Analysis

I know a lot of readers trade 1hr or lower timeframes and many even scalps off 5-minute charts. However, for the higher time framers (like me) who love to see not just movement, but price breaking to new highs without duress, this is a pair that has come up on both my momo matrix but also printed a bullish outside day. I’ll digress even further and throw a weekly to you and while few trades using weekly charts, we can take a step back and really devour the structure and feel of the flow – which is all we can do as margin FX traders, as we really are trying to profit from a hodgepodge of various capital flows, all doing different things.

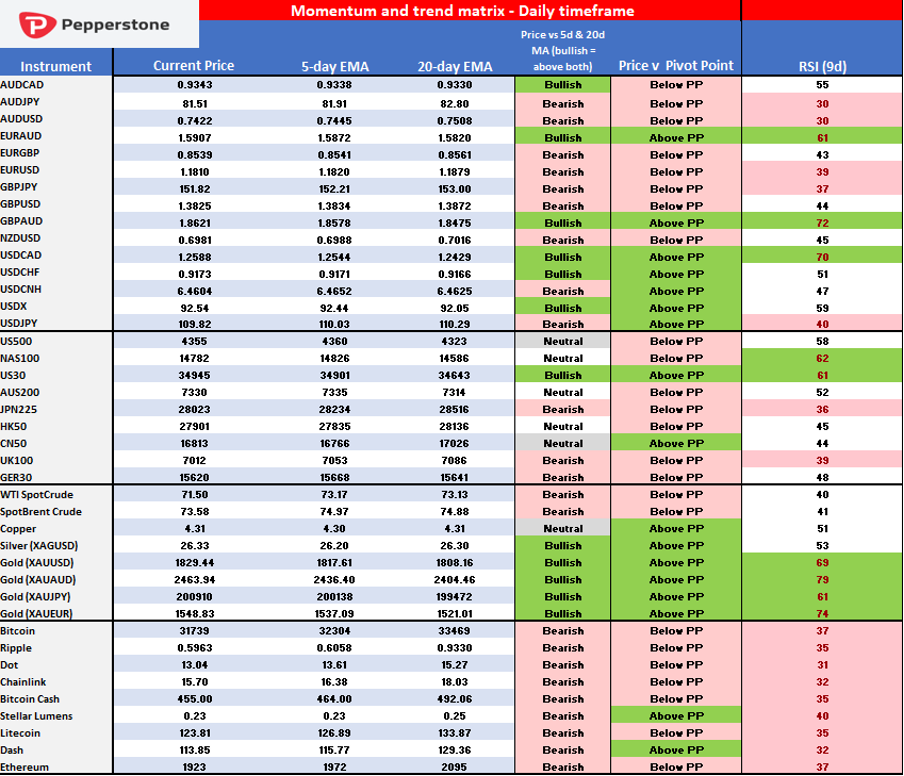

What’s hot and what’s not matrix – I want to see a confluence of the three variables.

How do you create an edge when money is moving for different investment purposes, the relative attractiveness of a country changes day-to-day, hedging flow, export demand and reserve management? Yup, it’s hard, but that’s what we do and this to me is why CFDs are best traded by aligning and buying when price exudes strength, and therefore following the flow of capital or selling with weakness. Any timeframe that offers context is small but vital intel. Momentum is often our best friend.

Of course, the real trick to trading is not necessarily the getting into a trade, although that helps obviously, but the average become good through the assessment of how much risk to take on and correct position sizing. This is a function of volatility and movement – the greater the movement or implied movement, the wider the stop, the lower the position size.

Managing an open position is where most retail traders lose out – “we’re managers of losing trades”, I hear a lot. For me taking a loss is actually quite straightforward, letting the trade run is far harder especially when trading off a 4hr or daily timeframe. Holding GBPAUD for 1.8900 can be troublesome when trading discretionary, as we consistently need to understand the signal from the noise and know when to hold and when to fold – this is the real art to trading. Knowing how to extract the most out of a profitable trade.

Anyhow, the AUD and NZD look weak, which was partly why my preference was to trade NZD outperformance vs the AUD and not the USD or the JPY. In fact, if we’ve seen a bullish outside day on GBPAUD and we’ve seen a bearish outside day on AUDUSD – Flip to the 4-hour and a break of 0.7420 and its Goodnight Irene – for now price is holding on, but if this gives way then the AUD will be taken down universally. AUDJPY is always a good proxy or risk, as is USDKRW, and AUDJPY is weak.

AUDUSD 4HR

(Source: Tradingview)

The unrelenting bid in the USD bond market remains the dominant question in macro and clearly the weakness is spilling over into other markets – the US 10yr now pushing 1.30%. In Japan, the 10yr JGB pushed to 18bp on 26 February and is now eyeing a move negative for the first time since 21 Dec – most people I speak to in the bond scene say yields are mispriced and this period of worry on economics will abate and yields will climb higher. It's yet to happen though and while many want to get short, no one is prepared to trade it with any conviction.

Certainly, USDJPY has been affected by the move in yields, but Gold remains supported and for those who didn’t watch my Gold weekly video the target, not that I will hold blindly if the price looks vulnerable, is 1850/53. Crude lower by 2% is probably not helping sentiment and the tape of crude looks weak, with price closing in areas where last week the buyers supported with gusto (green arrows). Crypto CFD also remains weak and dangerously close to the range lows and finds friends hard to come by – Bitcoin especially needs monitoring and while the buyers have supported 31,110 if this goes then this period of sideways chop and relative calm may give way to a period of trend and higher vol.

Watch and monitor exposures as we head into the weekend.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.