- English

- 中文版

Could that be a shape of things to come in margin FX and equity indices CFD? We see US cash markets are closed today for President Day and we look at the known event risk on the calendar set to drive markets this week.

- Geopolitics - We see a rapidly evolving situation in Ukraine, with all eyes falling on a meeting between US Secretary of State Blinken and Russian Minister of Foreign Affairs Lavrov (no set time, but likely Thursday). Hope is for a diplomatic solution, but this is a situation where traders are positioning for further escalation but hoping for the best. For traders, headlines will dominate and drive sentiment in broad markets, so expect volatility to remain high. Making sense of the news flow can be a challenge, so keep an eye on USDRUB as a guide, with gold, crude and NAS100 specifically sensitive here.

- Fed policy - As we eye the 17 March FOMC meeting the hot debate remains whether they hike by 25bp vs 50bp. While the next payrolls (5 March) and Feb CPI (11 March) will decide this outcome, we should look for further clues in speeches from Fed members Bowman, Bostic, Barkin, Mester and Waller - with 30bp (or 0.3%) of hikes currently priced for the March meeting (i.e., a 20% chance of 50bp hike), the USD, gold and tech stocks could be sensitive to the Fed commentary.

- Crude moves – SpotCrude traded a range of $95.98 to $89.23 last week and continues to find sellers into the rising uptrend (drawn from the March 21 high), with buyers into the 20-day MA. Geopolitics is supporting the price, while progress on an Iranian nuclear agreement is a clear negative – expect these two dynamics to continue impacting and leading to elevated volatility and chop in the price action.

- Inflation – while US inflation expectations are trending lower (US 5y inflation swaps sit at 2.34%), this week we see US core PCE (Sat 00:30 AEDT) as the main event on the US data front – The consensus is for PCE inflation to push to 5.2% from 4.9%. US consumer confidence (Wed 02:00 AEDT) may garner attention if it comes in closer to 100 (consensus is 110 from 113.8 in Jan).

- BoE speakers – ahead of the 17 March BoE meeting we currently see swaps markets holding a 36% chance of a 50bp hike at this meeting – watch for guidance on this pricing from BoE members Ramsden, Haskel, Gov Bailey, and Chief Economist Hugh Pill – the GBP could be sensitive to changes in rates expectations – preference for selling EURGBP rallies.

- RBNZ meeting a vol event for the NZD? The RBNZ meeting (Wed 12:00 AEDT) could certainly inject some movement into the NZD – 15 of 17 economists surveyed by Bloomberg see the RBNZ hiking by 25bp, with 2 calling for 50bp. This ties in nicely with the market pricing in a 16% chance of a 50bp hike. If the RBNZ ‘only’ go 25bp we could see a quick dip lower as the 16% gets priced out – unless they go 50bp the risks for the NZD seem skewed to the downside into the meeting. Preference for long AUDNZD trades.

- Aussie Q4 wages (Wed 11:30 AEDT) - AUDUSD gained 0.6% last week, and while the AUD will be a proxy of risk sentiment this coming week, on the domestic data from we watch Aussie Q4 wage - given the RBA has made it clear how important wages are to compel them to lift the cash rate, the market will watch this closely as the potential trigger for them to finally turn towards market pricing. Currently, market pricing sees the RBA cash rate at 1.25% by year-end (4.6 hikes), with lift-off priced between June/July. The consensus is calling for 2.4% YoY wage growth, where a print above 2.5% would be the best level of wage growth since late 2014.

- RBA speakers – RBA member Kent speaks (Tues 12:00 aedt) – his comments come before wage data, so its unclear what new intel we’ll gain.

- EU manufacturing and services PMI (Mon 20:00 AEDT) – The market expects improvement in the diffusion indices CFD – that said, it’s hard to see this data series trumping the Russia/Ukraine tensions as a driver for the EUR or EU equity indices CFD.

Gold on the radar – for gold traders I put this piece together on Friday on the drivers of the yellow metal – I argue the various reasons why Gold has been on the rise.

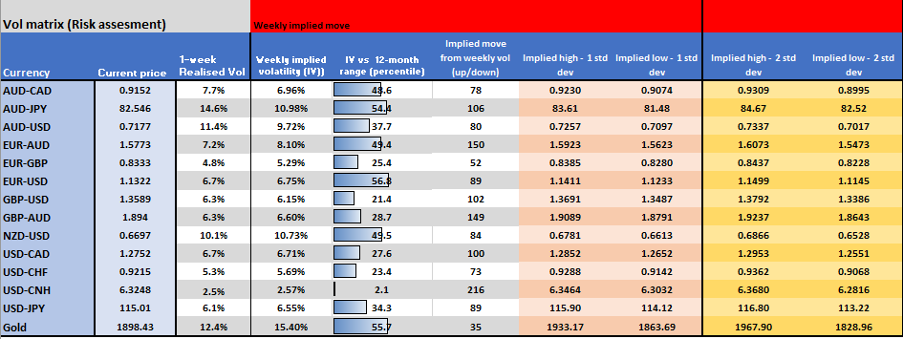

Implied volatility matrix – we take the implied volatility priced by the options market and calculate the implied move (higher and lower) and project this to Friday’s closing levels. We can see where the market sees the potential moves with a 68.2% (1 standard deviation) and 95% level of confidence (2 standard deviations). Traders can use to understand potential areas for mean reversion, but we can also use for our risk management – specifically, those working off longer time frames – perhaps swing or position traders.

(Source: Pepperstone - Past performance is not indicative of future performance.)

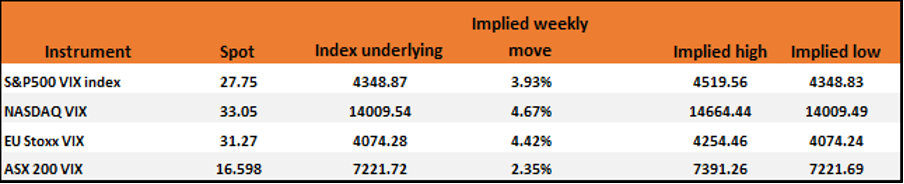

Equity Index vol matrix

(Source: Pepperstone - Past performance is not indicative of future performance.)

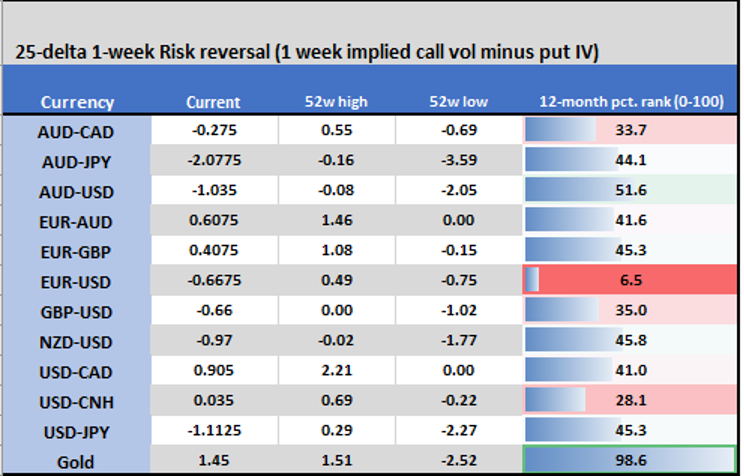

Risk reversals - Options sentiment guide – we see the skew of 1-week call volatility and subtract 1-week put vol – if the net figure (‘current’) is negative, such as we see in EURUSD (as an example) it details the market saying if we see a move, we’ll likely see a bigger downside move than an upside one over the week. We can use as a guide to sentiment.

(Source: Pepperstone - Past performance is not indicative of future performance.)

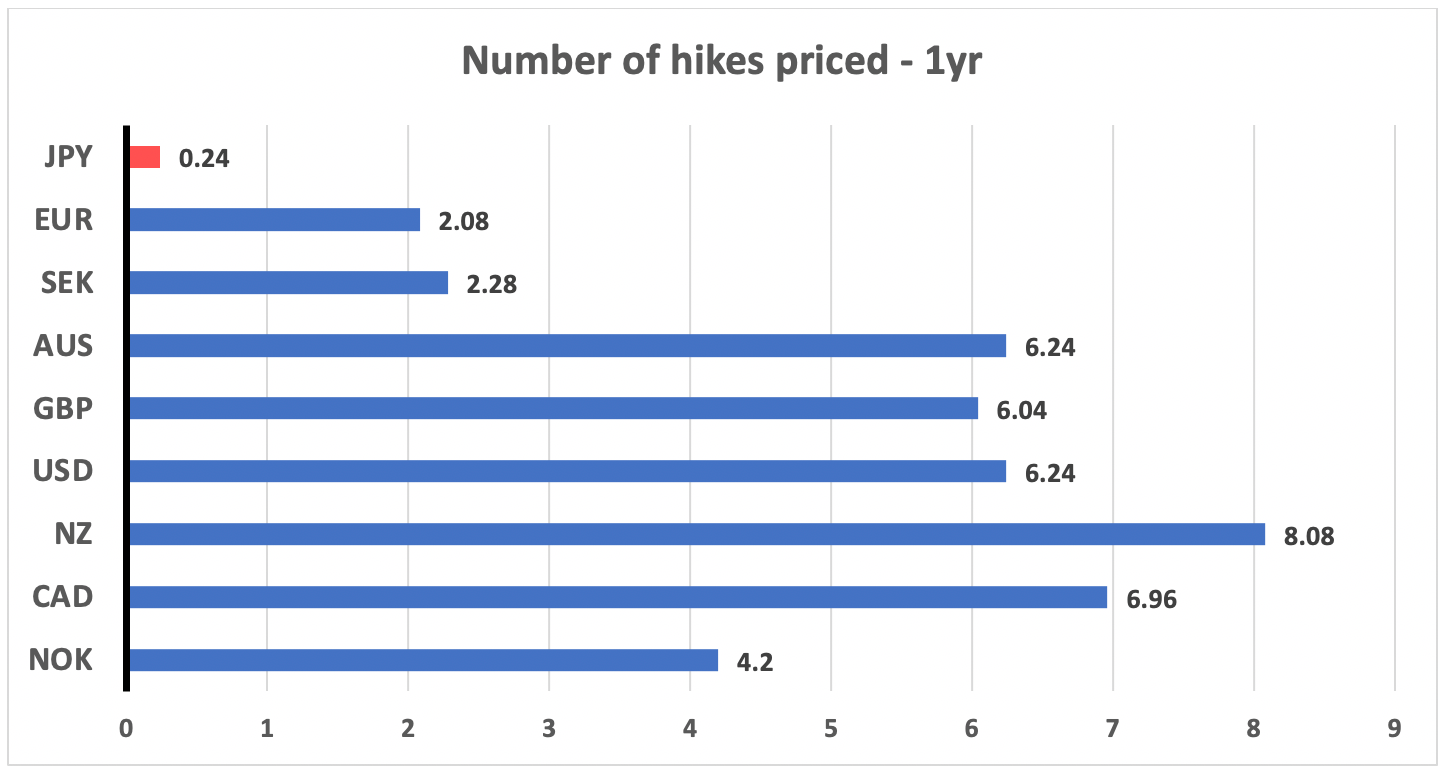

G10 margin FX Rate hike monitor - Implied number of hikes as priced by the swaps market.

(Source: Pepperstone - Past performance is not indicative of future performance.)

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.