- English

- 中文版

A further move lower in implied volatility would help, too, with the VIX index falling from 15%, encouraging capital back in the equity markets — as would a further reduction in high-yield credit spreads (over US Treasurys), where we saw spreads come in 12bp last week. While I’ve been advocating selling the Russell and going long the S&P 500, for those feeling we could see a cyclical upturn in the US and global economy, then an outperformance from small caps versus large caps would be a strong proxy and a leading indicator of a US economic upturn.

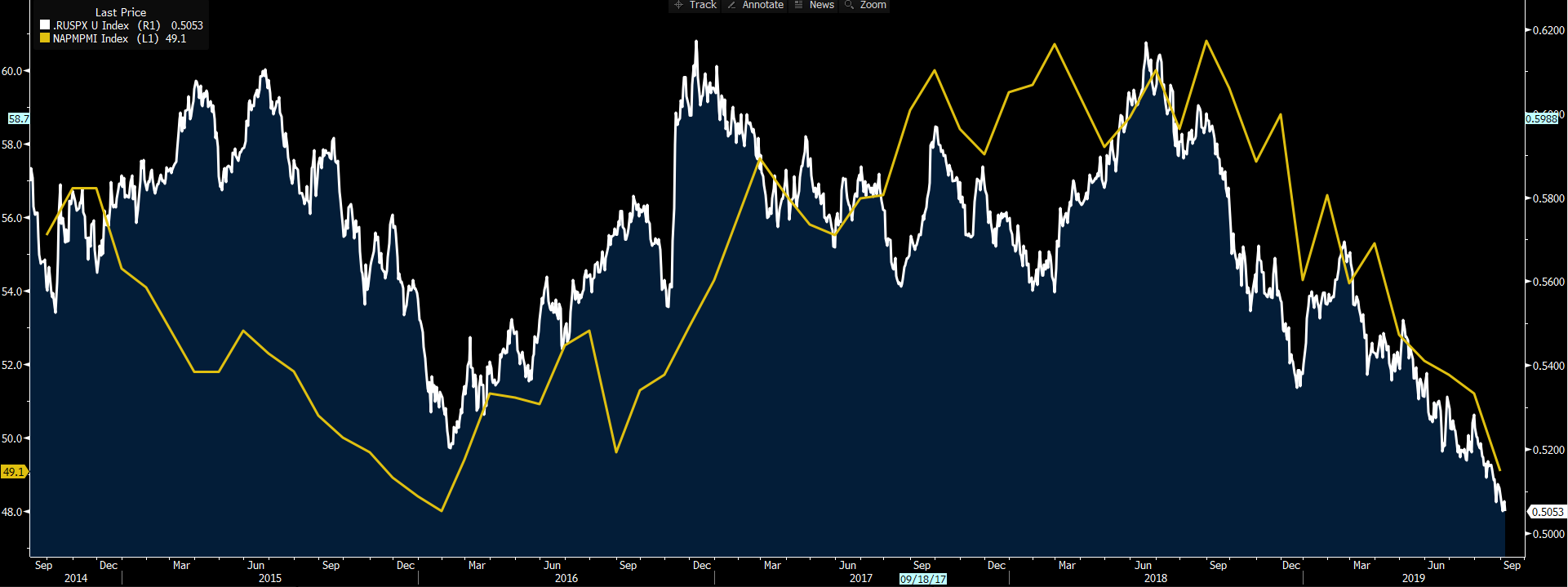

Here, I’ve overlapped the Russell 2000 / S&P ratio versus US ISM manufacturing index.

Certainly, the technicals in the S&P 500 are looking constructive, and much has been made of the 2945-to-2822 range break in the S&P 500, where on the weekly a further push higher at the start of the week would coincide with a bullish momentum crossover.

Eyeing the seasonal effects

Here, I’ve aggregated or blended the moves in the S&P 500 over the past decade to show the effects of seasonality, with the shaded area representing the current period we’re in. Past performance doesn’t suggest what could be in store, of course, but we can’t rule out the bulls building on last week’s solid run, with the EU Stoxx index +2%, the Hang Seng +3.8%, the China CSI 300 +3.9%, S&P 500 +1.9% and the ASX 200 +0.7%.

If the money supply is headed higher, then we can assume there’ll be support for equities. It makes sense, then, that there’ll be an increased focus on this week's China credit data (no set time). New yuan loans for August are expected to increase a touch to CNY1.2t, with aggregate financing expected to increase 59% to CNY1.6t and M2 money supply gaining 10bp to 8.2%.

We have USDCNH on the radar given the People’s Bank of China cut 50bp off bank reserve ratio requirement (RRR) and 100bp off required reserves for certain commercial banks. We’ve seen USDCNH open on a flat note, with support kicking in at 7.10 and where a potential break here should in turn take AUDUSD through Friday’s high of 0.6862 — building on from last week’s bullish outside period (on the weekly chart). This arguably would target as high as the 0.6950/0.7000 area.

It’s the Chinese equity market that I want to focus on most intently, though, as it feels, at least from a tactical basis, that the Chinese authorities will be wanting to see economics and equities supported, with a stable CNY into the 70th anniversary of the People’s Republic of China on 1 October. There are a number of indices to track, but I’d expect clients to go direct to the China A50 index (CN50). We’ve already seen a 10% rally off the 6 September low here, but a firm break of 14,000 and we head to the year-to-date highs of 14,179. That’s one to watch.

We see a flat open in AUDJPY and USDJPY in line with the S&P 500 futures open. Asia will have a chance to have their say on Friday’s non-farm payrolls, although the USD is already reflecting a jobs print that had something for everyone, with a poor headline of 130,000 and a 20bp rise in the U6 employment rate to 7.2% amid solid average hourly earnings of 3.2% YoY. By way of USD event risk this week, the eyes of the market fall on Thursday’s US (August) CPI print (consensus 2.3% from 2.2%), ahead of the August retail sales report (advanced +0.2% and control group +0.3%).

With the Fed’s blackout period in full swing ahead of the 18 September FOMC meeting, as well as rates pricing in a 4% chance of a 50bp cut and 55bp of cuts by December, we’re unlikely to see these data points move the USD too greatly. It certainly feels as though we’re on the money with pricing. Fed Chair Jerome Powell’s speech on Friday was broadly unchanged from his Jackson Hole narrative. And he had every opportunity to review market pricing and guide should he have felt it wasn’t correct. Unless we see something dramatic in markets, we’ll see a 25bp cut.

For USDJPY traders, keep an eye on the front end of the US fixed income curve. And while I argue that the pricing for the September FOMC meeting shouldn’t move about too intently, we still need to consider USD and US Treasury positioning. If equities are indeed heading higher, at least in the near term, then expect bond yields to head higher. I feel US twos could be headed to the 55-day MA at 1.69% (the purple line), which has contained sell-offs since November. This suggests USDJPY could be pushing above 107 in the near term.

US 2YR versus USDJPY

ECB meeting will be the highlight

Of course, EURUSD is going to get a close watch this week with Thursday’s ECB meeting the clear highlight, although perhaps the best guide will be the price action seen in EU banks. A barrage of ECB speakers in the past two weeks have guided our expectations for radical action somewhat lower. I’d also argue that the belief if we see the ECB's deposit rate taken -10bp to -50bp, we also get EUR30b p/m of asset purchases (QE), deposit rate-tiering, and a change in the banks forward guidance. This is the likely consensus now, and the risks are we see disappointment here, which suggest a higher EUR. That said, the EURUSD daily chart hardly screams of a market expecting disappointment and a higher EUR, with the trend lower and traders fading moves above 1.1050.

The UK political circus in full swing

Brexit makes fascinating viewing, too, although trading the GBP is as tough a gig as we’ll get. We’ve seen a move in the Cable from 1.1959 above 1.2200, but the “easy money” has been made. And the playbook now changes almost every few hours, so devising a probability matrix is almost impossible.

There’s an internal war raging within the UK Tory party, with Amber Rudd the latest member to leave the party and politics is fractured like we’ve never seen before. Reports that Boris Johnson is looking at plans to sabotage the Article 50 extension by offering a counter letter to the EU when he’s mandated to request an extension, detailing that the government doesn’t want to delay past 31 October and thus the ball falls not just into the EU’s court. The question, then, becomes whether the EU even accepts and offers an extension; therefore, by throwing strong doubt that we even get an extension, it increases the prospect of a general election as perhaps the only opportunity for the Remainers to avoid a no-deal Brexit.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.