We also saw the more timely monthly (December) CPI print coming in at 3.4%; a 90bp improvement – and just 40bp away from the 2-3% target band.

Next week’s RBA meeting looms large, and the tone of the statement should reflect a bank seeing inflation moving towards target, yet they will make it clear this is no time for victory laps and more needs to be done.

The RBA will be enthused by the fact core inflation is below the RBA’s cash rate – subsequently, we have a positive real cash rate for the first time since 2016 - this is a small but welcomed victory for Bullock and co.

With both core and headline CPI nicely below the November Statement on Monetary Policy forecasts, we question the possibility of tweaks to their projections for June and December 2024 CPI. These currently sit at 4% by June and 3.5% by December, so any revisions to these estimates could result in some solid movement in interest rate futures and by extension the AUD and AUS200.

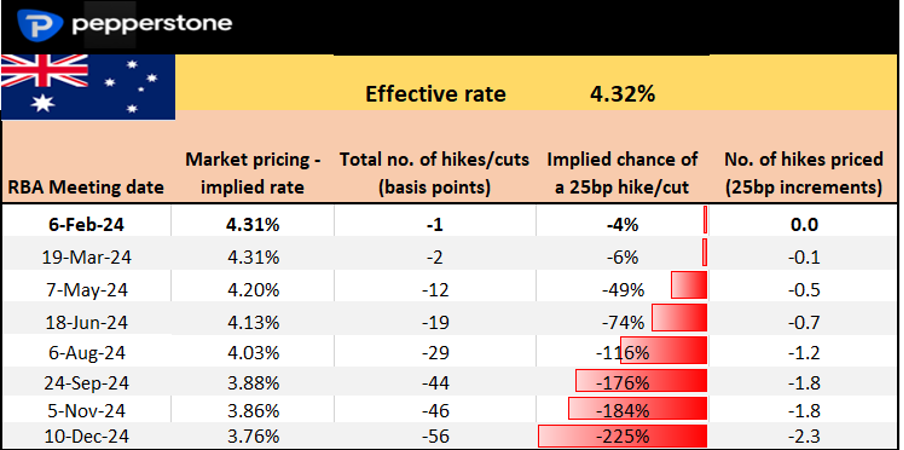

Aussie economic data has generally come in below market consensus expectations of late, so the pricing of expected RBA policy – through interest rate futures - has been part-validated in today’s CPI print. Looking at Aussie interest rate futures, the market prices no chance of a 25bp cut in either the February or March RBA meeting, and if anything, the RBA statements at these meetings need to lay the groundwork for cuts – although the tone of the guidance will be data-dependent.

Aussie 30-day interest rate futures pricing

While much of the disinflation has been driven by tradables, a 25bp cut in May is a real possibility and the market prices this at 50% - so essentially a coin toss. We see two 25bp cuts priced by year-end.

Eyes on Gov Bullock

Gov Bullock speaks next Friday (09:30 AEDT) and while she speaks after the RBA meeting statement and SoMP (both on Tuesday 14:30 AEDT) her testimony will be scrutinized and will move interest rate pricing, and by extension the AUD. I think we’ll have a fair idea of the timeline for potential policy easing from here.

Gov Bullock has a straightforward job – time rate cuts perfectly. Obviously, that’s easy to say but tough to do in principle but if we focus on the capital markets, we see little risk of an implied policy mistake and we see the ASX200 at all-time highs, with bank equity and consumer-sensitive stocks in rude health. AUD 1-month implied volatility resides at 12-month lows, while the Aussie housing market shows few concerns.

I guess this is an issue with setting policy on quarterly core inflation -it is a slow-moving beast and clearly a lagging indicator the fact it is still 120bp from target feels like a hawkish Bullock may keep the peddle to the metal for now. The market will put more weight on the monthly CPI reads.

I also consider the frequency of central bank speeches, and this is where the RBA, the ECB and the Fed differ in a big way – In Australia, we simply don’t have the plethora of central bankers that speak almost every day, and it's often a long time between drinks for the RBA speeches. This is quite refreshing, but in times like this it can be useful to know how each member stands, giving almost real-time commentary on policy.

Anyhow, the markets speak out – the door is ajar for a cut in May but easing will be gradual relative to the Fed, ECB, and other G10 CBs. We also see the floor in the RBA cash rate priced at 3.5%, so loosely four 25bp cuts are priced to a ‘terminal’ level.

The RBA won't try and keep pace with the Fed, they will work on their own merit and focus on their set of economics – either way, the trajectory for CPI suggests we will join the rate cut party and a ‘soft landing’ seems to be the more probable outcome, at least judging by the message from the markets.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.