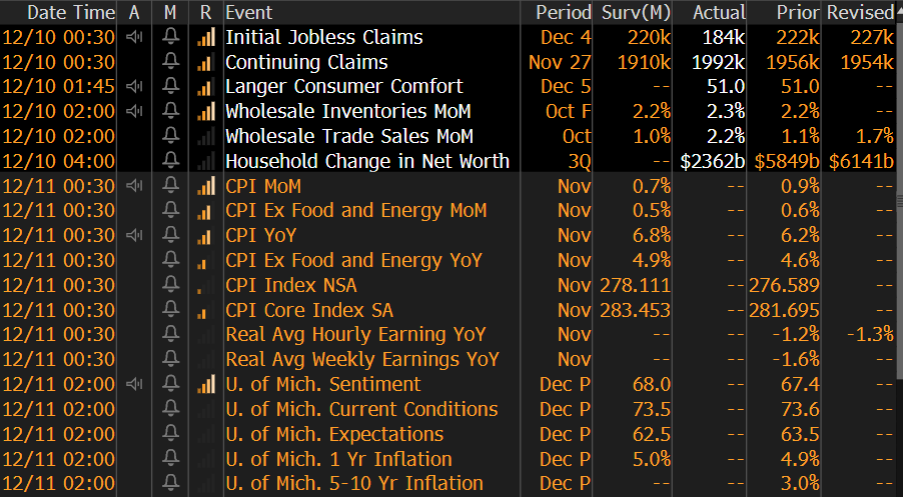

Let’s take the expectations for the year-on-year change in headline and core CPI, which currently sit at 6.8% and 4.9% respectively - we can devise a simple playbook from this and try and understand potential movement and subsequently our risk – my own view is while we still need to contend with Omicron headlines, simplistically, should we see a 7-handle on headline and a 5 on core then we should see US 2-year Treasury yields rising above 70bp and the USD should follow, notably vs the JPY, EUR and CHF. If the equity markets fall as a result of a hot CPI and the NAS100 could be a good guide here, then we should see a bigger percentage move lower vs the AUD, ZAR and NZD.

Consensus expectations

(Source: Bloomberg - Past performance is not indicative of future performance.)

XAUUSD would be interesting on a strong number, as the tape will be dictated by inflation-adjusted bond yields – or real rates. As we’ve seen before when recent US CPI has beaten consensus, real rates typically fall and the XAUUSD benefits – in fact, in the last US CPI print (11 November), in the 30 minutes after the data came out far hotter than consensus, we saw XAUUSD rally 1.3% - Taking this out to the past 12 CPI prints, XAUUSD has rallied +0.3% on average (again, in the 30 mins after the CPI drops, rallying 10 of 12 occasions.

While form suggests we get a beat, we obviously can’t dismiss a poor number and of course an inline print. I think if we get 6.4% or below then AUDUSD should fly. USDJPY is well supported into 112.74 and we can't rule out a test here if inflation comes out 30bp below consensus. The NAS100 should rally strongly.

The question macro heads will be asking is how does the CPI print affect the Fed’s thinking next week? Judging by the way the USD is trading, with negative flow in Crypto CFD and the meme share CFDs in the past 24 hours, as well as the big move higher in US real rates, I’d argue traders are positioning for a higher CPI print which cements a view that the Fed will increase the pace of taper its QE program from $15bn/month to $30b/month – therefore, closing out the QE program in March and opening the door for hikes in June 2022.

A 7-handle on CPI will have people falling over themselves that the Fed are ‘behind the curve’ and it may increase political pressure from the Biden administration that the Fed need to end its QE program far earlier. Granted, economists will be fraternising over the finer details and whether inflation was driven by car auction prices or owners’ equivalent rents, but the first reaction in rates, the USD, Gold and NAS100 will be on the headline print.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.