Analysis

The insatiable bid in commodities and what it means for the AUD

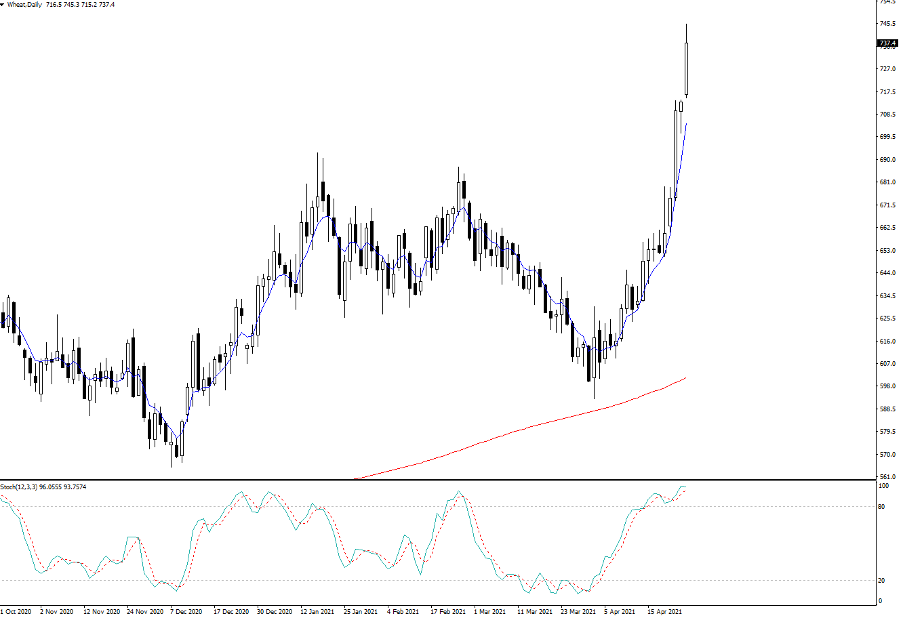

Gold and crude are consolidating, but Copper is flying (new highs seen in the Copper and Gold ratio). Iron ore futures are pushing to new highs and Lumber is in beast mode. Head to the softs and we see Wheat, Soybeans, Coffee, Cotton and to a lesser extent Cocoa, all pushing higher. Housing too. The trends in some of these markets, while mature, have been telling and we’re hearing about it from many US corporates through reporting season – many of whom are having to wear the input cost into margins. Some are passing it on, but this is the very essence of price pressures and inflation.

These sorts of explosive moves offer fantastic opportunities for trend traders and more so now, mean reversion focused traders. Will these moves spill over into a bid in Gold as inflationary pressure rise? At this point we’re not seeing that flow.

(Source: Tradingview)

What's clear is combination of higher copper and iron ore and the S&P 500 is great for commodity currencies. The bulls would like a better bid in Chinese equities and a breakdown in USDCNH, but as we see on the daily, AUDUSD is pulling out of the consolidation range. Ready to trade the opportunity?

Copper vs AUDUSD (orange line)

(Source: Tradingview)

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.