Trader thoughts - the set-ups, event risks and moves you need to know

- Given the dynamic in the bond market gold has gained 2.0%, with silver up 3.5%. I've flagged a turn in gold off trend support, conditional on real yields moving lower. Well, price closed above the 5-day EMA (XAUUSD) however, with the event risk on the docket and the subsequent two-way risk in bonds, longs still lack conviction and I’d keep position sizing small. However, there's been some solid short covering.

- On the day we see better buying play out in the nominal Treasury curve, with the US 10-yr Treasury closing lower by 6bp at 1.52%. Real (adjusted for inflation expectations) Treasury yields are also lower, with 10s down 7bp. We’ve seen 4.5bp being priced out of the US rates market through to 2023 – this is key and broad markets have reacted as I discuss.

- Can bond yields go lower? Perhaps but key event risk looms ominously - US CPI (in US trade at 00:30 AEDT) will be closely watched, with expectations of 1.7% (from 1.4%) for headline CPI YoY. We also see the US Treasury auctioning $38b in 10yr Treasuries (5am AEDT) – if there is weak demand in the auction and a hotter CPI print, yields could easily go higher and this could set markets off. Good demand and weaker CPI and yields go lower.

- The US House will vote on the COVID-19 relief bill at 9:00am local time (1am AEDT). I suspect this is priced into the markets, but I also see limited scope for a fade the fact scenario to play out.

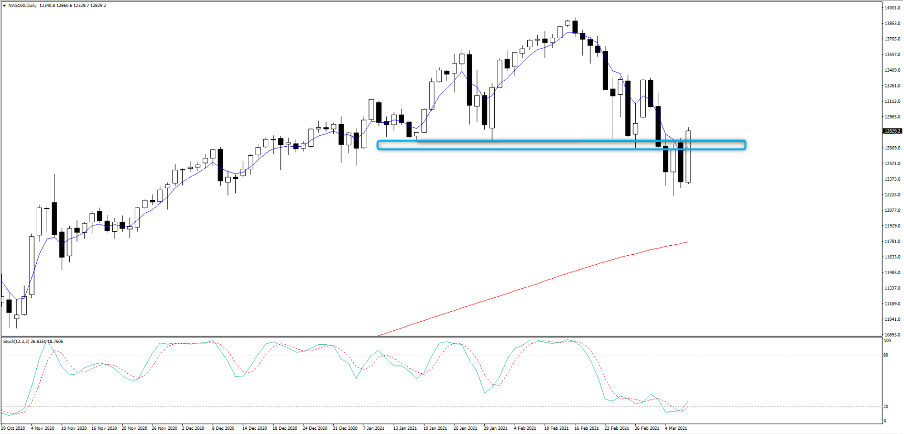

- Tech has flown. The NAS100 has printed two higher lows and closed through resistance into 12,780 and sits up a punchy 4.0% on the day. Value, while up on the day, has underperformed and there's been rotation into growth and tech. Again, is this a one-day affair? The bond market holds all the clues but 13,000 is the target followed by the 50-day MA at 13,147.

- Tesla has absolutely smashed it today, rallying nearly 20% - the best day since 3 Feb 2020. Volume is not as convincing as some would like (given the extent of the rally) at 66m shares traded, but it shows that a small move in bond yields can cause a huge move in this name.

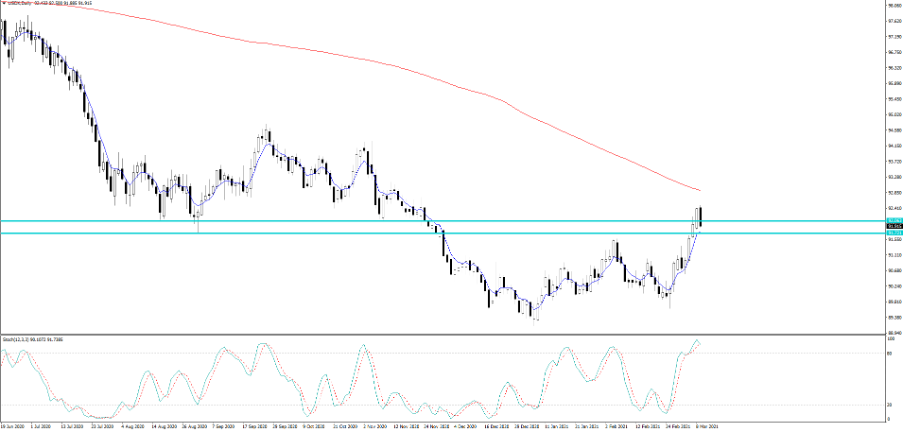

- The USD sits -0.4% lower, but the declines are broad based. The big percentage moves on the day have been seen vs the ZAR, MXN, and SEK. EURUSD has found buyers into the 200-day MA at 1.1829, with the yield premium demanded to hold USTs over German bunds coming in 3bp and compelling EURUSD buyers.

- All eyes on the ECB (tomorrow 23:45 AEDT), so watch EUR exposures into this meeting - the market expects a dovish turn as the bank really don’t want tighter financial conditions, but will they meet dovish market expectations? I (perhaps optimistically) favour selling EURAUD rallies into 1.5480, with the pair getting a small boost after RBA gov Lowe speech this morning.

- The fall in yields has weighed on USDJPY, which has been sold almost to the pip at the 2015 downtrend. I favour buying weakness into 108.07, but again the fate of this pair hinges on the direction of the US bond market.

- USDCNH gets a strong focus today, as will the Chinese equity markets (trade the CN50 with us) given the recent declines and volatility. USDCNH is especially key for broad financial markets given the influence on reflation assets, such as commodities and there will be focus on China’s February CPI/PPI print at 12:30 AEDT (consensus -0.3% and 1.5% respectively). There'll also be a focus on Iron ore futures which traded nearly 6% lower yesterday.

- Bitcoin looks strong at 54,700 and it wouldn’t shock to see price make an assault on the February high of 58,350. Lots of talk of large buyers in size over $100k doing the rounds.

Charts to keep an eye on

(USDJPY daily)

USDX

NAS100

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.