- English

- 中文版

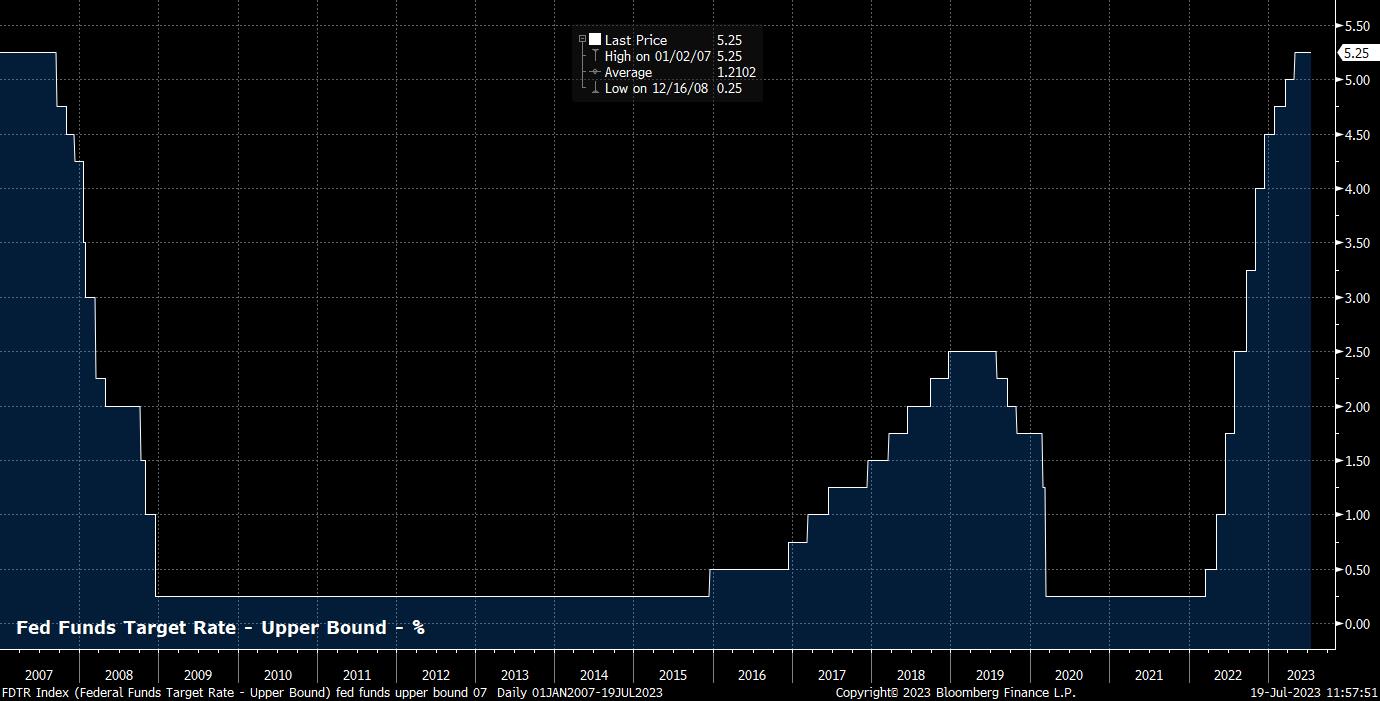

Both money markets and fed fund futures almost fully price a 25bps increase at this meeting, taking the target range for the fed funds rate to 5.25% - 5.50%, with OIS implying a roughly 95% chance of such an outcome, which would prove the decision in June has turned out to be the ‘skip’ we expected, rather than an outright pause in the hiking cycle.

Given that such an outcome is, as near as makes no difference, fully priced, focus for financial markets will again fall on the guidance that the FOMC issues with regards to the future rate path. At the June meeting, the Committee reiterated their data-dependent stance in determining future policy shifts, noting that they will take into account “the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial development”.

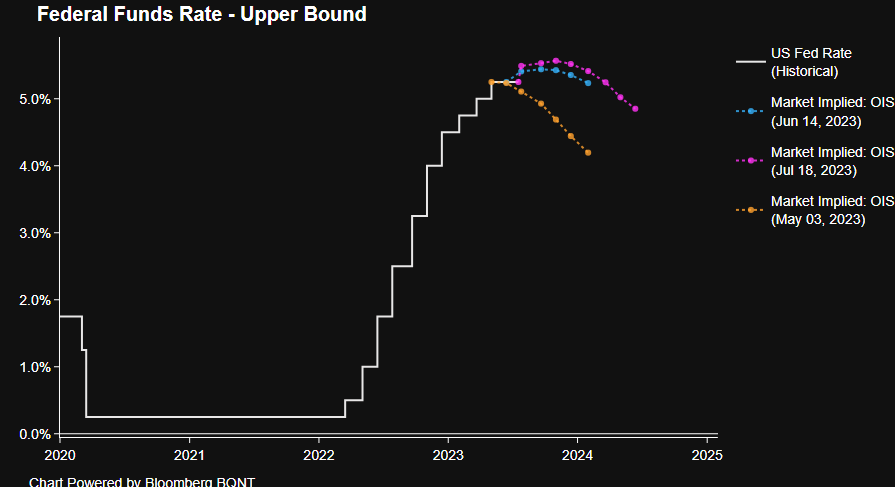

This guidance is likely to remain in place, with any pre-commitment to action after the summer break highly unlikely, especially considering that there are two labour market reports, and a further two inflation prints, between the July and September meetings. Despite this, a further 25bp hike remains likely, particularly if the economy remains as resilient as at present, at either the September, or the November meetings.

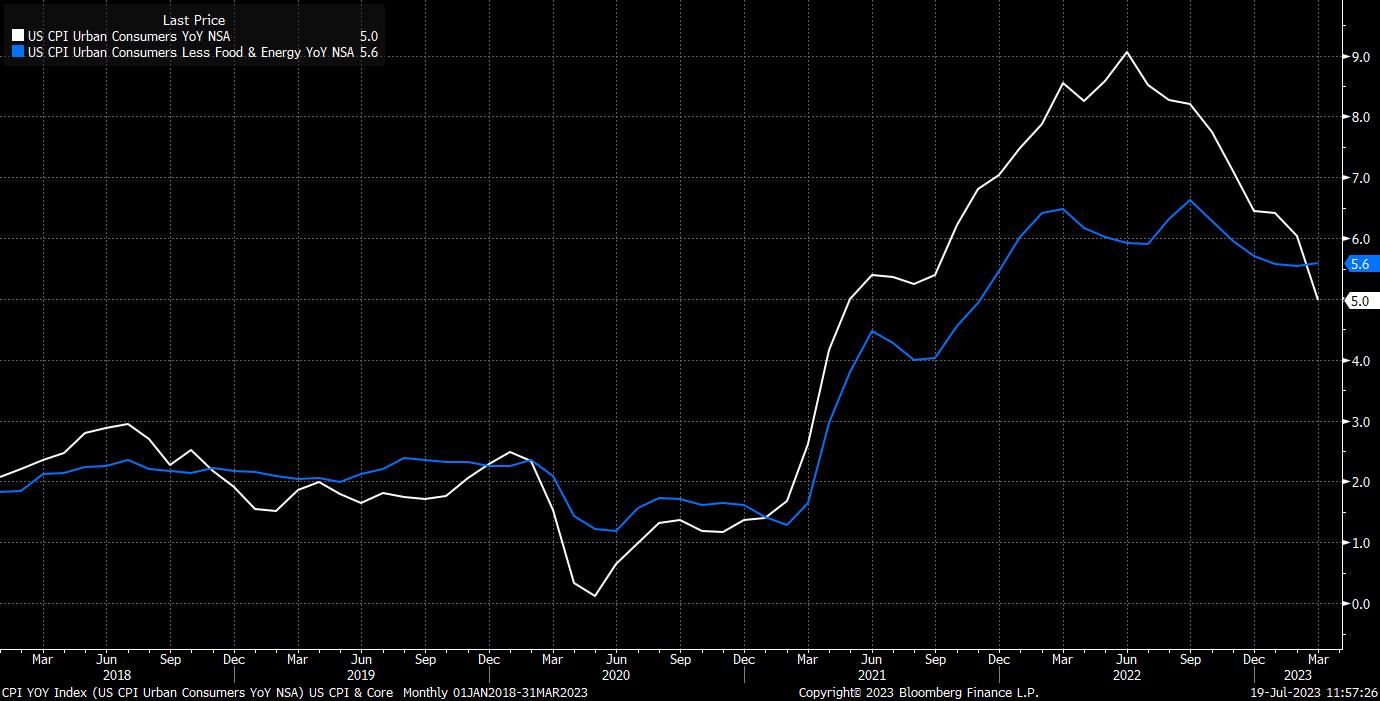

On the subject of the economy, incoming data has continued to evolve broadly in line with the FOMC’s expectations. Headline inflation has continued to decline on a YoY basis, with CPI falling to 3% YoY last month, the lowest level since March 2021, as core CPI fell beneath 5% YoY for the first time in over 18 months.

However, base effects from the elevated inflation seen last year is somewhat distorting those YoY figures. Chair Powell has noted this previously, tending to favour a focus on inflation in the services sector, which is proving much stickier than that of goods, and on measuring inflation by annualising a series of MoM prints, which removes the skew caused by YoY comparisons. When looking through this lens, inflation remains elevated – core services inflation rose 6.2% in June, while overall core CPI rose at an annualised rate of over 4%. Consequently, there’s plenty of ammunition for the Fed’s hawks, and Chair Powell if he so wishes, to argue that progress in bringing inflation back to target remains unsatisfactory.

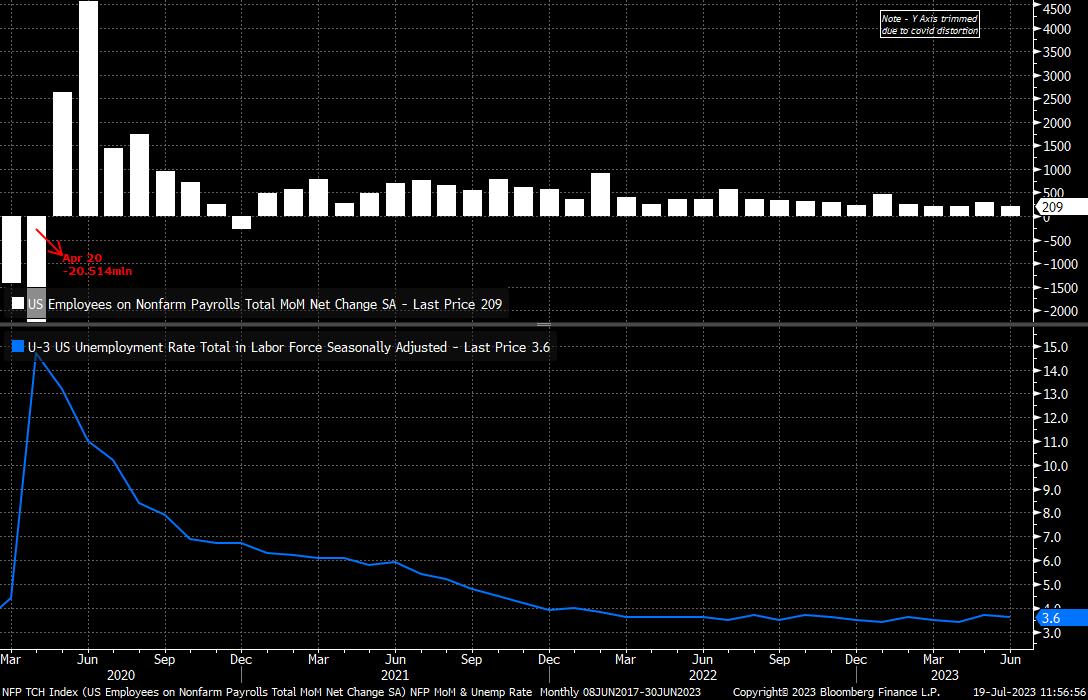

Although the disinflation process may be running slower than desired, the tightening delivered thus far appears to have had a limited impact on the labour market, likely much to the relief of policymakers. Headline nonfarm payrolls rose by 209k in June, a touch below market expectations, though still a healthy pace that is comfortably above the monthly average job gains seen prior to the pandemic. Furthermore, unemployment remains considerably below most estimates of the equilibrium level at 3.6%, while prime age participation continues to rise, touching 83.5% last month, the highest level since early-2002.

This is, perhaps, a reason as to why earnings growth remains relatively contained, with average hourly earnings having risen 0.4% MoM in June, and 4.4% YoY, a pace that – while pointing to positive real wage growth – is unlikely to threaten any form of wage-price spiral. It will be interesting, though a question for September, whether the FOMC continue to see unemployment rising to 4.1% by year-end, which would require a rapid deterioration in labour market conditions from present levels.

Clearly, both the labour market and the inflationary backdrop justify a continued hawkish policy stance, not only in terms of the likelihood of further near-term rate hikes, but also holding rates at the present level for some considerable time.

The growth picture supports this view, with the services sector continuing to perform well, offsetting continued weakness in the manufacturing industry. GDP grew by an upwardly revised 2.0% on an annualised QoQ basis in the first three months of the year, while the Atlanta Fed’s GDPNow estimate points to a similar, if slightly faster, pace of growth in Q2. So long as this resilience continues, there will likely be little desire from the FOMC to ease up on the present hawkish policy settings and rhetoric.

On that note, another hawkish press conference is likely to be delivered by Chair Powell, with the script presumably, by and large, a repeat of remarks from last month, given how there have been few significant changes to the economic outlook in the intervening period.

Consequently, the balance of risks for financial markets appears tilted towards a hawkish surprise. Though a 25bp hike at this meeting is fully priced, markets see just 6bps of further tightening over the remainder of the year, while also envisaging around 44bp of cuts (from present levels) in H1 24. Such a pace seems rather over-the-top, with Chair Powell potentially giving markets a reality check in terms of this dovish pricing, likely leading to some degree of this easing being priced out.

Such an eventuality poses an upside risk for the USD, which last week broke to the downside of the YTD range, trading at its lowest level since early 2022 against a basket of peers.

_d_2023-07-19_11-55-52.jpg)

100.85 remains the key level upon which markets are likely to focus, with this having proved support for the buck all year, and now likely becoming stiff resistance. Elsewhere in G10, 1.12 in EUR/USD, 1.30 in GBP/USD, and 140.00 in USD/JPY are all worth having on the radar.

As for equities, any hawkish surprises from the FOMC are likely to be met with a knee-jerk move lower, perhaps including the S&P dipping beneath the 4,500 handle, which the market broke above around a fortnight ago.

However, any downside seems likely to be relatively limited, with the bulls having a firm grip on proceedings at present, particularly as the rally shows signs of broadening out from having been concentrated heavily within the tech sector. On that note, ‘big tech’, and other, earnings releases are likely to be the main driver of risk appetite for the time being, rather than an FOMC which is unlikely to significantly rock the boat before the summer break.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

_(1).jpg?height=420)