- English

- 中文版

The Daily Fix: Moderna drug trials not all the bulls had hoped for

Today we’re told (in the latter stage of US trade) that a STAT “expert report” has downplayed the Moderna vaccine trial, which most had listed as one of the inspirations behind yesterday’s market rally. The report suggests “there’s no way to know how impressive, or not, the vaccine may be” and that “we don’t know if the antibodies are durable”.

I personally felt the large driver of Monday’s move was down to Fed chair Powell’s comments, a solid rally in European equities and moves in commodities and crude more broadly – today, we are seeing how much of the vaccine was priced and shows just how important the markets see the vaccine to mitigate what is essentially the biggest market risk – the prospect of a fresh wave of COVID-19 cases, that leads to renewed shutdown fears.

(Top pane – S&P500 futures/red circle indicates the Asia close)

(Source: Bloomberg)

The move lower in the S&P500 has left equities lower on the day, with the S&P500 -1.1%, NAS100 -0.4% and the Russell 2000 -2%. All sectors closed lower, although energy (-2.9%) and financials (-2.5%) led the declines with 79.8% of share CFDs closing in the red. The Asian open is looking a tad dicey, with Aussie SPI futures -1.5% and weaker tape in Hang Seng and Nikkei futures. The breakout in the ASX 200 is on thin ice, and the bulls will need to support the open, or we run the risk of moving back to 5350.

Failed breaks in the JPY crosses

The move lower in equities was good for 50-pips in the AUDUSD, where the pair had moved to 0.6585, breaking to the highest levels since 9 March, before taking the hit. We’re left with an ominous-looking candle on the daily chart, and one where a lower low today could see attract greater profit-taking. It probably won’t shock to see the similar price action on the US500 or NAS100, given they’re effectively the same vehicle these days. The 20-day rolling correlation between S&P 500 futures and AUDUSD sits at 0.77, with AUDJPY at 0.80.

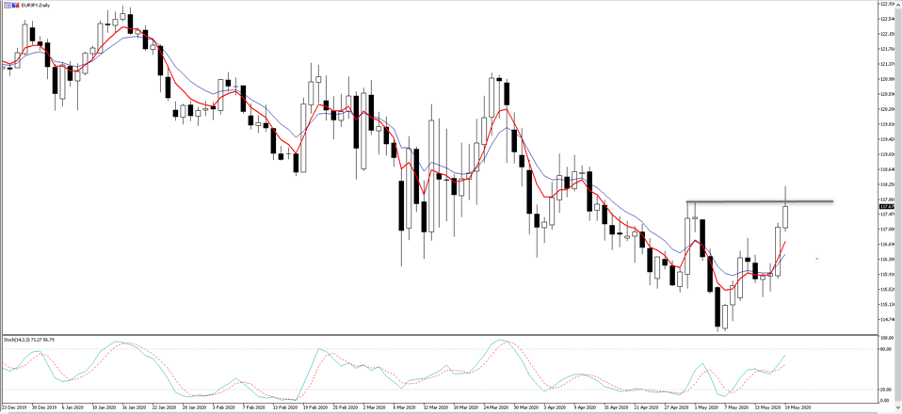

AUDJPY pushed to 70.96 but has found sellers above the 100-day MA (70.58) but seems to be holding its breakout high of 70.17. One to watch through trade, as this could be somewhat of a lead indicator through Asia today. EURJPY is another JPY cross getting some attention has been well traded, with sellers on the 117.78 break – This could be telling if price rolls over through Asia today.

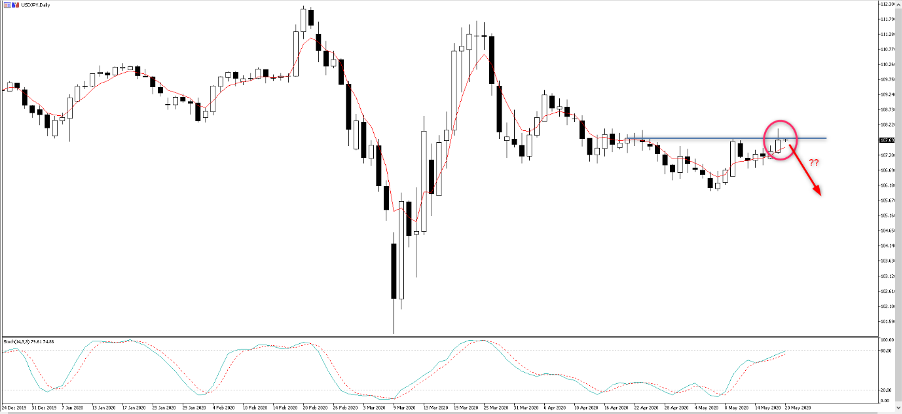

USDJPY, another of the JPY crosses, where price made a higher high, but failed to hold the bid and failed breaks could manifest in Asia.

The session percentage change masks the late session charge for the JPY, with the currency net lower vs all major currencies ex-BRL, with NOKJPY and NZDJPY the stars of the show. That said, again, as the S&P500 moved lower into the close the JPY and the USD caught a bid, with the VIX index – a barometer of risk and implied movement – pushing back above 30%, with good buying of S&P500 1-month 25delta put vol (+2.3 vols at 31.97%).

Bond and gold moves

After yesterday’s strong move in breakevens (inflation-expectations), we see 5-year expectations -3bp to 82bp and 10s -2bp to 1.14%. We’ve seen a better bid in gold (XAUUSD), with the metal (+0.8%) finding buyers all through EU and into US trade, with price holding the 5-day EMA and holding a new closing high. Gold miners have rallied strongly, with the GDX ETF (gold miners ETF) closing +3.6%, and this offers a belief from equity investors that the yellow metal is headed higher.

On the docket ahead there is little data to worry Asia, while UK CPI (16:00 AEST/07:00 BST – headline expected to decline 0.1% MoM) may get some focus given the delicate set-up in

GBPUSD daily chart – make or break time.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.