the benefits in trading commodities?

Trading commodities offers an opportunity to diversify beyond equities and foreign exchange, tapping into markets that are often less correlated. This approach allows you to take a broader perspective, considering global economic trends, geopolitical developments, and shifts in demand. At a macro level, commodities are particularly reactive, with their prices often moving first in response to breaking news and major world events.

What are the risks in trading commodities?

More than any other markets, commodity prices are driven by supply and demand. The deliverable nature of the underlying contracts means commodity prices can be extremely volatile. For example, between April 2023 and April 2024, cocoa prices rallied by +285.0%, according to data from Trading Economics. Commodities can be subject to short squeezes or extreme oversupply, each having a direct and immediate effect on prices.

A notable example is the price of European Natural Gas (TTF), which jumped by more than +400.0% between June and mid-August 2022 due to global gas supply constraints following Russia’s invasion of Ukraine. Leveraged contracts, such as commodity CFDs, are powerful tools for traders but can magnify losses as easily as they can profit if not used correctly.

What factors influence commodity prices?

Commodity prices are shaped by a range of factors, with geopolitics and seasonality being two of the most significant. Geopolitical events can quickly disrupt supply and demand. For example, the Russian invasion of Ukraine had a direct impact on oil and gas prices. Similarly, the conflict in Gaza has led major shipping lines to avoid the Suez Canal, increasing the cost of transporting commodities from Asia-Pacific to European markets. Seasonal factors, such as weather, also play a critical role in pricing agricultural commodities and foodstuffs. Extreme weather conditions—whether cold snaps, heatwaves, or irregular rainfall—can significantly affect crop production, yields, and harvests. Additionally, issues like disease and pests can further drive volatility in the prices of crops and livestock, adding to the complexity of these markets.

How important is diversification in commodity trading?

Diversification is one of the main attractions of commodity trading because commodities such as gold move independently of equity and bond markets. Traders and money managers will often add precious metals and other commodities to their portfolios for this very reason. Traditionally gold is seen as a store of value and hedge against inflation, as such it acts as a safe haven in times of crisis.

What is margin trading and how does it work in commodities?

Margin trading enables traders to control larger positions in the commodity markets than their account balance alone would allow. This is achieved through leverage provided by the broker, which amplifies both potential gains and losses.

For instance, with $500 in your account and 10x leverage offered by your broker, you could take a position worth $5,000—ten times your account balance. To do this, your broker facilitates the difference between your initial margin (deposit) and the full value of the trade.

To open and maintain a leveraged position, you’ll need to meet the initial margin requirement and ensure you have enough funds to cover any running losses, known as variation margin. If your account lacks sufficient funds to cover these losses, you’ll face a margin call and risk having your position closed. This underscores the importance of appropriate position sizing and maintaining a balance between your account size and the number of open trades.

If a trade remains open overnight, funding or interest charges are applied to the notional value of the trade. However, trades opened and closed within the same business day may avoid such charges, depending on the broker's policies. It's important to note that leverage rates vary across products and jurisdictions.

How to use leverage when trading commodities?

Leverage in commodity trading can amplify profits on successful trades. For example, a 10% increase on a leveraged position of $5,000 would result in a $500 profit, compared to a $50 profit on an unleveraged $500 position. However, leverage also magnifies losses; a 10% drop in the same leveraged position would result in a $500 loss, compared to $50 on an unleveraged position.

To trade successfully with leverage, it’s critical to exercise discipline in risk management, position sizing, and account allocation. Over-leveraging your entire account on a single trade can lead to significant losses. By adopting a careful and balanced approach, you can harness the benefits of leverage while minimising risks.

What are some common strategies for trading commodities?

Commodities are largely priced in US dollars, and the strength or weakness of the dollar directly affects the value of commodities. A stronger US dollar tends to depress prices, while a weaker US dollar can lift commodity prices. Traders can take advantage of this relationship by selling commodities when the dollar is strong and buying commodities when the dollar weakens. However, it is important to note that there are other factors that can affect the pricing of commodities, such as supply and demand dynamics, geopolitical events, and economic indicators.

Traders also often buy or sell gold based on the mood of the share CFD and bond markets. If equity traders are feeling “Risk-Off,” they are likely to sell share CFDs and buy safe havens, such as precious metals, theoretically pushing their prices higher. Conversely, if markets are in a “Risk-On” mood, traders will be selling safe havens and jumping back into riskier assets like share CFDs, and against that background, gold prices are likely to fall.

While these are common strategies, there are always additional factors that can influence the price of commodities, making it crucial for traders to stay informed and consider a wide range of variables in their decision-making process.

How do I manage commodity trading risk more effectively?

To manage your commodity trading risk more effectively you need to follow some simple rules:

- Don’t over-trade

- Consider using a stop loss and think about where you place your stop.

- And remember that all commodity prices can be affected by movements in the value of the US dollar and often by major macroeconomic data releases.

What role does sentiment analysis play in commodity trading?

Sentiment analysis can play an important role in commodity trading. However, unlike other markets that focus on analysing social media posts and commentary, commodity traders primarily rely on positioning reports to gauge market sentiment. The most important of these, the Commitment of Traders or CoT report, is published each Friday by the US CFTC or Commodity Futures Trading Commission. The report provides a breakdown of the open positions in US futures markets held by specific groups of traders, as of the close of business, on the previous Tuesday. Changes in those positions can shed light on what large speculators or commercial commodity traders think about commodity markets and may help to identify emerging trends within those markets.

Commodity trading FAQs

What does a commodity trader do?

Commodity traders aim to make profits from trading commodities. They take long or short positions in commodities such as oil, coffee, copper, wheat, and sugar, hoping to benefit from shifts in the underlying prices. If they have sold a commodity short, they will look to buy back that short position at a lower price than their entry level. Conversely, if they have a long position, they aim to sell that position at a higher price to make a profit. However, if the price moves against the trader and they close their position at a less favourable price than their entry level, they will incur a loss.

How do I start trading commodities?

To start trading commodities, you could look to open and fund an account with a broker such as Pepperstone, where you can trade commodities using CFDs.

What are examples of commodities?

Examples of commodities are all around us—they include everyday items we consume, such as coffee, tea, sugar, petrol or gasoline, and coal. In fact, most raw materials and foodstuffs can be classified as commodities.

What is a commodity vs a share CFD?

Commodities are the raw materials and foodstuffs we use every day. While share CFD are in limited companies, the ownership of which provides stockholders with a share CFD in the profits of that company. Commodities are traded on futures exchanges, whilst share CFDs and shares trade on dedicated share CFD exchanges. Commodity futures have a finite lifespan, whereas share CFDs trade for as long as a company remains listed on a share CFD exchange.

Is commodity trading profitable?

Commodity trading can indeed be profitable. However, it also carries the potential for generating losses. Profits depend on your ability to spot opportunities and execute trades correctly, while maintaining a disciplined approach to trade sizing, risk management, and money management. If you don’t adopt a disciplined approach, commodity trading can become unprofitable. Misusing leverage, overtrading, trading emotionally, and ignoring money and risk management principles can lead to significant losses.

What is a CFD in commodities?

Commodity CFDs are leveraged, cash-settled contracts on commodity prices. They allow traders to speculate on the rise and fall of commodity prices, without the need to take ownership or make delivery of the underlying.

What platform are commodities traded on?

Pepperstone offers commodity trading through CFDs on multiple platforms including cTrader, MT4/MT5, and the popular charting tool TradingView. These trading platforms are available on desktops or as mobile trading apps

What commodities do well in inflation?

Gold is seen as a safe haven and a hedge against rampant inflation, because, unlike paper currencies, physical gold can’t simply be printed by governments or central banks. Money tends to flow into gold, and other precious metals, in times of economic crisis, and those flows can push up the price of gold, platinum, silver etc. Of course market dynamics can change and gold may not always act as an effective hedge against inflation, or as a store value in times of crisis.

Which commodity has the highest demand?

Demand for specific commodities varies and is often driven by economic growth, geopolitics and seasonal effects. The demand for oil and gas, and their refined products, is probably the most consistent. However, this may change in the long term as alternative sources of energy become more popular.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.