- English

- 中文版

January 2024 ECB Preview: Pushback Falling On Deaf Ears

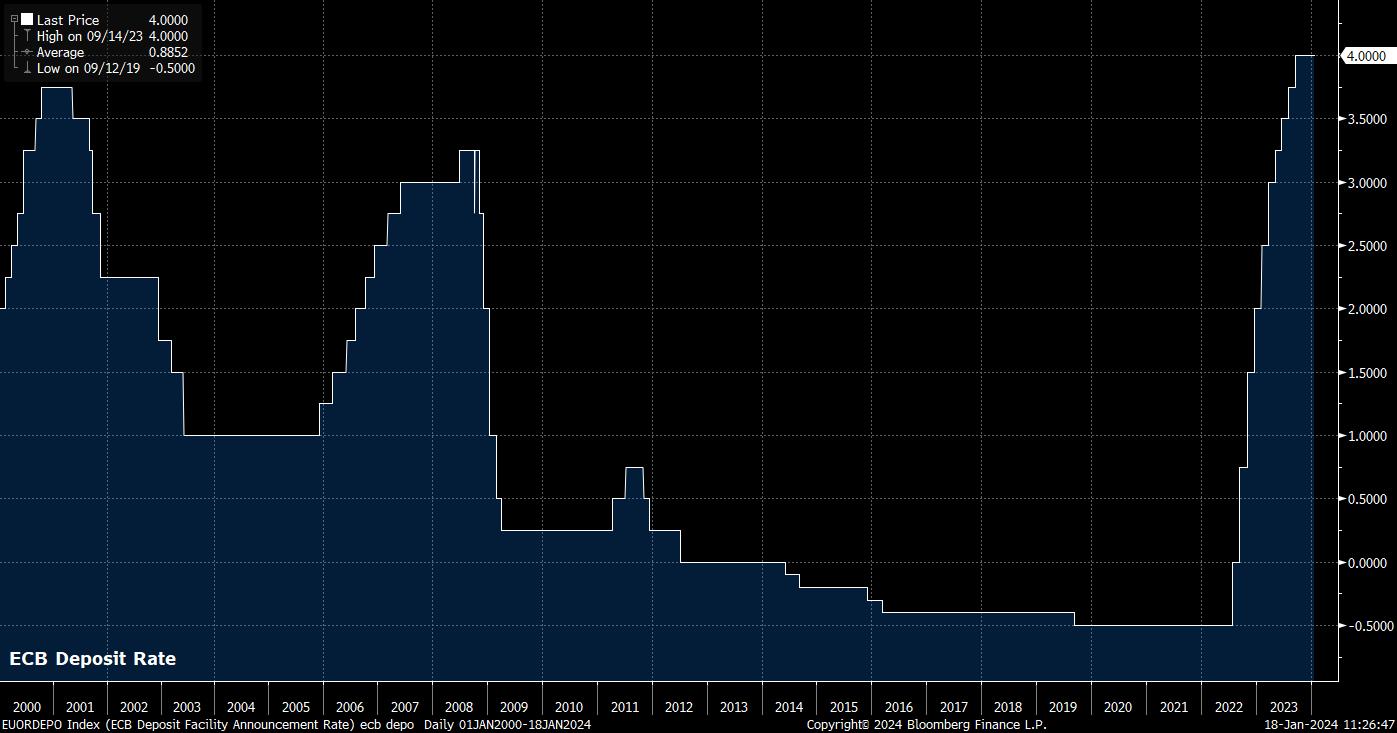

It should, largely, go without saying that the deposit rate will be maintained at a record-high 4%, with OIS implying such a hold as a near-certainty. In fact, at this late stage of the economic cycle, it would take a significant inflationary shock to result in a further rate hike, and even in such an unlikely scenario, with economic momentum waning rapidly, such a move is far from guaranteed.

As noted, however, it is the remainder of 2024 where the policy outlook becomes significantly more interesting, and where a chasm opens between the views of Governing Council members, and the path markets currently price.

In light of inflationary pressures continuing to fade, EUR OIS has begun to price a rapid pace of easing throughout the year ahead, implying a roughly 4-in-5 chance that the first 25bp cut will be delivered by the April policy meeting, along with an expectation that as much as 140bp of total easing will be delivered of the year in its entirety.

Unsurprisingly, such a path, and the loosening in financial conditions that it has provoked, is of concern to policymakers. In fact, of the 17 who have spoken since the turn of the year, all but three have attempted to pushback on this dovish implied path, noting in one way or another that markets are “too optimistic” on the prospect of near-term cuts. Despite this deafening amount of rhetoric, it seems unlikely that the policy statement will be significantly altered, likely repeating the prior stance that rates will remain at “sufficiently restrictive levels for as long as necessary”.

Interestingly, though, recent remarks have largely fallen on deaf ears in terms of market reaction, with OIS pricing having hardly budged over the last fortnight, and the EUR also trading relatively flat over the same period. This, therefore, raises the question of whether the market will actually listen to whatever the ECB have to say at the January meeting, with recent form indicating that messaging will likely fall on deaf ears once more.

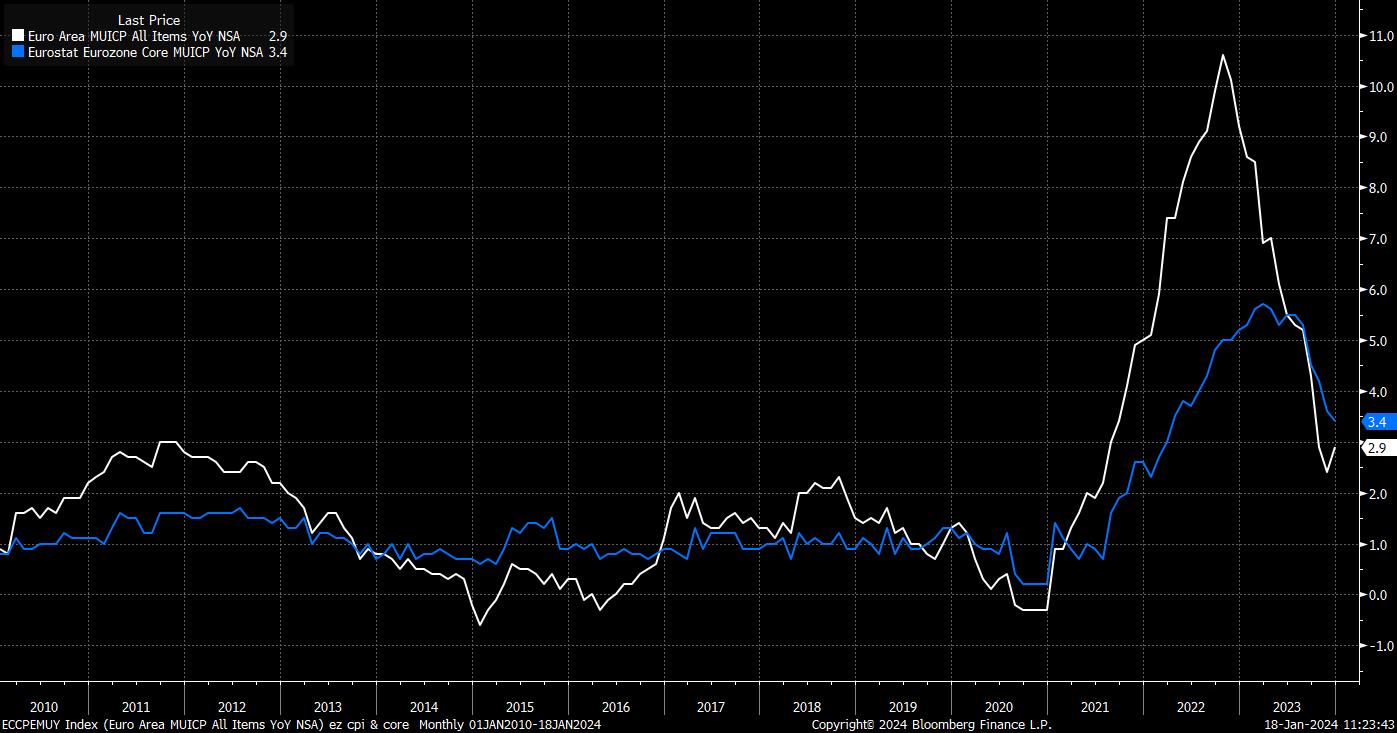

Perhaps the biggest reason for this divergence is the market’s focus on what policymakers ‘should’ do, rather than what they ‘will’ do. Recent inflation figures are perhaps the biggest cause of this, with the bloc continuing to experience relatively rapid disinflation, particularly on a core basis, with prices ex-food and energy having risen by 3.4% YoY in December, the slowest pace since April 2022. While headline inflation has ticked marginally higher, to 2.9% YoY, this was driven largely by energy-induced base effects, and is almost certain to be ignored in policy-setting discussions.

Nevertheless, while inflation continues to fade, the Governing Council will be loath to take a premature victory lap, with the experience of dismissing price pressures as ‘transitory’ in the period following the pandemic still fresh in most minds. Consequently, at the margin, the ECB’s reaction function is likely substantially more hawkish than markets currently estimate, likely leading to policymakers seeking as much evidence as possible of inflation having returned to the 2% target, before beginning to cut benchmark rates, likely putting the timing of any cuts into the second quarter at the earliest. This is in contrast to the market’s perceived view, that rates should be reduced in advance of inflation’s return to target, in an attempt to support growth, and stick a ‘soft landing’.

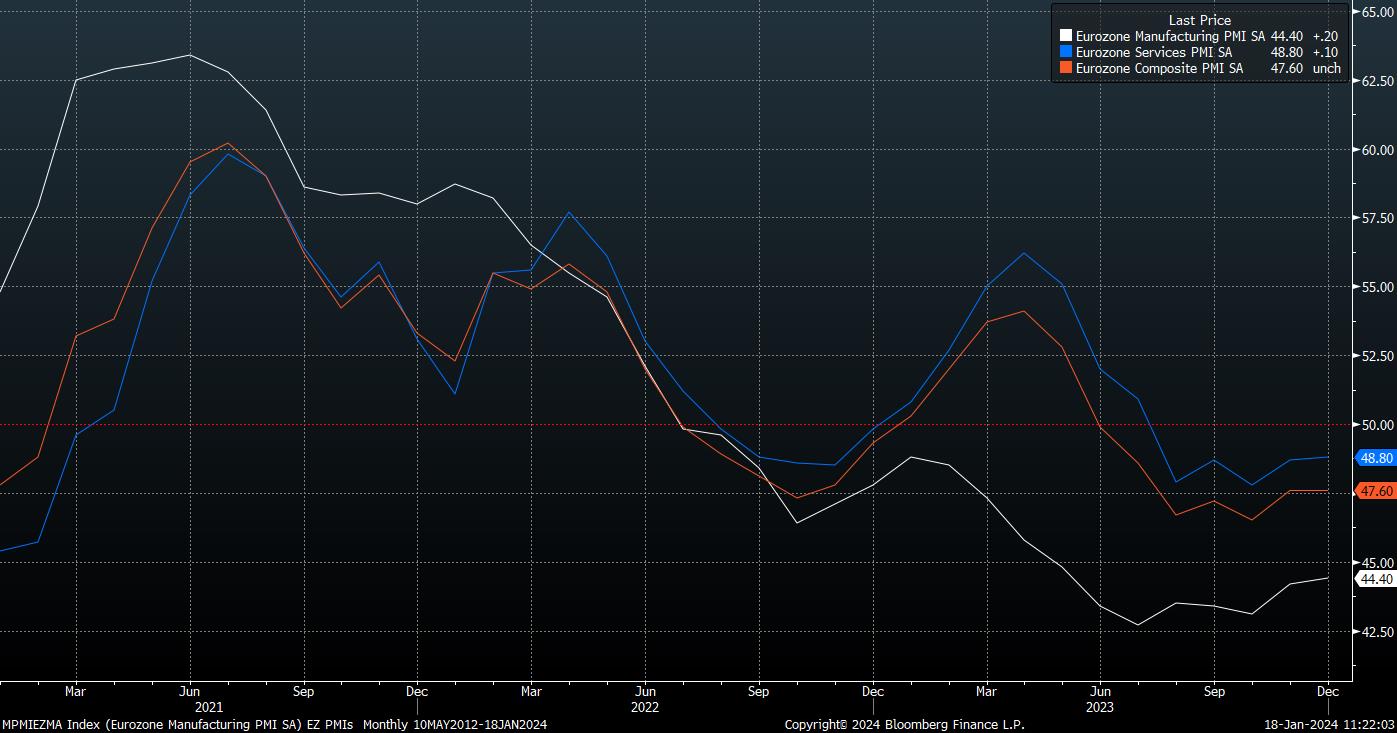

On the subject of growth, the eurozone economic outlook remains rather dour. The most recent round of PMI surveys pointed to a continued bloc-wide contraction across both the manufacturing and services sectors as 2023 drew to a close with both indices having now stagnated for around six months, implying a steady pace of declining output growth over said period. While January’s PMI round will be released a day prior to the ECB’s decision, the data is unlikely to differ significantly from recent trends.

Furthermore, risks to the economic outlook remain clearly tilted to the downside, already placing under threat the ECB’s forecast for an anaemic 0.8% pace of GDP growth this year. Said risks are numerous, and by this point well-documented, including Germany’s continued economic woes, the ongoing lack of recovery in China posing an increasingly stiff headwind, in addition to the recent surge in geopolitical tensions in the Middle East, with the eurozone particularly exposed to rising shipping costs as the Red Sea continues to be largely avoided.

A handful of other items are also worth covering off. Firstly, the ECB are highly unlikely to alter the balance sheet reduction plans unveiled last month, in that PEPP reinvestments will slowly be tapered in the second half of the year, before coming to a halt entirely at the end of 2024. Secondly, President Lagarde’s press conference will be closely watched for any additional policy guidance, with remarks likely to echo those made recently in Davos, whereby Lagarde noted that victory cannot be declared until inflation is ‘sustainably’ at 2%, and that it is ‘likely’ a cut could be delivered by the summer, though this latter remark was taken slightly out of context by headline writers.

Turning to financial markets where, as noted above, the scale of any significant reaction to the ECB’s first meeting of the year is somewhat uncertain. Not only have markets shown little desire to react to recent policy messaging, while 1-week implieds, covering the period over the decision, sit just over 6%, implying – with 1 standard deviation of confidence – an approximate move of +/- 80 pips in EUR/USD over the tenor.

_eur_spot_2024-01-18_11-21-02.jpg)

In terms of spot, the common currency has been rather rangebound of late, trapped between the 200-day moving average to the downside, and the 50-day moving average above. While a closing break of either level may entice some to chase the move, long EUR positions on the basis of a hawkish ECB surprise still seem rather tough to justify, not least owing to the continued dismal growth backdrop, with a closing break below the recent 1.0850 low likely to see price test the 1.07 figure in relatively short order, notwithstanding some potential dip demand around the 100-day MA.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.