- English

- 中文版

Netflix Q2 2025 Earnings Preview – Can It Deliver Against Sky-High Expectations?

A well-loved & Owned Position

Netflix is a well-loved and owned position, with the share price up +40.3% YTD, and outperforming the S&P500 by an impressive 33 percentage points, highlighting that being long of Netflix equity is a crowded trade. Yet, while Netflix is certainly not cheap on 42x forward earnings, justifying the outperformance is straightforward, with the company insulated from tariffs and backed by an exciting pipeline of new content that should help maintain the trajectory of subscriber growth and result in solid EPS and sales growth in 2H25.

Netflix also have a strong pedigree of overdelivering on earnings, with the company having beaten the analysts’ consensus expectations on sales in each of the past seven quarterly reports, and in nine consecutive quarters on EPS and operating margins.

Option’s pricing suggest big movement in the share price

Traders are also well conditioned to see outsized moves on the day of earnings, typically 3 to 4 times what we’d see on any non-reporting day. For context, the stock has closed -/+8.5% on average over the past 8 earnings releases. For the Q225 report, options pricing implies a -/+6.9% move on the day of earnings, which, if realised, poses risk to those holding existing exposures, but also opportunity for those nimble to capture the ensuing move.

The numbers that matter to investors

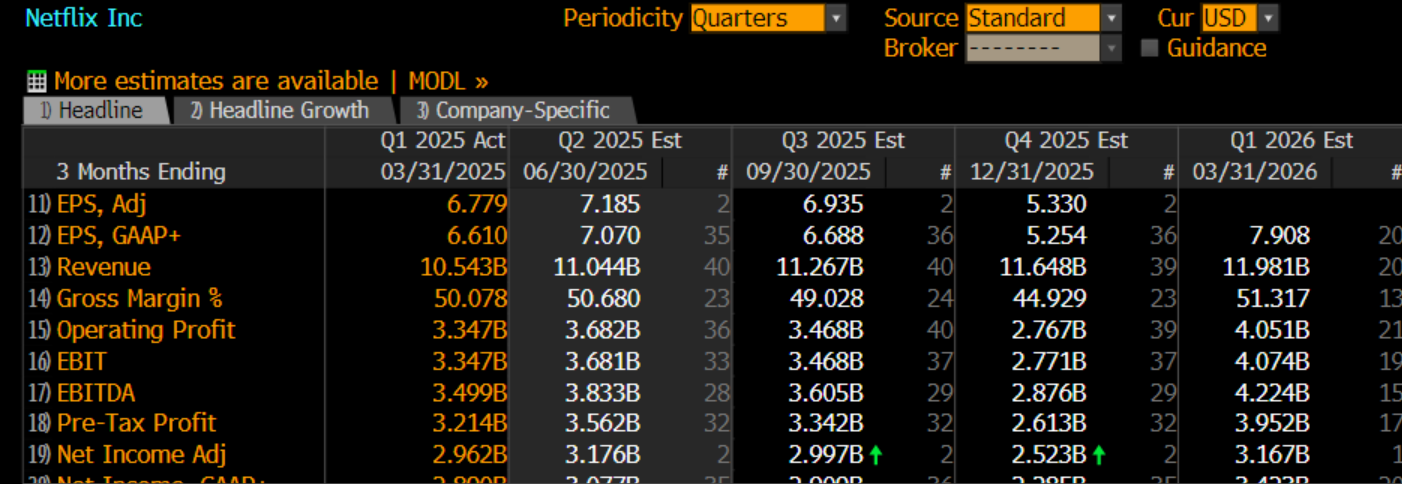

As investors/traders run through the numbers and the guidance and assess the health of the business, we can focus on the actuals from the Q225 report, but also company guidance for the upcoming Q325 reporting quarter.

Expectations for the Q225 reporting quarter:

• Net streaming subscriber additions – Whilst net sub additions are clearly a key driver of Netflix’s earnings, Netflix took the decision to stop reporting this metric in the Q125 report. This is a hard metric to gauge, but the street extrapolates and models 4.66m net adds for Q225, with total streaming paid memberships at 307,995,280.

• Q225 Revenue – The consensus expectations from analysts fall in line with prior company guidance for Q225 sales of $11.035b and EBIT of $3.675b.

• Q224 Operating Margins (OM) – prior company guidance is for Q2 OM of 33%, with the street positioned in line with prior guidance.

Guidance for the Q325 quarter: The consensus estimates that set the benchmark

Given the lofty valuation, if the market is going to bid Netflix into $1350, we will need to see upgrades to company guidance for Q325 earnings that result in analysts rerating the stock.

• Q325 Revenue Guidance - The street is looking for Netflix to guide to Q325 revenues of $11.265b. The bulls will want to see guidance set above $12b to impress.

• Revenue guidance for FY2025 - Prior company guidance for FY2025 was for $43.4b to $44.5b. The street is currently modelling $44.5b, so management will likely need to raise its FY guidance above $45b to please the market.

• Q325 Operating Margins (OM) - The market models Q325 OM of 30.5%. The bulls will want to see guidance for Q3 OM’s north of 32% to see new cash put to work on the long side.

All up, Netflix is in a strong position, and the strong outperformance is justified on a number of metrics. That said, with the street already positioned for a beat and raise (to guidance) on sales and OM’s and conditioned to Netflix having form at earnings, Netflix may have to report some very impressive numbers to get the share price pumping higher. Either way, volatility is almost assured, and this will be one for traders to have on the radar.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.