- English

- 中文版

The Mexican Peso: An Important Opportunity for LATAM Traders

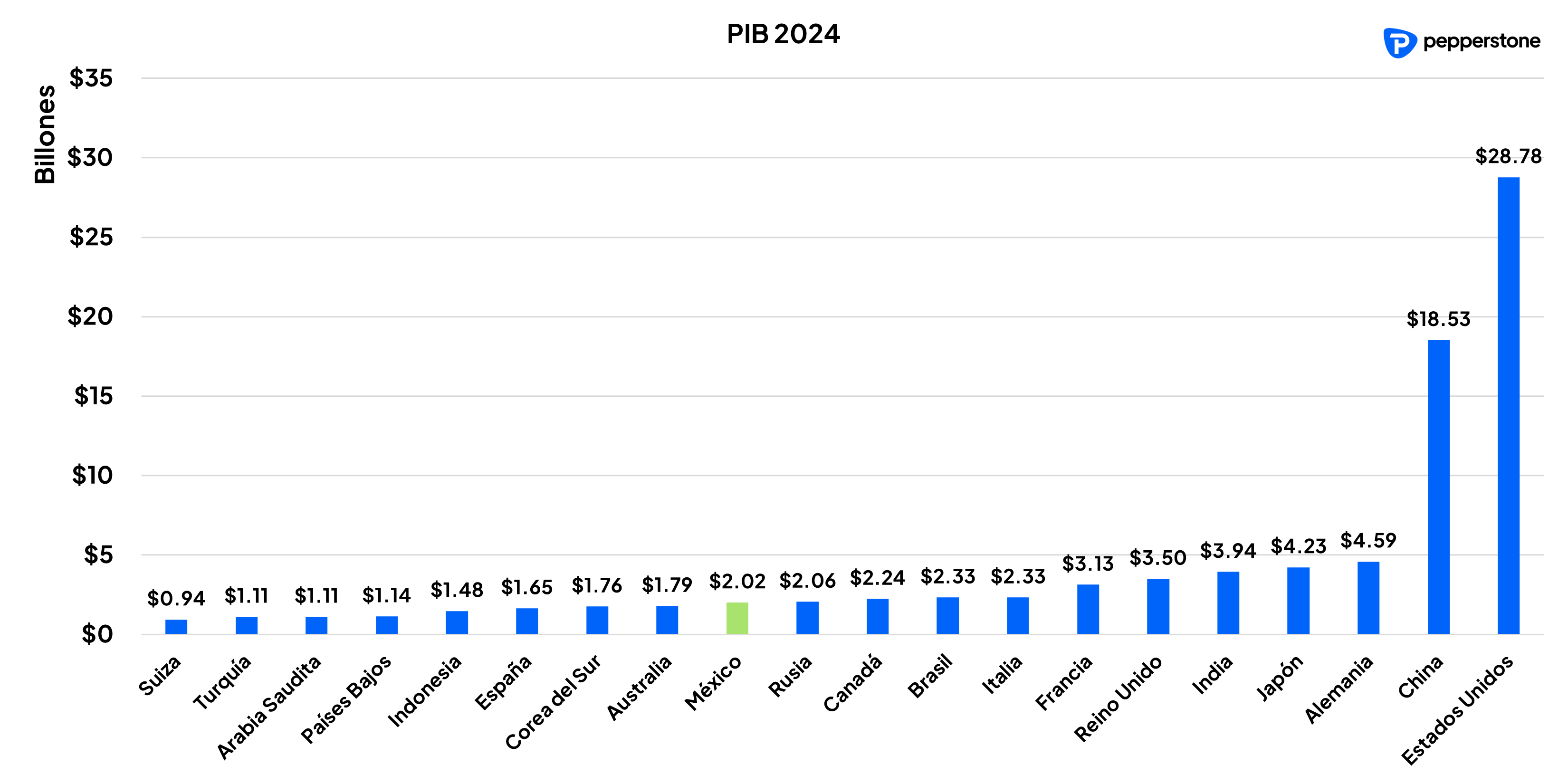

GDP 2024 (Projected)

What is the Mexican Peso?

The Mexican Peso (symbol: $; code: MXN) is the official currency of Mexico and is quite significant in the forex market. Besides representing one of the major global economies, it is preferred by traders as a proxy for exposure to the thematic of emerging markets. Its history dates back to colonial times, but it was not until 1821, when Mexico gained independence, that the Mexican Peso was officially established as the country’s currency. The Mexican Peso is issued by the Bank of Mexico, the institution responsible for the country's monetary policy and economic stability.

Why Trade the Mexican Peso?

- Volatility and Opportunities: The MXN tends to be more volatile than other major currencies, which can translate into higher profit opportunities (and risks) for traders.

- Diversification: Including MXN in your portfolio can help diversify trading operations and reduce exposure to other major currencies.

- Correlations: The Mexican Peso often shows correlations with commodities, opening up the possibility for interesting trading strategies.

- Carry Trade: Emerging markets often implement monetary policies that result in higher interest rates compared to major currencies. This makes the Mexican Peso (MXN) an attractive option for carry trade strategies, allowing investors to benefit from wider interest differentials when market conditions allow it.

- Expanded Access in Pepperstone: Now, at Pepperstone, you can trade MXN not only against the US Dollar (USD) but also against the Euro (EUR), British Pound (GBP), Canadian Dollar (CAD), and Japanese Yen (JPY). This gives you even more flexibility to take advantage of market movements!

Factors Influencing the Mexican Peso

The value of MXN is affected by a variety of factors, including:

- Monetary Policy: Decisions by the Bank of Mexico regarding interest rates.

- Global Economy: Global economic growth and commodity prices (Mexico is a major oil producer).

- Relationship with the United States: Given the close trade relationship between the two countries, US policies and economy significantly impact the peso.

- Investment Flows: The inflow and outflow of foreign capital in Mexico.

- Recently, this aspect has gained more relevance as Mexico has become one of the main beneficiaries of global fragmentation and trends such as "friendshoring" and "nearshoring."

- Political Events: Both domestic and international political events can cause volatility in the MXN.

Pepperstone Reduces Spreads on MXN Pairs

Good news for LATAM traders! Pepperstone has reduced spreads on all currency pairs that include the Mexican Peso. This means you can trade MXN at a lower cost, improving operational conditions for the peso.

Take Advantage of This Opportunity

If you are looking to diversify your trading operations and explore new opportunities in the forex market, the Mexican Peso can be an excellent option. With Pepperstone's reduced spreads, there has never been a better time to start trading MXN!

Start today! Open an account at Pepperstone and discover the advantages of trading the Mexican Peso.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.