- English

- 中文版

The Fed portray that a V-shaped recovery isn't going to happen

The Fed aren’t going anywhere

There is little doubt the Fed was dovish, and the gravy train is going nowhere with future asset purchases continuing at the current pace of $80b p/m and MBS $60b p/m, which should underpin risk for some time. Judging by the bank's economic projections (and dot plot) interest rates are not going up well past 2023, and the conversation on yield curve control (YCC) was certainly explored a few times, something Powell said was still “an open question”. One suspects if they are going to announce YCC it will take place in the September meeting, and that meeting will be a biggy as it will give them a decent stretch to see how their many programs, not to mention economics, are evolving and the impact they are having on getting them towards its mandate.

When we consider YCC, I would expect the Fed to focus on the 3-5-year Treasury curve, more akin to what the RBA is doing than the BoJ, although there are a ton of questions around its commitment and of course what level (of yield) would they target.

Real Treasury yields promoting a bid in gold

For now, though we see a solid move lower in nominal yields, with the Fed importantly managing to generate a positive move higher in inflation expectations, with 5-yr Breakeven rates moving +3bp and above 1% for the first time since 9 March. This has resulted in US 5-year real Treasury yields collapsing 11bp to -70bp. For gold traders, this is all that matters and for gold bulls, it is the perfect storm, especially when married with such as the bearish trend in the USD.

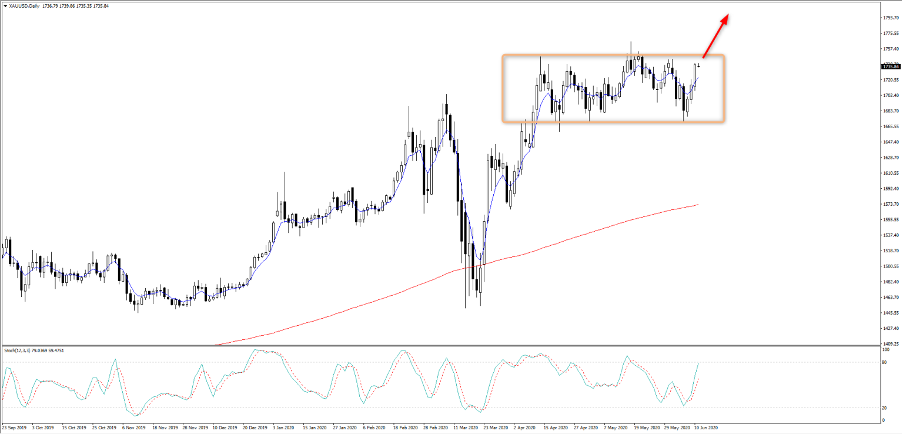

Gold has been happy to track the 1750 to 1650 range since mid-April, and I have argued many times, the answer lies in the bond market and it appears to be playing out - Is this the time we finally see a solid break of the range?

(Daily gold chart)

The move in bond yields has propelled the NAS100, which will feed off lower yields every day, with the Fed keeping the punchbowl in the mix for as long as it takes. On the other hand, the dour economic projections have really made it clear that the Fed sees the prospect of a V-shaped recovery as incredibly low, so we’ve seen the Russell 2000 lower by 2.6%, while the S&P 500 fell 0.5%, held back by financials (thanks to the flatter yield curve), and energy (crude fell 2.2%). Asia is feeding off these leads and risk is under pressure, with traders taking a bit off the top.

The USD is heading lower longer-term

If we consider the Russell 2000 is more reflective of inward factors and the US economy, it perhaps tells us why the USD is also being further shunned. The US is no longer the standout and almost isolated destination for global savings that it has been in recent years, and investors now have a choice and have redistributed capital accordingly. Lower yields are certainly incentivising an offer in the USD too, especially with raised prospects of YCC the months ahead. Why? Because if the Fed is going to add an extra measure to further increase its balance sheet through unlimited bond purchases, to fix a specific parts of the Treasury curve at a given yield, then it just increases the prospect of deeper negative real yields and an ever bigger balance sheet.

After a big move in the USD - Trading margin FX from a tactical standpoint

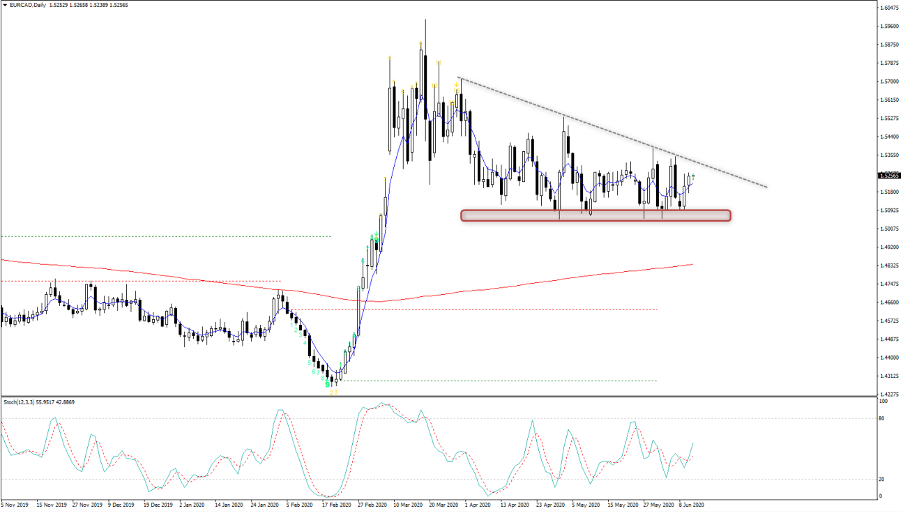

From a tactical perspective, the USD may still in the doghouse, but if the S&P 500 is looking at the Fed’s dour economic projections, the index could find a few headwinds in the near-term. Despite liquidity, if the S&P 500 tracks lower then global growth proxies such as AUD, CAD and MXN may also struggle near-term. It makes the currency crosses become a more attractive trading vehicle. I am watching EURCAD. After some messy price action, the buyers are starting to get a better say here and should crude come off further and we start to see a few more sellers in the S&P 500 then the funding currencies (EUR, JPY, CHF) will outperform. Whether this starts to trend is questionable, but the battle lines are drawn.

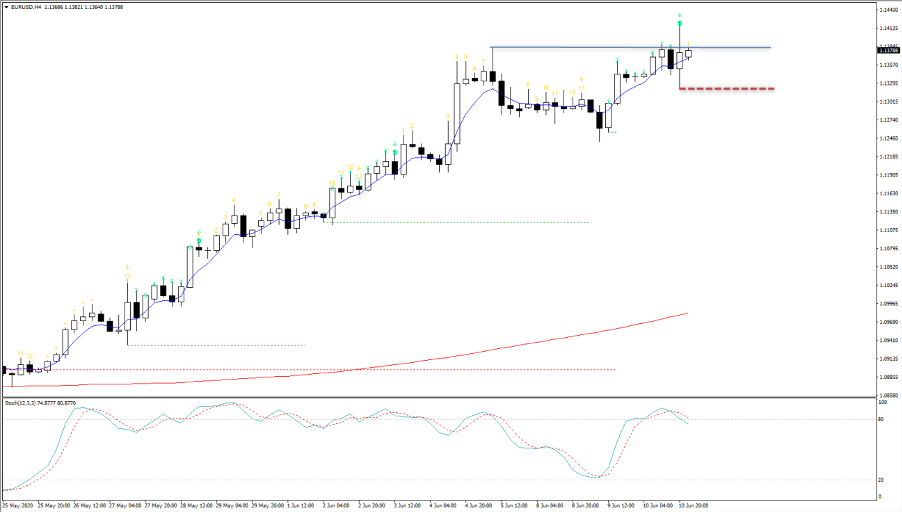

If playing the USD, AUDUSD is looking more vulnerable, but EURUSD is still strong and would be a preference if keeping the USD in play.

We see price still holding the 5-day EMA and there are few reasons to be short with any genuine conviction on current price action – happy to stay bullish here, where a close above 1.1383 would open up 1.1500. Will turn more neutral on a break of 1.1321.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.