- English

- 中文版

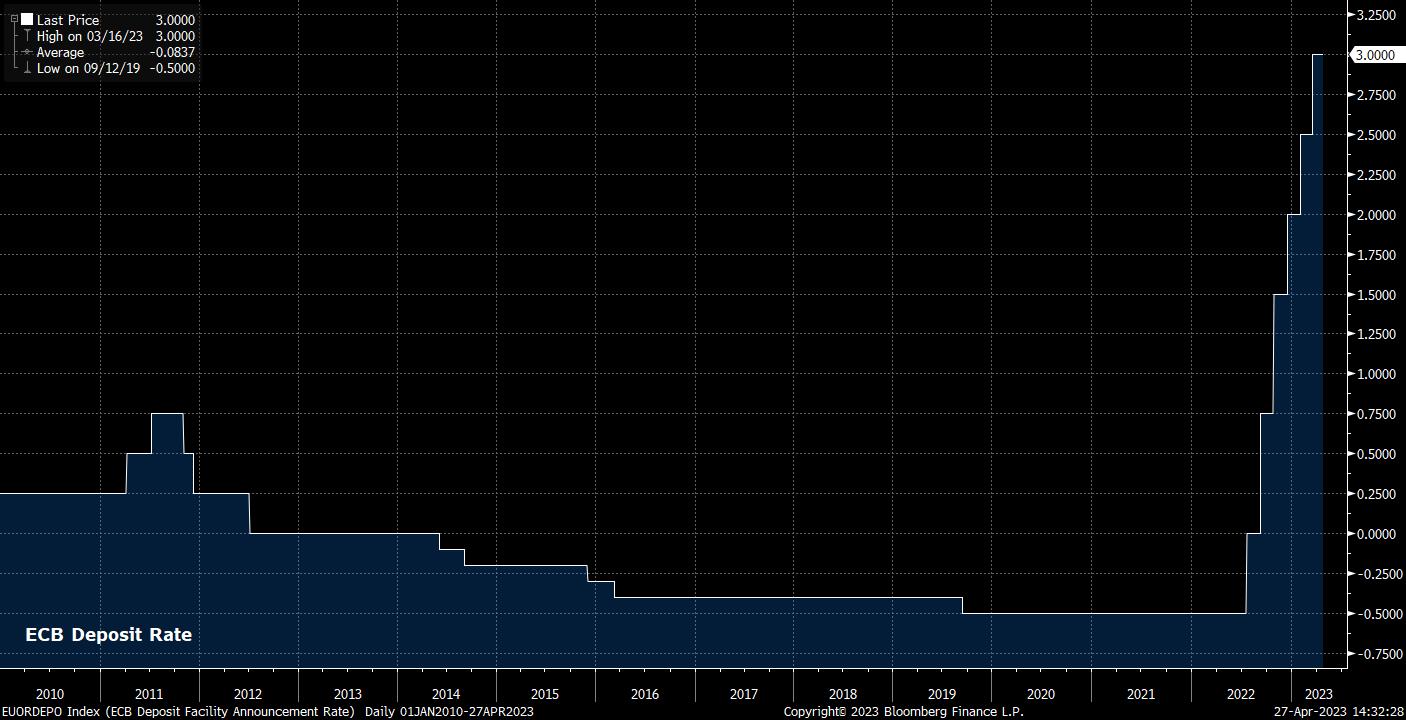

Such an increase is unlikely to come as a surprise to traders, with money markets fully pricing in such a hike, in addition to another 25bps increase at the following meeting in June. Such pricing seems broadly in line with recent remarks from policymakers, with even the typically dovish Chief Economist Philip Lane touting the prospect of further hikes (note, plural).

Despite continued hawkish commentary, the ECB seem unlikely to issue concrete guidance as to the future policy path. However, a distinct tightening bias will be maintained, not least to avoid an unwarranted easing of financial conditions across the bloc. Said bias is supported by the dearth of any clear disinflationary signs within the bloc, and is also facilitated by the Governing Council continuing to make a distinction between their monetary policy, and financial stability functions.

While headline inflation has begun to roll-over, this is almost entirely due to falling energy prices, with other components of the HICP index continuing to see intense price pressures. Hence, the core inflation measure has taken on greater importance, and continues to print record highs on a monthly basis, now standing at 5.7% YoY. It is the persistently high nature of core inflation, and the upside risks that this poses to earnings growth, which is likely to keep the hawks in the driving seat for now.

The ECB’s continued hawkish stance is also emboldened by the relatively resilient growth dynamics that persist within the bloc. While Q1 GDP is yet to be released, last week’s ‘flash’ PMI surveys pointed to continued resilience in the services sector, with the gauge rising to a 12-month high. The composite output gauge also rose to a 1-year high, allaying some concerns about a broader contraction in the bloc’s economy after the manufacturing sector contracted at its quickest rate since mid-2020.

Nevertheless, there remains a substantial amount of economic data still to come between now and the next policy decision; all of which will arrive during the quiet period, when policymakers are not permitted to make public comment.

Of the releases, it will be the ‘flash’ April inflation data, as well as the latest bank lending survey, both due next Tuesday, that are likely to have the most influence on the GC, as policymakers continue to assess the impact of cumulative tightening on the economy, in addition to providing an opportunity to examine the degree to which policy continues to be transmitted effectively across the bloc. A solid lending survey, and another upside core inflation surprise, could nudge the GC towards a larger 50bps increase, though the bar for such a hawkish move seems a rather high one.

In terms of the markets, despite volatility having been persistently low of late, a number of European assets sit at, or close to, interesting levels.

EUR/USD, for instance, trades within a whisker of the 1.11 handle, and close to its highest levels since last March, benefitting from the widening divergence between the continued hawkish stance from the ECB, and an FOMC that is moving ever closer to ending the hiking cycle. A decisive upside break would target the mid-1.11s, however a closing move below the uptrend that has been in place since mid-March would leave little by way of support until just under the 1.08 handle.

_eurusd_mb_2023-04-27_14-29-45.jpg)

As for European equities, the recent bull run appears to have run out of steam a little over the last week or so, despite corporate results continuing to surprise to the upside. The DAX, for instance, has traded in a tight range between 15,650 – 15,900, both being key levels that traders should have on the radar over the ECB decision. An upside break could put the bulls on track for a test of the double-top from November 2021 and May 2022 at 16,285.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.