- English

- 中文版

The Daily Fix: US fiscal debates heat up, while tech finds its mojo

The anticipated good news from the Oxford/AstraZeneca vaccine trials has been in focus, as has the EU Recovery Fund negotiations, while the US fiscal stimulus debate cranks up.

In equities, the big players are running a barbell strategy, running a mix of growth and value in the portfolio and this is serving them well through a constant rotation of investible factors. The big talk here is that the NAS100 closed up 2.9% and at a record closing high, outpacing the S&P500 (+0.8%), while taking the shine off the move, we saw the Dow closing flat and the Russell 2000 lower by 0.3%.

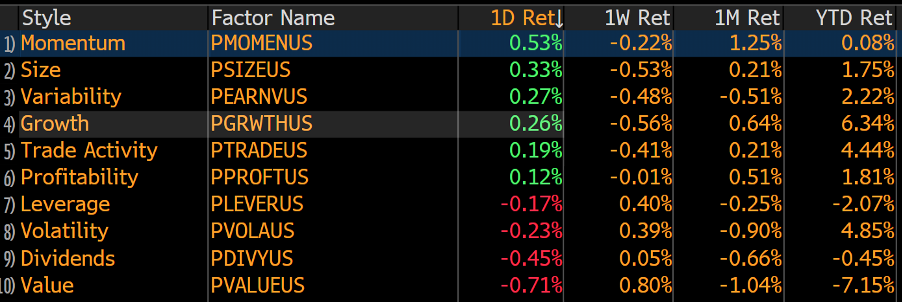

Factors that worked on the day

Source: Bloomberg

My ‘strong stock’ scanner (logic: price >10-day MA, price >50-day MA by 10%+, price closing near a 50-day high) has no recorded share CFDs from our equity universe at this stage. However, if this move in US equity indices CFD continues then it won’t be long before a few names start to come onto the scan and these names have a strong pedigree of outperforming the market. Happy to keep clients posted if this is of interest.

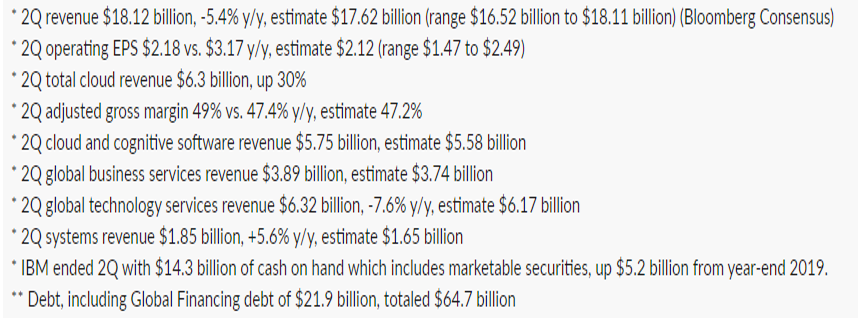

IBM is also keeping the dream alive, reporting solid earnings relative to consensus and rallying 3.7% after-hours and this won’t do futures any harm through Asia – notably on the Dow where IBM has a 3.24% weight. It should reinforce the notion that Asian equities should fire up on the long side when they resume trading in the cash session. Aussie SPI futures are currently +0.7%, with Hang Seng and A50 futures up around 0.9%.

Real yield once again supporting risk, and gold

Volatility is once again offered, with the VIX index lower by 1.2 volatilities to 24.46%, and our VIX index continues to home in on the June lows of 26.03%. In fixed income, the long-end of the Treasury curve has found a few buyers, with UST 10s and 30s lower by 2bp, but the shorter durations are unchanged – with inflation expectations up a touch higher in the 5-year duration we’ve seen real yields ever lower – possibly one of the reasons why the NAS100 has outperformed so intently today and has likely supported gold, which is currently testing the 8 July high of 1817 – A break here seems more likely than not, and I continue to like gold higher over any time frame.

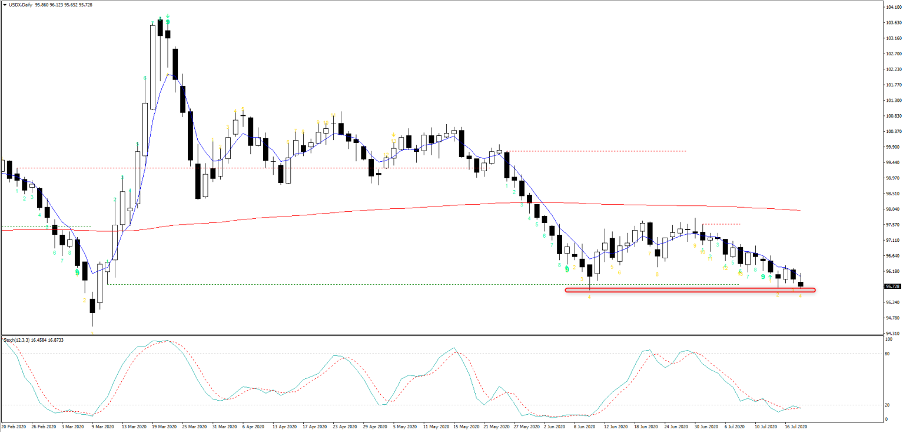

The USD is lower on a broad basis, with DXY currently right on the June lows, where every rally has been contained below the 5-day EMA since 30 June. The GBP has been the star of the session in G10 FX, followed by the NOK and SEK. We’ve seen upbeat flow in EURUSD and some of the EUR crosses, with a few sensing a move from 1.1167 in mid-June may not just be a USD play and perhaps an agreement in the EU recovery fund was largely baked in. That seems to have played out well, with EURUSD finding good sellers from 1.1468 despite Italian 10-yr BTPs closing 5bp to 156bp over German bunds – the markets go-to proxy of EU sovereign risk.

USDX daily chart

I remain of the view that EURUSD trades higher and will be buying dips in the near-term into 1.1380 and I know many will adamantly disagree, but I do think the fact we’re likely to hear confirmation of a near 50/50 split in grants and loans (E390b/E360b), which has pushed the ‘Frugal Four’ nations to accept the deal when the starting mix was a 2:3 ratio) - the total package remains at E750B.

Whether this a true game-changer for the Eurozone is debatable, but the program is not just breaking new ground in shared debt issuance, but it's actually one of the first times the EU has gone above and beyond expectations. It has not taken weeks/months of meetings to forge a deal that 27 nations can take back to their respective electorates and sell it as one they fought for.

Eyes on the US fiscal negotiations

The US fiscal debate has cranked right up and talk (source: WAPU) is we are not going to see further stimulus cheques, and it seems Trump will get his payrolls tax, at least in the draft, with the more palatable measure being that it is a deferral. This means at some stage in the future the public will need to pay the income boost back, although I am quite sure that will never happen. Unemployment benefits are to be cut, but again that shouldn’t surprise, and the question is whether they fall from $600 p/w to $400 p/w or lower.

Recall this is just a draft, so expect it to get some serious push back from the Dems who will not like the fact that this stimulus draft is so beneficial to those who already have jobs. It feels like this could get painful, although with many of the benefits due to expire at the end of the month time is not a luxury Congress can afford.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.