- English

- 中文版

Playing China volatility - could deleveraging be the next big catalyst?

There are a number of ways to play China with Pepperstone.

In margin FX, USDCNH (yuan traded in HK) is one the most influential crosses and has been so integral to the global reflation trade that is now being called into question – so far, despite some big volatility (vol) in Chinese/HK equities, we’ve not seen much movement in the margin FX cross – but the line in the sand is 6.5000, so an upside break here could resonate in weakness in AUDUSD and other China proxies – but at this stage a 6.4550 to 6.5000 range is in play.

(Source: Tradingview)

On the index side, traders can play the CN50 (A50 index), CHINAH (H-shares) or HK50 (Hang Seng).

The correlation between these indices is naturally extremely high, although there are differences between the companies that make up the index and their respective index weights. The HK50 is comprised of HK companies, while the CHINAH is a mix of both HK and Chinese mainland names.

The CN50 is the pure play on China and represents the top 50 Chinese mainland companies traded as a futures instrument on the Singapore Exchange (SGX). While we can’t trade the CSI 300 directly (due to capital controls), a 2-year regression between the two variables sits at 0.97 – in layman’s terms, the CSI300 and CN50 typically move as one.

We know that the weightings of tech names differ from index to index, so this can have a sizeable impact on movement – especially with Tencent and Alibaba commanding 17% weight on the HK50 and CHINAH alone. The concentration risk can easily exasperate the moves.

We can also trade Baidu, Didi and Alibaba as an equity CFDs or in the ETF space the FXI - iShares China 25 ETF and MCHI - iShares MSCI China ETF.

Investors always look for risks to earnings expectations, and in a market where the government can make sweeping changes quite rapidly, regulatory risk is often cited as a key reasoning why international investors shy away from Chinese investments – that is, if they can express the same thematic through US equities, they’ll often invest in those – its why US tech and internet share CFDs often outperform Chinese share CFDs and wear a far higher P/E multiple.

Most understand that Chinese share CFDs are not reflective of Chinese economics, but they are reflective of politics. Therefore, it seems the biggest risk is now being realised, with significant regulatory changes taking place in big tech, but also the internet and education sectors – there is talk healthcare and property could be next.

US-China relation is likely adding to the headwinds.

In essence, the market is trying to price risk and struggling at this stage to get much clarity.

The fact that global investors can’t readily short the CSI 300, suggests one play where they can get easy access on the short side is via the A50 futures (CN50 index).

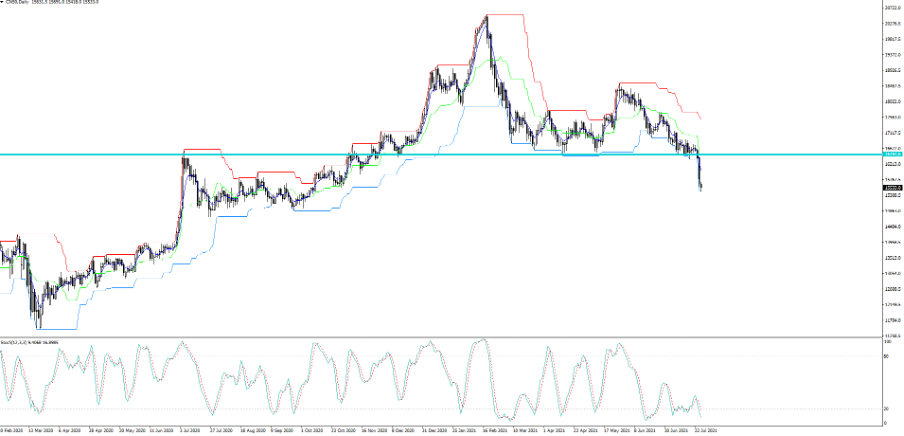

CN50

(Source: Tradingview)

On the current set-up, we see price falling sharply – is akin to catching the proverbial falling knife? It feels as such, and in the absence of clarity, and a market still trying to understand the changes taking place in the “Common Prosperity” drive, the buyers may stand aside for now – when the bid comes out the market it is often ripe for short sellers.

We also know that margin debt has increased 154% since February 2019 and sits at the highest levels since July 2015. This will not sit well with authorities, and suggests we could see deleveraging from investors. Could this be the core reason why markets head another 5-10% lower?

Total margin trading – total outstanding balance of margin transactions

(Source: Bloomberg)

The risk for shorts is that we see the so-called ‘National Team’ step in and support at any stage – naturally, like any central authority the understanding is that there is a connection between a drawdown in financial assets and the wealth effect, which feeds full circle into weaker economics. So, for those who hold positions longer than 5 minutes, it is always prudent to have eyes firmly on the tape, as a bearish turn could play out swiftly and without news. However, for now volatility seems assured.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.