- English

- 中文版

Here, we look at market measures of the sentiment in the macro backdrop, which has improved somewhat but remains fluid.

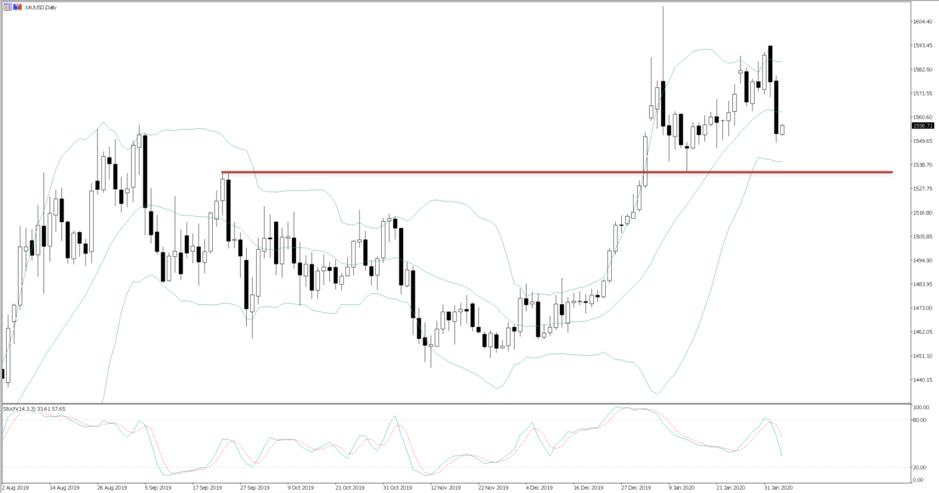

I look at correlation analysis, looking at the 20-day rolling correlation and 12-month regression analysis to build a framework to understand what is really driving gold. I have focused on the technical set-up (see below), risk reversals (options skew), positioning and other key variables we should consider.

For those in search of the true drivers of gold it can be incredibly difficult to pinpoint what they are, and whether this is USDJPY, USDCNH, the US bond markets, or higher volatility. Identifying the prominent driver can actually be advantageous and help us with our edge. Of course, for those scalping or trading purely off-price action then knowing that the bond market is the main driver perhaps doesn’t appeal as much. But having an understanding of the expected moves and the implied volatility can offer increased confidence in the algorithm.

As we see the correlation matrix I look at various inputs and assess the rolling correlation and 12-month R^2 correlation coefficient – with regards to the former, any reading below -0.75 or above +0.75 interests me and is significant.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.