- English

- 中文版

February 2026 BoE Preview: Laying The Foundations For Another Cut

Summary

- Standing Pat: The MPC will hold Bank Rate steady at 3.75% in February, standing pat after a rate cut at the end of 2025

- Split Vote: Policymakers are likely to remain divided on the appropriate course of action, with another 5-4 vote on the cards

- Foundations For A Cut: Updated economic forecasts, likely pointing to inflation hitting 2% this year, and then staying there, should pave the way to another cut as soon as March

Bank Rate To Remain Unchanged

As noted, the MPC are set to hold Bank Rate steady at 3.75% at the conclusion of the first policy meeting of 2026, having delivered a 25bp cut at the prior meeting last December.

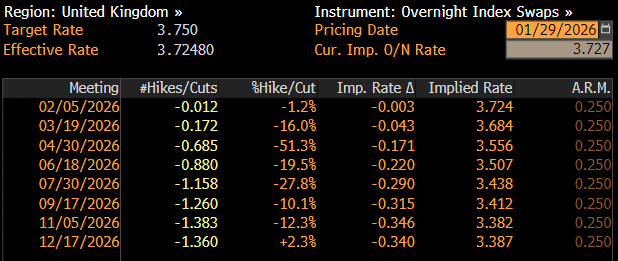

Money markets, per the GBP OIS curve, discount next-to-no chance of any action this time out, with the next 25bp cut not fully discounted until July – pricing which, given the relatively weak UK economic backdrop – seems somewhat too hawkish.

Vote Split To Prompt Intrigue (Again!)

That said, while Bank Rate is set to remain at its current level, the decision to stand pat is highly unlikely to be a unanimous one among MPC members, not least considering that the last two decisions – in both November and December – have come via the narrowest possible 5-4 votes.

This time around, another 5-4 vote seems most likely, with Governor Bailey continuing to act as the ‘swing voter’, and this time out likely preferring to maintain Bank Rate.

The other four MPC members (Breeden, Dhingra, Ramsden & Taylor) who voted in favour of a 25bp cut at the December meeting are likely to again vote for such action this time out. There is, however, a degree of risk that Deputy Governor Breeden may also switch her vote, to prefer an unchanged policy stance, given her desire to see ‘a greater accumulation of evidence’ on the economy making disinflationary progress.

As for the hawks (Greene, Lombardelli, Mann & Pill), their views seem relatively embedded at this stage, with a greater weight continuing to be placed on perceived risks of inflation persistence, thus leading to a belief that a more restrictive policy stance should be maintained for a more prolonged period. It’s difficult to envisage data since the December meeting having materially altered those views, though external member Mann’s decision to dissent for a hold last time out was ‘quite finely balanced’, presenting a modest degree of risk that she may make a renewed dovish pivot.

Familiar Guidance To Be Retained

While vagaries surround the vote split, the MPC’s policy guidance should be a considerably more straightforward affair.

In short, the explicit easing bias present in both November and December will be maintained, with the statement likely to note that Bank Rate will continue on a ‘gradual downward path’ providing that disinflationary progress continues to be made. The extent and timing of this further easing, though, will continue to hinge on incoming data, particularly how the inflation outlook evolves moving forwards.

Forecasting Inflation Back At Target

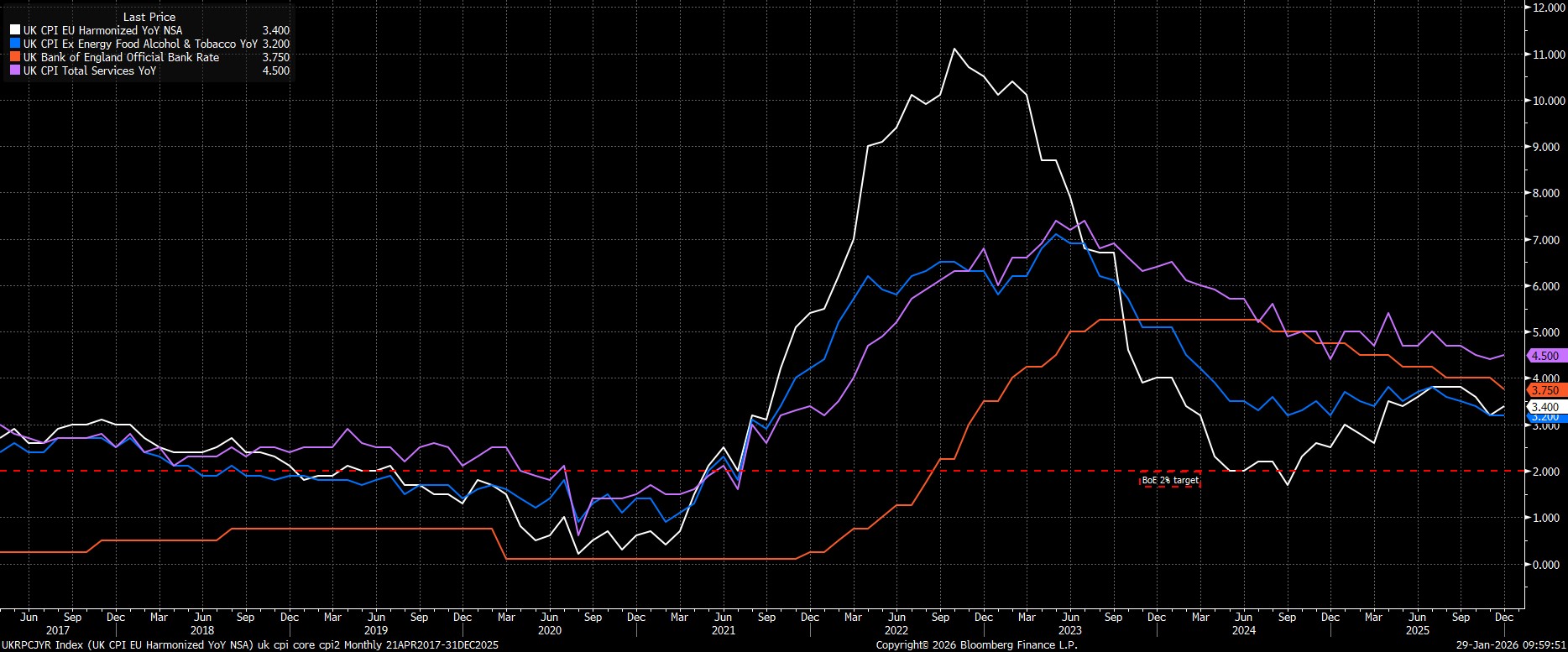

On that note, the Bank’s updated economic forecasts will be the primary focus this time around, with the CPI projection in particular likely to paint a relatively optimistic message.

The central forecast is likely to point to a considerably lower inflation profile than that outlined in the November MPR, reflecting not only a continued moderation in private sector earnings growth, but also the impact of policies announced in the autumn Budget, which should lower headline CPI by somewhere between 50-70bp from April. Hence, the updated forecast is likely to point to inflation being at, or very close to, the 2% target in 2026, and staying there over the remainder of the forecast horizon, in turn opening the door to further policy easing as the year progresses.

Growth & Unemployment ‘Marked to Market’

In contrast to the relatively optimistic message on inflation, both the GDP and unemployment rate projections are likely to be ‘marked to market’, reflecting a more pessimistic outturn than had been expected in November.

On the growth front, activity data in the second half of 2025 was undeniably soft and, while leading indicators point to tentative signs of a pick-up in early-2026, this softness is nevertheless likely to result in the Bank’s 2025 and 2026 growth forecasts both being nudged marginally lower.

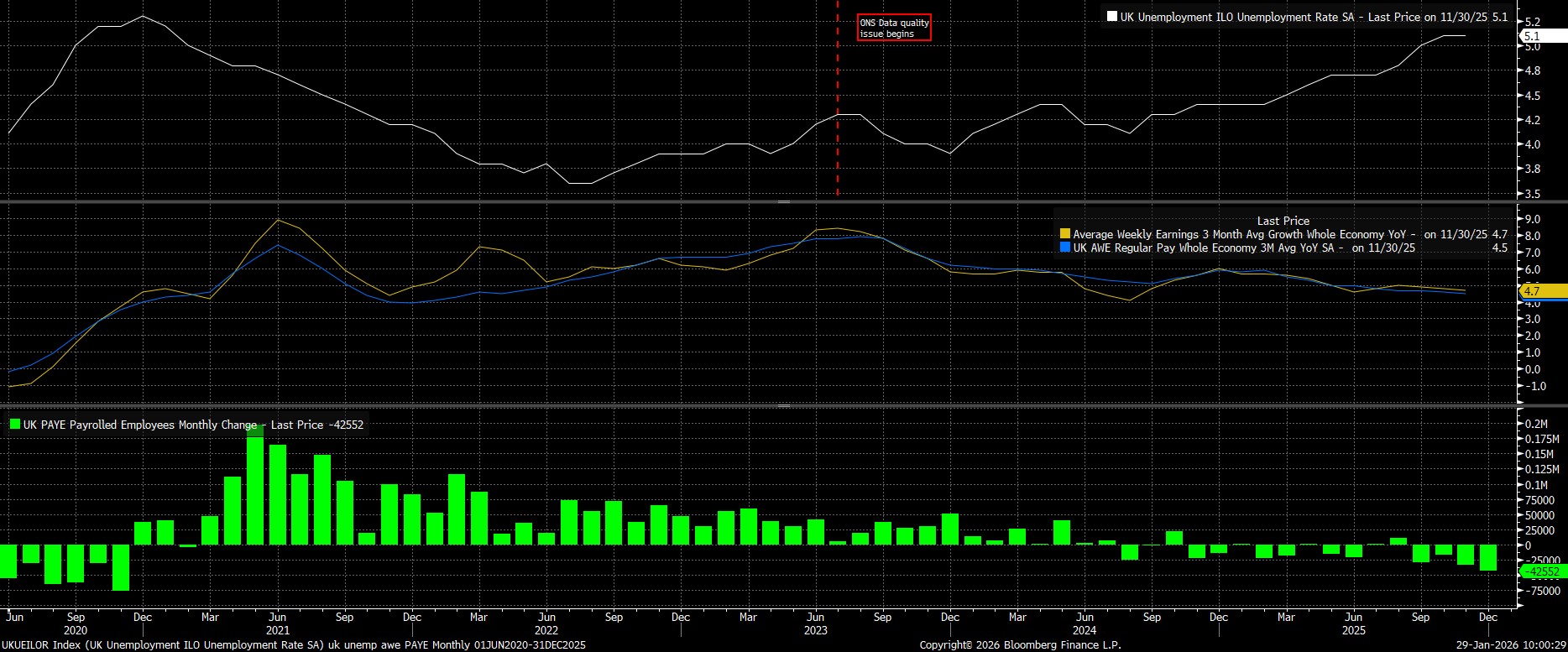

Similar applies to the unemployment projection. The labour market has continued to weaken in recent months, with headline unemployment having remained at a 4-year high 5.1% in the three months to November, and with the more timely PAYE payrolls metric having indicated the UK economy losing jobs for four months in a row. Consequently, the Bank’s prior expectation that unemployment would peak at 5.1% in Q2 26 now seems too optimistic, and is likely to be upwardly revised by 20-30bp, before the forecast then again pencils in a gradual decline in joblessness over the remainder of the horizon.

Governor Bailey Will Stick To The Script

The post-meeting press conference will be the first time this year that we’ve heard from Bailey on monetary policy, though the overall tone of his remarks is likely to resemble the ‘script’ used at the tail end of last year.

Consequently, Bailey is again likely to flag that further policy easing remains on the cards, and that the direction of travel for Bank Rate remains lower, while reiterating the statement’s guidance that the timing of such moves will hinge on how the inflation outlook evolves. It would also not be surprising to see Bailey display an increased degree of focus, or concern, over recent signs of labour market softness, particularly with private sector earnings growth now, roughly, at a level compatible with achievement of the inflation target over the medium-term.

Conclusion

Taking a step back, the February MPC meeting shan’t result in any policy shifts, but it is likely to lay the groundwork for the ‘Old Lady’ to take further steps back towards neutral as the year progresses. The next of those steps, in the form of a 25bp cut, is likely to come at the March meeting, by which further evidence of embedded disinflation should be in hand. Beyond that point, further rate reductions are likely, though much hinges on the MPC’s view of where the neutral rate sits. My base case is that said level is around the 3% mark, meaning we can pencil in another two rate cuts beyond March; however, were a considerably looser fiscal stance to be adopted, potentially resulting from a Labour leadership challenge after the May elections, a more hawkish Bank Rate path than that base case is likely.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.