- English

- 中文版

The Daily Fix: Governments throw the kitchen sink, but is it enough?

Firstly, we like the Fed’s plan to set up a Commercial Paper (CP) funding facility, potentially buying up to $1t of short-term paper. This will help liquidity with the Fed offering short-term loans to those eligible, maintaining the availability of credit to the US economy. During October 2008 and January 2009, the Fed used this facility to good effect buying $350b of commercial paper at a time when the banks couldn’t offer the loans and liquidity. This is a positive step.

While the NZ govt brought out the big guns, the UK hit us with a $330b government guarantee loan for SME’s and we’re hearing of a c$25b fiscal package from the Canadians. The markets have warmed to the US administration's proposed $1.2t (over 5% of GDP) stimulus package. It’s a strong start and the numbers seem to be rising from the earlier proposal of $850b (4% of GDP). There has been lots of talk of a $1k cash injection to households, where this is likely to be capped to those earning less than $85k. The news flow seems to have assisted the equity story (and bond sell-off), with the S&P 500 closing +6%, although futures are trading sharply lower after the cash index close and it wont surprise if we hit limit down shortly. Liquidity remains a key driver here and it is awful.

We’ve seen some modest selling of implied volatility, with the VIX index lower by 6.7 vols to 75% - that still implies daily moves (higher or lower) in the S&P 500 of 4.8%. So, it’s still a rocky road from here and until vols (both realised and implied) collapse, volume dramatically reduces on down days, we see range contraction and the market making an accumulation base, then expect to be trading wild markets. High yield credit has performed ok falling 24bp, although at 648bp spreads are still at elevated levels and equity markets will always look here in this environment.

The echoes of recession are clear

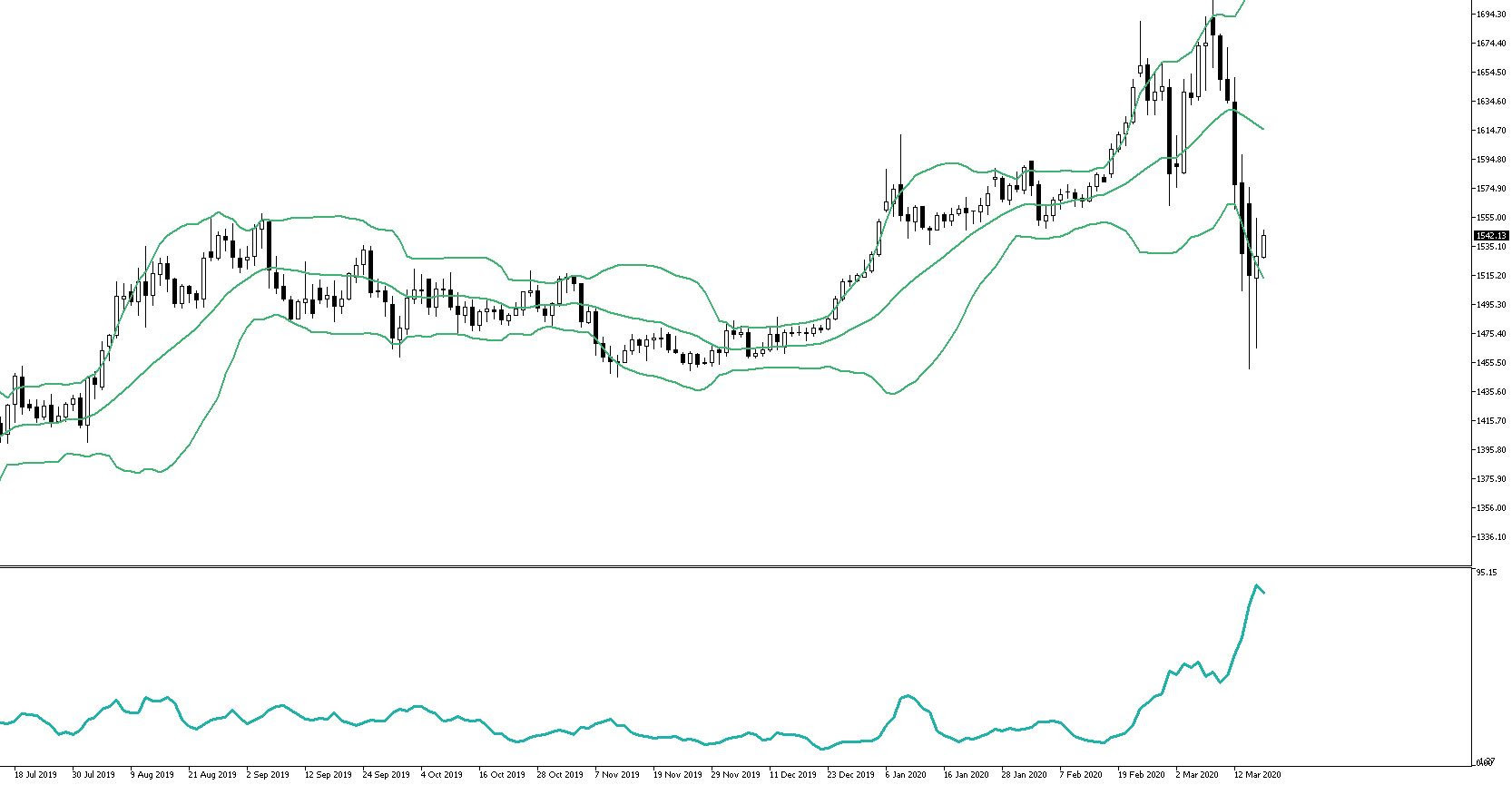

We now see the US 3m vs 10yr yield curve bear steepening by an incredible 40bp and into 89bp (the steepest since 2018). Long-end bonds are selling off hard here with 30yr +40bp. Importantly, inflation expectations continue to fall and this is having a dramatic effect on real (or inflation-adjusted) rates, with real Treasury yields moving strongly higher again and we see the US real 5yr +29bp on the day. It's surprising the equity markets have not negatively reacted to such insane moves in real rates of late, and also we see gold finding such solid buying off the intra-day low of 1465 and now sit up at 1528, having been as high as 1553. I guess these markets make little sense these days, but maybe the large chunk of the forced liquidation has played out and gold buyers can start to put money to work again.

(Spot gold - XAUUSD)

Industrial metal also gives me cause for concern, with copper closing -3.5% and we see the Bloomberg industrial metal index -2.6%, the lowest levels since September 2018. We see WTI oil moving to a low of 26.79, so it’s no surprise to see US inflation expectations falling fast. This is a worry for any central bank. Perhaps the equity market feels they have already priced in a fairly dire situation.

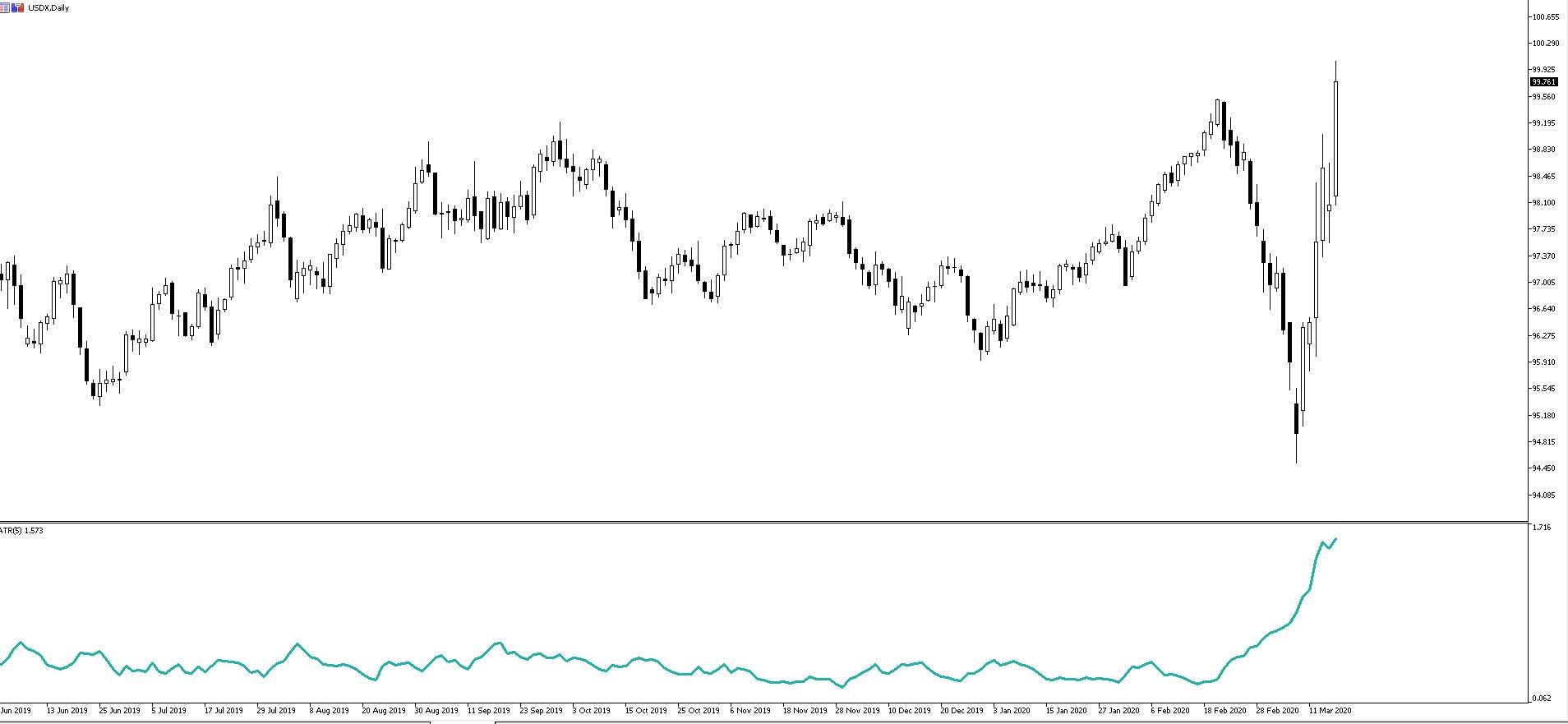

In FX markets the combination of lower oil, metals and a rush to further de-risk and we see the NOK and AUD the weak links on the day, falling 2.1% and 1.9% respectively. AUDUSD hit a 17-year low of 0.5959, although currently sits a touch higher here, although this is also a massive hunt for USDs. The Fed has set up FX swap lines, and they are already being utilised – that said, the market is looking at the USD funding channels and FX basis, which has collapsed of late and showing a sizeable demand for USDs. The strong widening in EURUSD, USDJPY, AUDUSD cross-currency basis, along with the incredible move in US real yield, has seen the USD on a one-way ticket higher as its driving rate differentials (in favour of the USD) and is incentivising funds to add to USD longs.

(USDX daily)

The USDX has broken out, with EURUSD trading into 1.0955 and USDJPY 107.86, and remains a key momentum play here, although that cannot last. The Fed can’t let it go one-way when global growth and notably EM is getting whacked, inflation expectations are falling, and yield curves are steepening. Swap lines are one solution, and they have caused some narrowing of FX basis, but USD longs will need more to close, and the market wants to see a Term Auction Facility, and that is a risk for a growing USD long position. The move in real rates, FX basis and the USD must be on the radar as the one-way moves are unsustainable.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.