- English

- 中文版

The Daily Fix: Risk Margin FX flying with carry trades on fire

The S&P 500 closed +1.2%, but well off the highs of 3021, and failing to close above the 200-day MA. That may well still come, but the moves intra-day justify the VIX index being at 28%. One suspects the systematic hedge funds are now max long NAS and S&P 500 futures now and judging by flows through US brokers it seems retail is too!

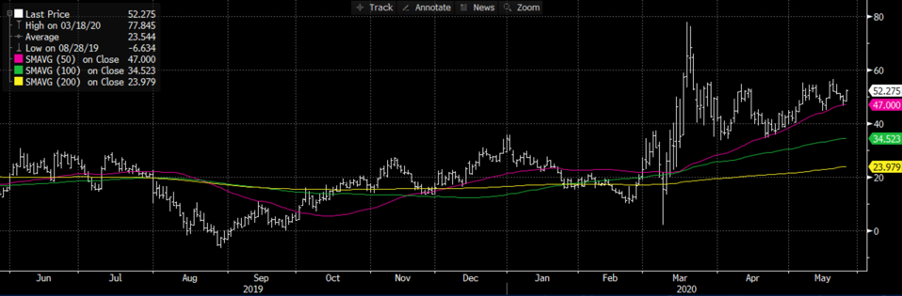

(Chart of NAS futures)

(Source: Bloomberg)

We saw a strong close higher in the Russell 2000, but it was the NAS100 that gets focus with the index rolling over and actually closing -0.3% and 1.9% off its opening high, with traders fading every rally through the cash session. As we can see from the futures chart (above) we have a defined wedge pattern and a rather ominous candle. Volumes were good too, notably through cash trade (S&P 500 turnover was 10% above the 30-day average), while we’ve seen 1.7m S&P 500 futures contracts traded.

The bulls will like the fact we’re seeing long-end Treasury yields moving higher, with the UST 2s vs 10s curve moving +3.5bp to 52bp and a break of 56bp would likely see further outperformance from US (and global) banks. A rising yield curve is also a sign that we feel economics are on the mend, so watch this one, especially with the 50-day MA defining the steepening.

European equity markets closed higher, notably the Spanish IBEX (+2.2%), although given EU futures have tailed off as US stocks fell into the close then if EU equity markets were to open now, they would do so on the back foot. The fact we saw a reminder of US-China tension just took a bit of the froth out of the move, with headlines below hitting risk into the close.

- *MCENANY SAYS TRUMP `DISPLEASED' WITH CHINA'S EFFORTS

- *U.S. MULLS SANCTIONS ON CHINESE OFFICIALS, FIRMS OVER HONG KONG

Asia may open on the back foot early with the Aussie SPI -0.7% lower from the ASX 200 cash close. Hang Seng and Nikkei 225 futures are largely unchanged. Certainly, moves in the ASX 200 had a lot of interest yesterday and will likely do so today. Turnover on the 3% rally was huge and 22% above the 30-day average, driven by REITS and financials. This seems key for me, as not only have they lagged, but if the risk rally is genuine and built on a thesis of better economics then the banks simply have to be part of it, as they are central to the economy.

With weakness eyed on open of the ASX 200 cash, one questions if the bulls just use this to accumulate or will weak longs cut and run. The buyers need price to hold 5636 (in the AUS200), although, I would be letting this bull run go on for now, cutting on a daily close through the 5-day EMA and

In terms of positive drivers for risk, there are many and these are the top-down views from across the desk

Causing the lift in risk:

- Novavax – A US biotech name testing its COVID19 vaccine on 130 adults in Austraila. Novovax don’t have the best record of getting drugs to market though

- Trump detailed that there is enough tests for 200m Americans per month

- Despite the US putting 33 Chinese companies on its ‘entity list’ there has been limited tangible retaliation – Better buying in CNH helping equity sentiment

- Japan lifts emergency orders around Toyko

- The UK will allow retail stores to start trading 15 June

- Germany to ease travel restrictions in next few days

- Talk from Bank of France gov of more QE

- Anticipation ahead of today’s EC Recovery Fund proposal, which commences with Commission President Ursula Von der Leyan due to speak at 12:30 to 14:00 BST.

- All 50 US states under lockdown easing

- All TINA, FOMO and MOMO

Risk margin FX has flown. Considering the implied vol in margin FX markets, which, alongside the moves in equities has seen the carry trade work like a dream – how are the moves in MXN and BRL of late, especially vs the EUR! Getting paid to be in a position works well in this backdrop, and it’s especially appeasing when the capital position is working in your favour. That said, some of the moves in carry are mature move now and if equities do roll over here a touch then carry will be hit pretty quickly.

The big flow has been in AUD, GBP and CAD, while the BRL sits as the top performer. The percentage changes were clearly not expected, but welcomed. Where the absolute moves, while in-line with the direction the price volatility matrix detailed (in yesterdays note), were in excess of what the market was thinking.

If the money flow starts to really kick home and model has the direction right, I won’t blindly sell out of the position just because the implied move and the R2/3 has portrayed an area of potential fatigue. If the ROC is rising and risk sentiment in equities and commodities is elevated, then this can have a big impact on how far a move in risk margin FX can go.

In fact, this is a better guide to stop loss placement on a directional trade and not just mean reversion. I will be posting this regularly on our Telegram channel, so if you see value in this sign up to the channel for this and other breaking information.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.