- English

- 中文版

GBP trader - Trading the GBP amid BoE hikes and political change

Not just because of the hiking cycle in play from the Bank of England (BoE) and the cyclical considerations around relative economic trends – but also on the future economic impact stemming from the Tory leadership battle that currently dominates the front pages.

The battle between Liz Truss and Rishi Sunak is now well known to markets and much is now priced – Liz Truss seemingly has the job as the Conservative PM in the bag, with the bookies saying this is a done deal. Notably, Truss has received the backing of Ben Wallace, Nadhim Zahawi, Brandon Lewis, and Tom Tugendhat, with Sunak seemingly the one chasing votes and changing tactics most aggressively throughout the head-to-head debates.

Truss does have a more combative line with regards to the Northern Ireland Protocol and there may be some tensions with the EU the market will need clarity, which could mean the GBP wears a geopolitical premium. That is a GBP negative, but traders are not going to trade this thematic at this early juncture.

Truss’s policies of canning the planned company tax increase (which is set to increase 6ppt in 2023), reversing the National Insurance hike that came into play in April and spreading out the “Covid Debt” repayment plan, seem most known to markets and are GBP positive at the margin.

We now see Sunak reversing course and moving to a more fiscally expansive setting, promising VAT, and income tax cuts, although in the market's eyes the net effects of his policies are still not as accommodative/supportive as Truss’s. Policies, which if enacted should keep the pressure on the BoE to hike throughout 2H22.

Given the polling, which has Truss well ahead, when we do get the announcement of the party vote on 5 September – when the winner will be announced – in theory, we shouldn’t expect too much of a move in UK assets given it should be priced.

As always though, an open mind is essential and preparing for surprise is prudent.

On the equity front, near-term the UK100 will likely be driven by the exchange rate dynamic, with around 70% of sales in the UK100 derived offshore, where moves in the GBP should read through to the bottom line.

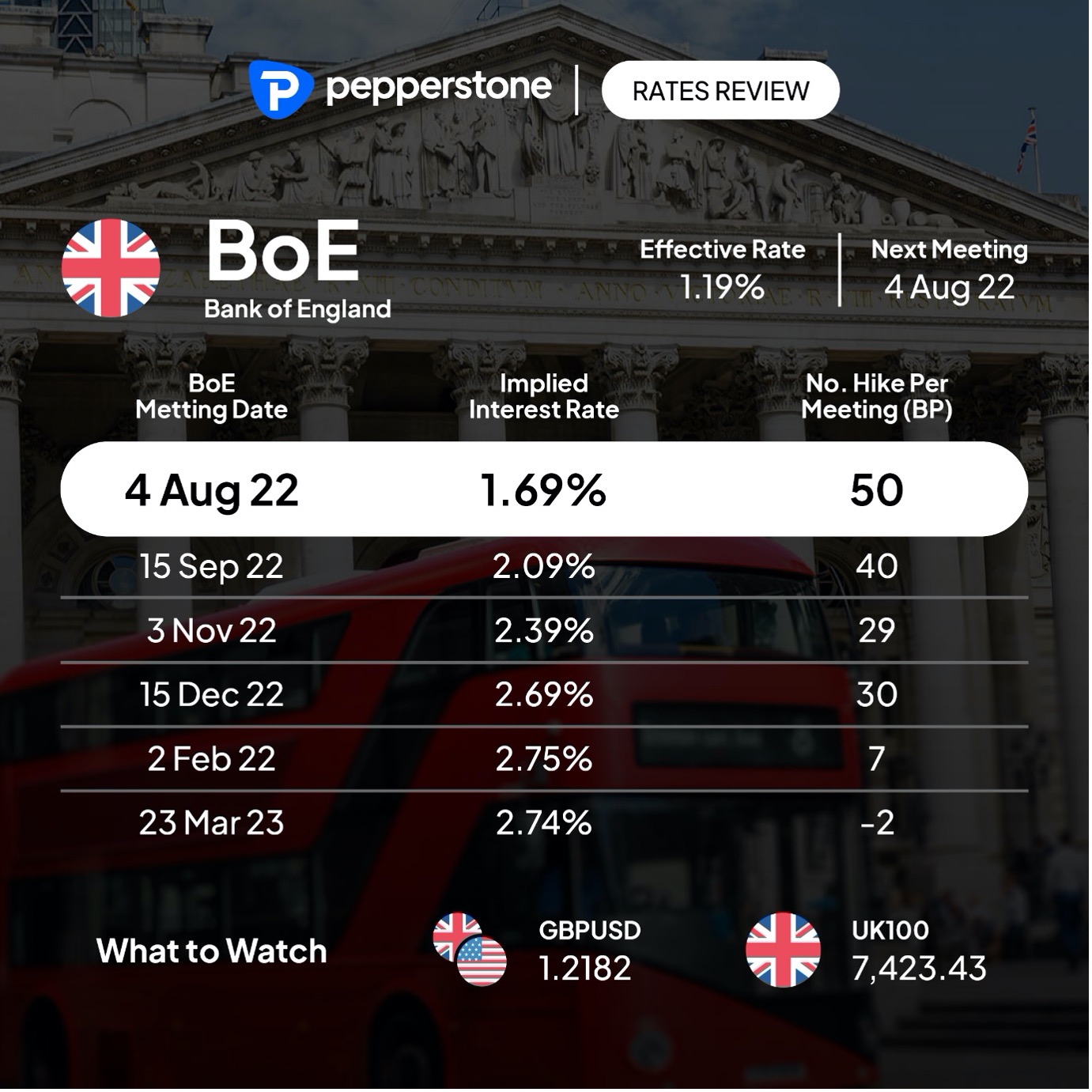

Pepperstone rates review – what’s priced for the next BoE meeting and the step up per meeting.

(Source: Pepperstone - Past performance is not indicative of future performance.

GBPUSD trades fair to the UK-US relative 2-year bond yield – and near-term we see exactly 50bp of hikes priced for this week's BoE meeting. The consensus from economists is also that they hike 50bp, with a 7-2 vote. The recent inflation CPI print of 9.4% outweighs the ailing growth dynamics and concerns of recession risk in the market's eyes and many economists calling for further hikes will bang the drum that much of Rishi Sunak’s recent cost of living support package is skewed for the second half of the year.

GBPUSD daily chart

(Source: Tradingview - Past performance is not indicative of future performance.

Naturally, given current pricing, a 25bp hike would send GBP sharply lower on a broad basis. Technically it seems this weakness will be supported, and despite GBPUSD finding supply into the 50-day MA, the pair is still working nicely into a bullish channel – I’ve used a 3 standard deviation regression channel – with the classic momentum indicators all favouring a long bias for now. Consider that if the BoE goes 50bp this week, then the statement will need to suggest they will go hard again in September, or we could see GBP sellers – given we see a further 40bp of hikes priced here.

There are other factors which could markets, such as offering real depth around forcibly selling the bonds on its balance sheet (QT). The larger the expected sales the more GBP friendly this will become, with the market likely pricing £8bp p/m in UK bond sales.

We see GBPUSD implied volatility (derived from options pricing) relatively elevated, so the market is expecting movement in the GBP – do they go 25bp or 50bp? Will the outlook from the BoE live up to what’s priced in the interest rates market and ultimately will a Truss leadership win have much bearing on the GBP? Without even looking at the US (or another side of the exchange rate ledger) it’s no wonder clients are seeing opportunity and you can trade it with Pepperstone.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.